- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Doing the first Trust and Estate for father in law for 2020. I have1099-R from companies for ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing the first Trust and Estate for father in law for 2020. I have1099-R from companies for death benefits for estate. Where do you put 1099-R in Trust program?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing the first Trust and Estate for father in law for 2020. I have1099-R from companies for death benefits for estate. Where do you put 1099-R in Trust program?

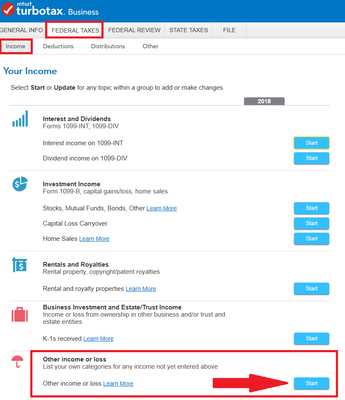

Enter the taxable amount in the Other income or loss section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing the first Trust and Estate for father in law for 2020. I have1099-R from companies for death benefits for estate. Where do you put 1099-R in Trust program?

Thanks for the reply. I saw the same answer in a post for 2019 that was dated 2020. So no change in the simple way of adding this info. If you are not too busy.... all I am doing is giving information about the 1099-R amount? I am not giving Payer's name, address or their tax number information. How does this information get attached or given to the IRS?

Again... thanks for the help in understanding what is needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing the first Trust and Estate for father in law for 2020. I have1099-R from companies for death benefits for estate. Where do you put 1099-R in Trust program?

The 1099R should have a federal ID # on it for the administrator of the pension plan and a federal ID # on it for the recipient of the final distribution of the balance of the pension plan at the death of the decedent. That is how IRS would "match" the 1099R to the return.

A 1099R distributed to the trust/estate of the remaining balance in the retirement account at death distributed to the trust/estate would be entered as Other Income (can list 1099-R and name of plan in definition of "other" in return). A 1099-R retirement distribution in the Trust/Estate return will be taxed at the Trust/Estate tax rate.

The trust/estate must have a federal ID # of it's own.

The 1099R in the Father-in-law's name and SSN for the amount of pension he withdrew prior to his death belongs on his final individual income tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing the first Trust and Estate for father in law for 2020. I have1099-R from companies for death benefits for estate. Where do you put 1099-R in Trust program?

I think I understand what you are telling me. I have the 1099-R with all the info the IRS needs. I will list the small information on the form and they will match up the proper 1099-R with what is listed on the form.

Yes- I have the other info and ready to fill out the form.

Every question is asked by the software, but not 1099-R.

Thanks for the help.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

lanawar

New Member

danahutchinson43

New Member

jc41

New Member

Sactax74

Level 2

patnkelli

New Member