- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Tax Year Prior to 2020: Excess Roth IRA Contribution

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

David -

Last few Qs for you:

1) Does this mean that for my situation, I'll need to wait till 2021 (to get 1099Rs for 2020) and then file amendments for 2017 and 2018?

2) Also, for 2019, I am removing all past excess roth tomorrow but wont get 1099Rs for that till next year which will details earnings and contributions etc. I'll have no penalties to pay next year as I am paying penalties this year. However, I'll still need to amend for 'earnings' and 10% early withdrawal on earnings which I wont get till next year on the 1099R form?

3) Is there no way for me to take care of these amendments for 2017 and 2018 right now and also accurately file 2019 taxes now rather than waiting till next year to file amendments after receiving 1099-R forms? I can easily calculate the earnings from each year's contributions over the years using starting and end market value and weighted average of contributions made. 6% penalty calculation excess contribution for each past year is built into Turbo Tax and I believe I need to pay 10% early withdrawal fee on 'earnings' (and include them along with earnings for the same year where contributions were made).

Here's what I am thinking of doing if I can do these 2019, 2018 and 2017 filing this year without waiting for 1099 R next year. Please advise if this is feasible or do you recommend waiting till next year and filing amendments:

- Calculate earnings from excess contributions for each year using starting, ending market value and weighing by contributions made in that year

- I was thinking I could put these 'earnings' in 1099-MISC etc in TurboTax for each year

- 6% fine on excess contributions is already calculated by TurboTax in 5329 forms for each year

- Not sure where to put the 10% early withdrawal fee (that applies to the 'earnings' from contributions): Ideally, this will have to be applied to the same tax year as the year of contributions from where these earnings came. Is there an option is TurboTax to enter this or manually enter this somewhere?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

In response to your questions:

- Because your excess Roth IRA contributions are being removed after the last date for penalty-free corrective actions, you won't need to amend your tax returns prior to 2019 to report any income on the excess contribution.

- If there are earnings on your 2019 excess contribution that are removed before the due date of your 2019 tax return, those are reported in the year the contribution is made. So, if the 2019 excess contribution has earnings (not losses) those earnings will need to go on an amended 2019 tax return. The 10% early withdrawal penalty on the 2020 distribution is applied only to any earnings, not the excess contribution amount.

- No. You can't fix everything with the 2019 filing you are about to make. You will need to wait until you receive your 2020 1099-Rs that remove all the excess contributions so that you will know if you need to amend 2019 for any earnings on the 2019 excess contribution.

[Edited 7/13/2020| 4:37pm PDT]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

Got it! Super clear - thanks so much, David!

Here's my actual situation after reviewing all of my Roth since inception:

2009-2013: Eligible to make Roth Contributions(Total eligible contributions: 6,010)

2014-2018: Excess Roth contribution 5,900

Total Roth Account Contributions as of Dec 31 2019: 11,910

Roth Market Value, as of Dec 31st 2019: 22,800

I am trying to remove my excess roth and any earnings from 2014 - 2018 -> this means that ideally I'll have to remove 5900 (mentioned above) + any earnings from those 5900 excess roth till date. However, given the FIFO rule of Roth, even when I try to remove those 'earnings' from Roth for past years, it wont remove them before removing all my contributions (which is 11,910 as of end of 2019!)!

Question: Does IRS allow to keep earnings for past years in the Roth and not have to remove them and just have the contributions removed? Since it's impossible to 'get to the earnings piece' before removing all contributions from Roth, given the FIFO rule of removal?

Thoughts, if I dont have to worry about past earnings, let them be in roth and just remove excess 5900 roth contribution and pay 6% penalty for it this year + do any amendments when I get the 1099-R form next year? I called my brokerage and they said they wont be giving me any breakdown of earnings and contributions for past years but just remove the exact amount I tell them to remove. The problem is, even if i tell them to remove 5900 + earnings = my brokerage will use FIFO to remove contributions worth that total amount and hence 'technically' never remove the 'earnings' and so the 1099-R will have '0' earnings reported next year. Does that make sense - hopefully, I didn't confuse you.

I read this article: https://www.hrblock.com/tax-center/income/retirement-income/excess-ira-contributions/

that states "You do not need to remove any earnings made on the excess" if the extended due date has passed.

