- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Backdoor Roth IRA - Where is this distribution from (state)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

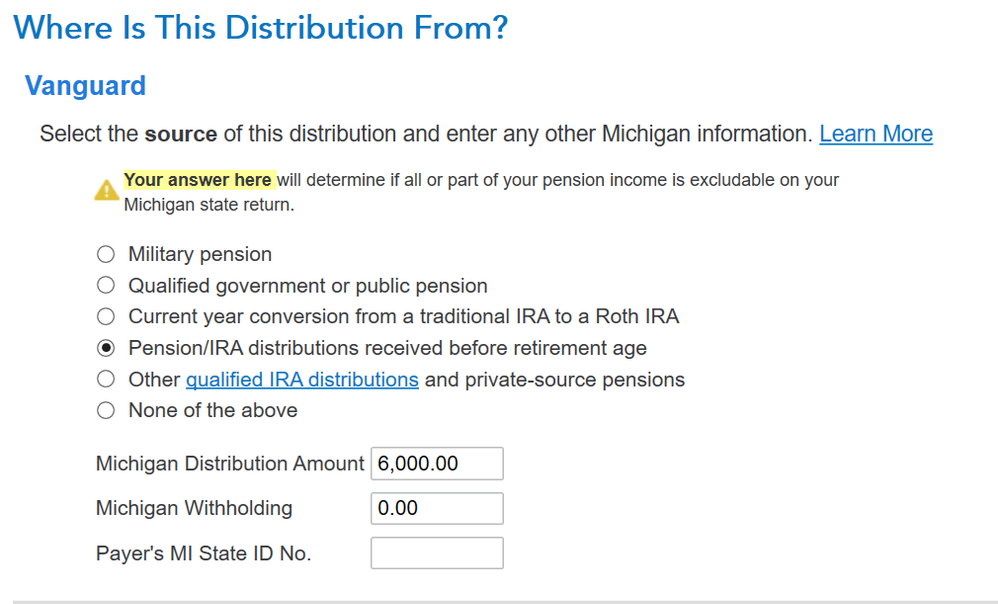

Backdoor Roth IRA - Where is this distribution from (state)

I followed the guide I found on TT (https://ttlc.intuit.com/community/entering-importing/help/how-do-i-enter-a-backdoor-roth-ira-convers...), but didn't see this question in the step, am I supposed to choose current year conversion from a traditional IRA to a Roth IRA? Also, even though box 15 and 16 are blank on my 1099-R form, it populates it when I import it from my brokerage. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA - Where is this distribution from (state)

Yes, You must enter current year conversion (2020) from Traditional Ira to Roth Ira on your 2020 income tax return. The amount on 1099-R line 2 on form 1099R is automatically entered on line 15 of 1099-R, if it was left blank.

With a backdoor Roth, you basically start the money off in a traditional IRA, transfer it to a Roth IRA and then pay the taxes you owe on that money now so that you can let your investments grow tax-free and enjoy tax-free withdrawals later. Income limit In 2020 is $139,000 for single and $206,000 for married filing joint.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA - Where is this distribution from (state)

Yes, You must enter current year conversion (2020) from Traditional Ira to Roth Ira on your 2020 income tax return. The amount on 1099-R line 2 on form 1099R is automatically entered on line 15 of 1099-R, if it was left blank.

With a backdoor Roth, you basically start the money off in a traditional IRA, transfer it to a Roth IRA and then pay the taxes you owe on that money now so that you can let your investments grow tax-free and enjoy tax-free withdrawals later. Income limit In 2020 is $139,000 for single and $206,000 for married filing joint.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA - Where is this distribution from (state)

Great, thank you @JoannaB2 for the clarification.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA - Where is this distribution from (state)

Sorry to bother you again @JoannaB2 , but in the backdoor Roth guide I posted, it states you should see Schedule 1 in your forms, I only see a Schedule 2.

Schedule 1 from the menu on the left side of the screen. Line 19 IRA deduction should be blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA - Where is this distribution from (state)

Doesn't look like I can edit a previous message on this board, but I believe I found it; it was under 1040/1040SR Wks. All is well now. 😁

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

gdelgado----

New Member

toga1950

New Member

rjs55

Returning Member

billiecrawford-m

New Member

Edge10

Level 2