- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Does not show turbo tax my 2020 Summary of Federal form 1099R?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does not show turbo tax my 2020 Summary of Federal form 1099R?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does not show turbo tax my 2020 Summary of Federal form 1099R?

Are you saying you did not see the Form 1099-R on your Summary screen? As long as you enter the Form 1099-R correctly, the numbers will be carried over to your Form 1040.

To enter a Form 1099-R in TurboTax online, here are the steps:

- Sign in to your account and select Pick up where you left off

- From the upper right menu, select Search and type in 1099r and Enter

- Select the Jump to 1099r

- Follow prompts

You'll receive a 1099-R if you received $10 or more from a retirement plan. After entering the information in the program, the amount will show on either line 4 or 5 on your Form 1040 depends on if your distribution is an IRA related.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does not show turbo tax my 2020 Summary of Federal form 1099R?

Sorry, I was not talking about the form 1040. I was saying about the form Summary of Federal form 1099R which has to be sent with the state tax form. The turbo tax is completed already, last years the Turbo Tax software produced it, but for this year it did not and I don't know why and I need it to mail in my state tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does not show turbo tax my 2020 Summary of Federal form 1099R?

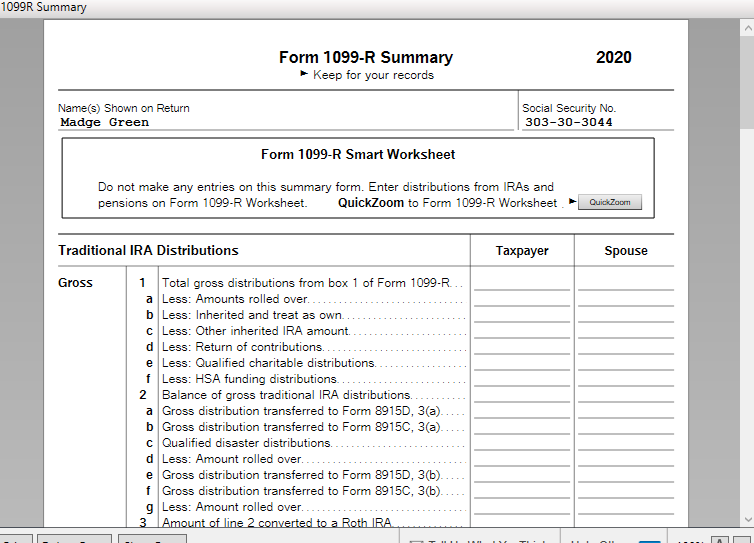

Yes, you should have a 1099-R Summary in your Federal return (screenshot).

Be sure when you Print or Save your return, you request 'all worksheets'.

Click this link for more info on Printing Forms and Worksheets.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dkjk5657

New Member

richard_rowdy_jr

New Member

Bend371

Level 2

Kell7

Level 2

tlc64tlc

New Member