The article states, "If you remove the contribution:

- After the extended due date of your return, you will be subject to the 6% excise tax each year the excess remains in the account at the end of the year (by December 31) until it is removed. You do not need to remove any earnings made on the excess"

Also, found this:

The ordering rules of the deemed sources of the distribution and their taxability are as follows:

- regular Roth IRA contributions (never subject to tax or early withdrawal penalty)

- qualified rollover contributions, on a first-in first-out basis with the taxable portion of each conversion before the nontaxable portion for that conversion. (taxable to the extent not already recognized in income, and subject to the 10% tax if made before the 5-year holding period determined separately for each conversion)

- nontaxable portion of each conversion (not subject to income tax or to 10% early withdrawal penalty)

- repeat (2) and (3) for each conversion

- earnings on direct Roth contributions and conversions (includible in income and subject to 10% penalty)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

Hi David (and everyone)

I had a question regarding excess contribution to Roth IRA, - I was hoping for some last minute guidance. Here are the basics:

Made $1,800 in excess contributions during the 2019 calendar year

Realized made excess contributions last week BEFORE filing my taxes

Excess contributions withdrawn and earnings on excess contributions withdrawn (will be receiving checks for both)

Earnings on excess contributions in 2019 were $45.43

Do I have to report anything on my 2020 taxes that I am about to file (tomorrow!)?

What form/information do I need to report on my taxes before I file them (tomorrow) to avoid having to do an amendment? Is it a 2019 1099-R that will be sent to me that contains the information? (If so, going to try and get this information from the financial institute tomorrow - not sure if do-able).

Further, I realized excess contributions were made so far this year in 2020, I have already halted further contributions and requested those be withdrawn and sent to me along with earnings on the excess contributions. When I file in 2021 (for 2020 tax stuff) will I report this the same way - using a 1099-R form for the earnings on excess contributions?

Most importantly, thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

Hi

I have a similar question, Made excess contribution for 2020 . Had the excess contributions and earnings removed in Jan 2021 prior to filing 2020 taxes. I am expecting the 1099-R while filing for 2021 taxes.

To the question on removal of excess contributions in 2020 taxes. Should i just include 2020 ROTH IRA contributions or also include the earnings also.?

Rgds

Ned

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

The amount of the excess contribution returned is the unadjusted amount of the excess, not the adjusted amount that includes gains. You'll also need to enter into 2020 TurboTax the code JP 2021 Form 1099-R that you expect to receive next year so that the gains will appear as taxable income on 2020 Form 1040 line 4b and will appear on 2020 Form 5329 as an early distribution subject to the 10% early-distribution penalty. This 2021 Form 1099-R will have:

- Box 1 = returned contribution plus gains

- Box 2a = just the gains

- Box 7 = codes J and P

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

Just the actual contribution so it does not carrying forward to next year as not being removed. That just tells TurboTax that the excess was removed. The earnings removed will be reported on the 2021 1099-R, but they must be reported on the 2020 tax return which will require amending 2020 after the 2021 1099-R is receives that should have a box 7 code of "PJ". P means taxable in 2020 and J means Roth IRA. Only the box 2a amount (earnings) will be taxable.

=============================

To avoid having to amend:

*IF* you requested a return of contributions due to an excess contribution and the excess was removed before the extended due date of the 2020 tax return and the earnings were also returned and you know that the IRA custodian will report this as a return of contribution and not as a normal Roth distribution but as a return of contribution with a code "JP" in box 7 - then:

You can just report it now and ignore the 1099-R when it comes unless there is Box 4 Federal Tax withholding and/or box 12 State withholding. Then you must also enter the 2021 1099-R into the 2021 tax return since the withholding is reported in the year that the tax was withheld. The 2021 code JP will not do anything in 2021 but the withholding will be applied to 2021.

You would enter the 1099-R with the total distribution in box 1 (the contribution plus the earnings),

The earnings in box 2a,

Enter code "P" in box 7 (Top) - don t worry that it will say "taxable in 2019 "

Enter code "J" in box 7 (Bottom).

On the "Which year" screen say that this is a 2021 1099-R. - That makes it taxable in 2020 and not 2019

After the 1099-R summary screen press continue.

If you are over 59 1/2 then on the "Lets see if we can lower your tax bill" enter the box 2a amount in the "Another Reason" box to eliminate the 10% early withdrawal penalty on the earnings.

