- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: I accidentally set my excess Roth contributions to zero (the excess was still there at the end of 2019), and now I can't figure out how to return to that page to fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally set my excess Roth contributions to zero (the excess was still there at the end of 2019), and now I can't figure out how to return to that page to fix it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally set my excess Roth contributions to zero (the excess was still there at the end of 2019), and now I can't figure out how to return to that page to fix it.

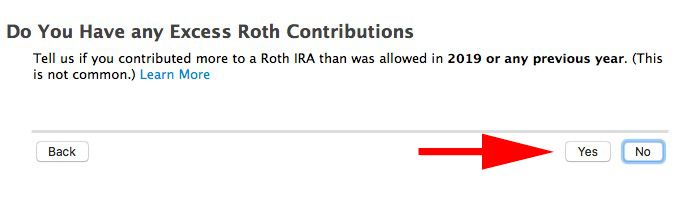

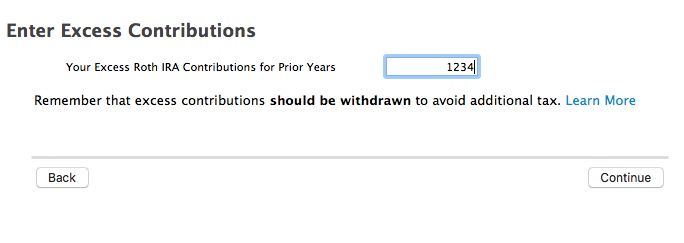

Check the Roth box, say yes, you made a contribution, enter 0 for the contribution and click through until it asks if you had a prior year excess, say yes and then enter the amount. Say that it was not removed. That should produce a 5329 with the excess and penalty.

Enter IRA contributions here:

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),

Retirement & Investments,

Traditional & Roth IRA contribution.

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "ira contributions" which will take you to the same place.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally set my excess Roth contributions to zero (the excess was still there at the end of 2019), and now I can't figure out how to return to that page to fix it.

Have you had the excess returned to you? You have until July 15, 2020 to do that. If you have then the excess in TurboTax should be zero.

What problem do you think you have?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally set my excess Roth contributions to zero (the excess was still there at the end of 2019), and now I can't figure out how to return to that page to fix it.

Okay, yeah—thanks—that was my thinking when I zeroed it out, before concluding that I should probably wait for the returned funds to appear on a 1099-R (?) for next year's (2020's) taxes. But yes, I finally had the (2018) excess returned to me in Feb 2020, having properly documented it and paid the tax penalty when I did my 2018 taxes this time last year.

I still wish TurboTax would provide a straightforward way to navigate to, and manipulate, any of their 'interview' screens and any darn field I want to manipulate manually on my 1040, but, if I understand correctly, you've rendered my IT question moot by clarifying the tax confusion that originally motivated me to want to go back to that screen. 🤣

Thanks @macuser_22

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally set my excess Roth contributions to zero (the excess was still there at the end of 2019), and now I can't figure out how to return to that page to fix it.

You did not say that it was a 2018 contribution - I assumed that it was a 2019 contribution.

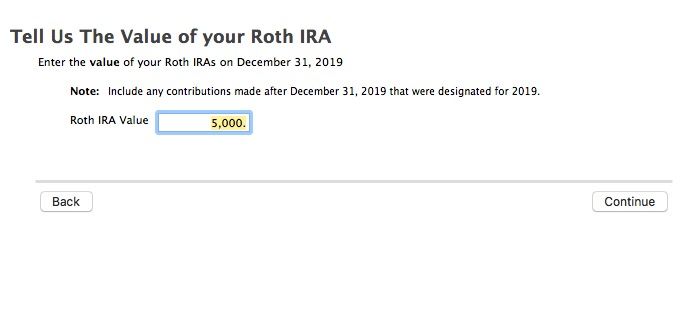

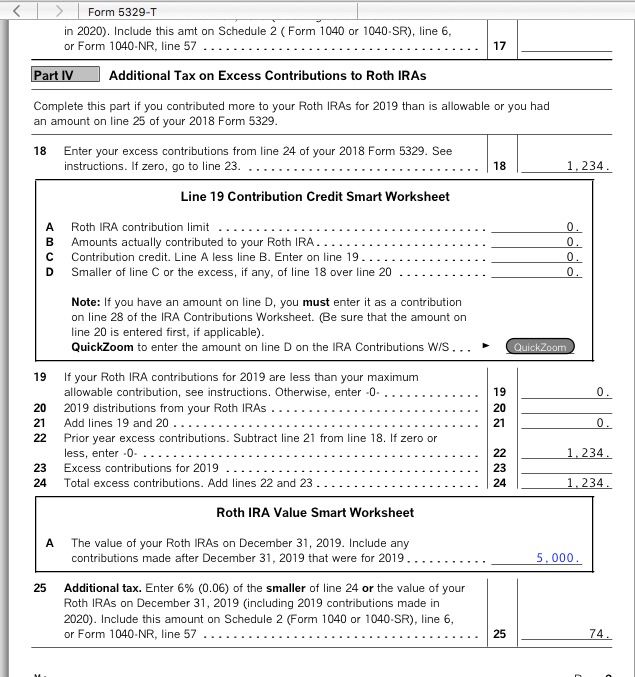

If this was a *2018* excess then it was to late to have it removed penalty free for 2018. You would owe a 2018 6% penalty on the excess. The 6% penalty will repeat in 2019 if it was not removed before the end of 2019. Do NOT remove it from 2019 if still there in 2020 - you will owe the 2019 penalty.

The penalty can be avoid in 2020 by removing the excess with a normal distribution (not a return if excess contribution) by the end of 2020. It will not be necessary to remove any earnings since the 6% 2018 & 2019 penalty must be paid. There will be no tax on the distributions since removing your own contribution is not taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally set my excess Roth contributions to zero (the excess was still there at the end of 2019), and now I can't figure out how to return to that page to fix it.

Okay, that's what I was thinking when I made my original plea for help on this forum—so my IT question remains—how the heck do I get back to the screen where I accidentally zeroed out the value of the excess contributions remaining in my Roth IRA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally set my excess Roth contributions to zero (the excess was still there at the end of 2019), and now I can't figure out how to return to that page to fix it.

Check the Roth box, say yes, you made a contribution, enter 0 for the contribution and click through until it asks if you had a prior year excess, say yes and then enter the amount. Say that it was not removed. That should produce a 5329 with the excess and penalty.

Enter IRA contributions here:

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),

Retirement & Investments,

Traditional & Roth IRA contribution.

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "ira contributions" which will take you to the same place.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally set my excess Roth contributions to zero (the excess was still there at the end of 2019), and now I can't figure out how to return to that page to fix it.

Thanks @macuser_22!!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ehouston1994

New Member

helloTT102

New Member

loopholejon

New Member

igpx330176

New Member

herosareangels

New Member