Enter the explanation for the excess contribution and that you are reporting a 2021 1099-R on your 2019 tax return to avoid having to amend in 2021.

The box 2a earnings will be taxable income reported on line 4b on the 1040 form and if under age 59 1/2 will also be subject to a 10% penalty on a 5329 form that will be reported on line 59 on the 1040 Schedule 4 form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

Thanks to everyone for the replies. Just a clarification , that you meant 2020 and not 2019 in the statement here

"Enter the explanation for the excess contribution and that you are reporting a 2021 1099-R on your 2019 tax return to avoid having to amend in 2021."

Rgds

Ned

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

ned75, in your case, that's correct. There's some confusion here because the original question that you added to was in regard to a contribution made for 2019 rather than for 2020. So substitute 2020 for each place where today's reply by macuser_22 mentions 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

I had excess contributions for 2018, 2019 and 2020 which were all removed in 2020 as follows:

2019 contributions - 4/29/2020 - 7559.20 (559.00 earnings)

2018 contributions - 6/15/2020 - 6500.00 (original contribution - excess was 6060.00 and I realize that after I removed it)

2020 contributions - 12/11/2020 - 2887.76 (733.79 earnings)

In 2020:

a) I filed 2018 1040X in 2020 prior to the extended tax deadline to pay the 6% tax

b) I filed substitute 1099-R with 2020 return for 2019 excess contribution removed in 2020.

c) I filed 5329 with 2019 return for 10% penalty on 2019 earnings and 6% tax on 2018 earnings

I received a 2020 1099-R listing each of the contribution removals listed above.

I have added the 2020 withdrawal on a 1099-R in 2020 return

Questions:

- How do I report 2018 excess contribution removal in 2020. If I enter a 1099-R for 2018 separate from the 2020 removal, TT taxes me - why is that - it doesn’t ask me what year the withdrawal was.

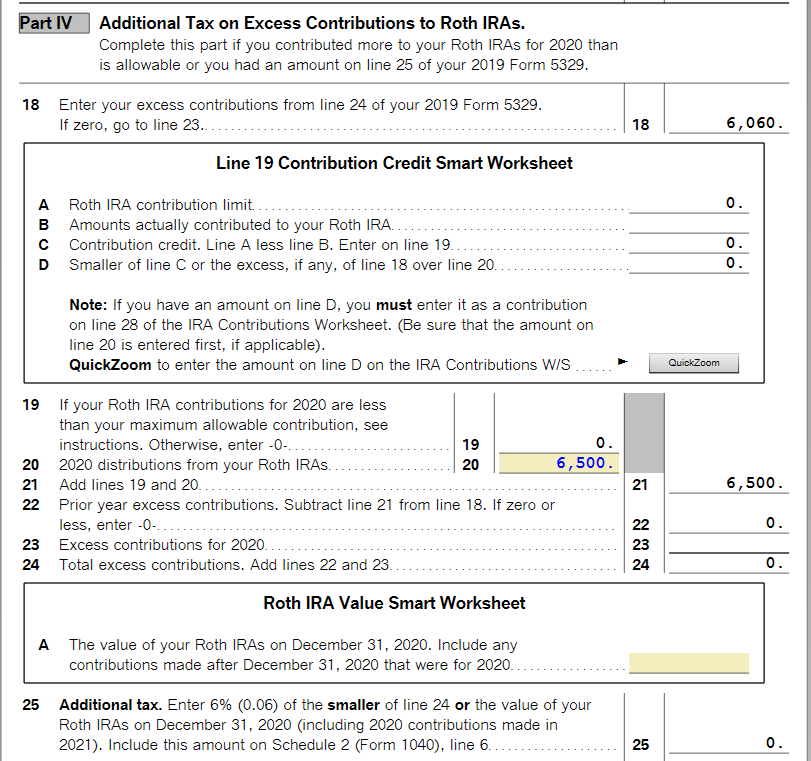

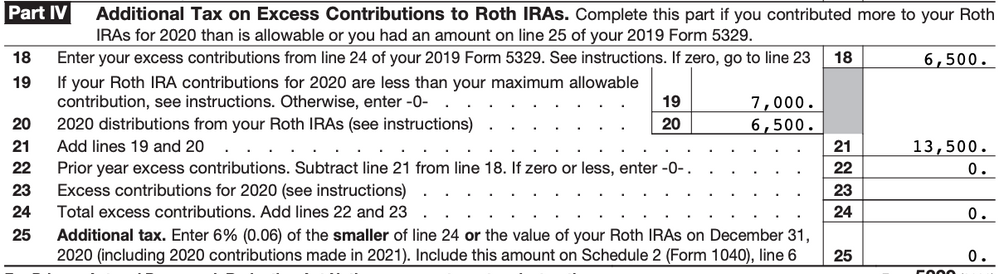

- On Form 5329 for 2020 - are the following amounts correct?

- line 18 shows 6060 (the amount of excess),

- line 19 shows 7000 (assuming because I didn’t make any contributions for 2020).

- Line 20 is blank (shouldn’t this be 6500, the amount I withdrew in 2020)

- Line 22, 24 and 25 show zero

- Do I need to report anything else on 2020 return for 2019 contribution withdrawal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

@tmepfox :

1. You simply enter the $6,500 code J Form 1099-R into 2020 TurboTax. In addition to including this distribution on line 19 of Form 8606, TurboTax will include this on line 20 of Form 5329 to be subtracted from the $6,060 shown on line 18.

2. 2020 Form 5329 Part IV. (I assume that you were not permitted any Roth IRA contribution for 2020, otherwise you would not have had any of your contribution for 2020 returned):

3. Only if the code JP 2020 Form 1099-R shows tax withholding do you need to enter it into 2020 TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

@dmertz - Thanks for the quick response

1. Before posting I did enter it in a 1099R but my mistake was not going through the entire process and answering the followup questions which is why it was taxing me. This is what I see now on Form 5329.

To answer your question in #2 above, I removed the 2020 excess contribution in anticipation (and calculations) that I would be ineligible, but that turned out to be incorrect. I believe that is also why I am seeing the $7000 on line 19.

Even though I am eligible to contribute, I think I am going to stay away from doing that this year just to stay away from any more complications in filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

"I removed the 2020 excess contribution in anticipation (and calculations) that I would be ineligible, but that turned out to be incorrect. I believe that is also why I am seeing the $7000 on line 19."

I see, that makes sense. That means that you did not actually need to obtain the regular distribution of $6,500 but could have instead treated the excess as part of your 2020 contribution. As you indicated, since you did obtain the regular $6,500 distribution, that by itself eliminates the excess and you can still make a Roth IRA contribution for 2020 if you choose to do so. I don't see how that would add any complication. It wouldn't change your tax return in any way other than to remove the $7,000 from line 19.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

I just thought removing the 2020 contribution and now contributing again would cause a mix up with the IRS since the 2020 removal is on the 1099R and will be reported to them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Excess Roth IRA Contribution

I have another question that I just received an answer to from Vanguard today. On my 2020 1099R, they list the amounts as outlined in the table below. There is an X against the 6500.00 in box 2b which for some reason doesn't show below. As mentioned I filed substitute 1099-R with my 2019 return for 2019 excess contribution removed in 2020 and paid the tax on the earnings as well with my 2019 return (Gross 7559 removed of which earnings are 559).

However, below Vanguard reported the distribution as $7000 only instead of 7559 and the Vanguard representative says since the distribution was made in 2020 it is taxable in 2020 and so it is included below as part of the 3446.96 amount (box 1) and in the 1292.99 taxable amount in 2a. Not sure if their reasoning is correct but now if I put these numbers in my 1099R in TT as is, I will be paying tax on the 559 again this year. How can I enter this in TT so as to avoid having to pay the tax again and at the same time not cause confusion for the IRS

Gross distribution (Box 1) | Taxable amount (Box 2a) | Taxable ---(Box 2b)-- | Federal income tax withheld (Box 4) | Employee contributions/ Designated Roth contributions or insurance premiums (Box 5) | Distribution code(s) (Box 7) | IRA/ SEP/ SIMPLE | 1st year of desig. Roth contrib. (Box 11) | State tax withheld (Box 14) | State/Payer's state no. (Box 15) | State distribution (Box 16) |

6,500.00 7,000.00 3,446.96 |

1,292.99 | 0.00 0.00 0.00 | J PJ 8J | 0.00 0.00 0.00 |

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jjyoo92

New Member

htb14

Returning Member

cparke3

Level 4

mcht

Returning Member

mcht

Returning Member