- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Can someone help me understand why the irs reduced my refund amount by $1719. They list in details the reason being one of 5 reasons But don’t tell which one is the cause

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone help me understand why the irs reduced my refund amount by $1719. They list in details the reason being one of 5 reasons But don’t tell which one is the cause

We changed the amount claimed as Recovery Rebate Credit on your tax return. The error was in one or more of the following:

The Social Security number of one or more individuals claimed as a qualifying dependent was missing or incomplete.

The last name of one or more individuals claimed as a qualifying dependent does not match our records.

One or more individuals claimed as a qualifying dependent exceeds the age limit.

Your adjusted gross income exceeds $75,000 ($150,000 if married filing jointly, $112,500 if head of household).

The amount was computed incorrectly.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone help me understand why the irs reduced my refund amount by $1719. They list in details the reason being one of 5 reasons But don’t tell which one is the cause

That is just the list of generic reasons they give if they changed the Recovery rebate credit on line 30. How much is on 1040 line 30?

Do you have an amount on 1040 line 30 for the Recovery rebate credit? Did you not get one of the first 2 Stimulus payments? Or qualify for more? Line 30 is only if you qualify for more or missed getting one.

If you claimed a missing stimulus payment on your return but the IRS took it off you have to ask the IRS. They think they already sent it to you. Did you get the 2nd round after you filed your return? Maybe it went to an account you don't remember. Or you got a check or a card. It was probably easy to miss the debit card in the mail and think it was junk mail. They have to put a trace on it.

How to put a trace on a missing 1st or 2nd Stimulus payment. IRS for Payment Issued but Lost, Stolen, Destroyed or Not Received

See question F3 here, you can expand it to see how to put a trace on it.

Line 30 is only if you didn't get one or both of the first 2 Stimulus payments or if you qualified for more, like if you added a dependent. Did you not get the full amount for the first two EIP payments? Maybe you got the second one after you filed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone help me understand why the irs reduced my refund amount by $1719. They list in details the reason being one of 5 reasons But don’t tell which one is the cause

Line 30 of my 1040 shows $1800. Yes I did receive both stimulus checks. However when i filed turbo taxed asked how many stimulus payments I received before a certain date in December. To which I had only received 1 before that date. The second wasn’t received till 2021

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone help me understand why the irs reduced my refund amount by $1719. They list in details the reason being one of 5 reasons But don’t tell which one is the cause

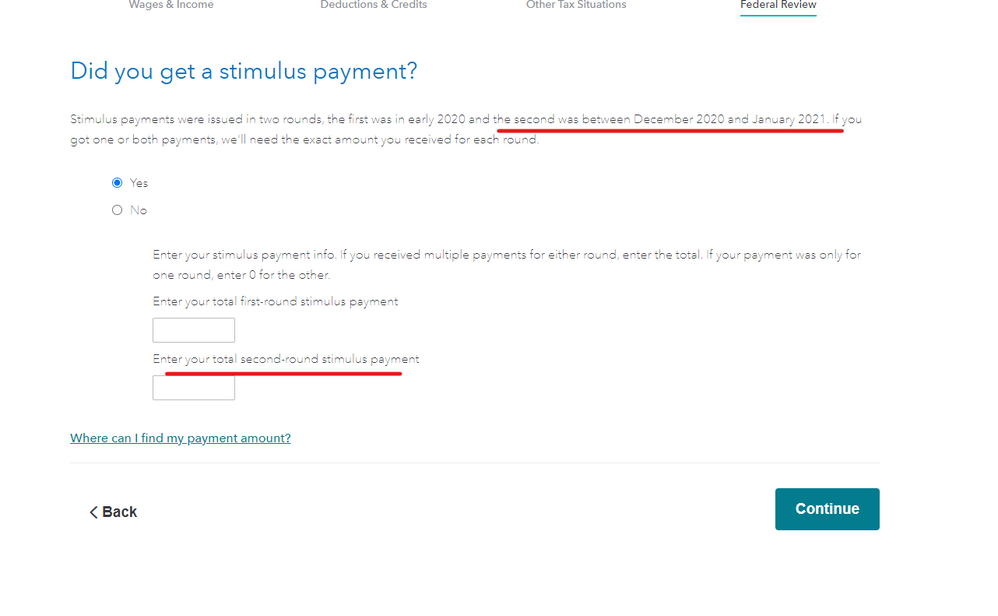

You were suppose to include the one you got in 2021. The payment you got in January or February 2021 is an Advance and based on your 2020 return. So you tried to get it again. The year you got it doesn't matter. The Stimulus entry screen even says the second one is between Dec 2020 and Jan 2021 so you should include any payments you received in January and February.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone help me understand why the irs reduced my refund amount by $1719. They list in details the reason being one of 5 reasons But don’t tell which one is the cause

That was your mistake. You were supposed to enter the EIP payment you received in 2021 as well. It did not specify getting it by a December date. Lots of those EIP #2 payments went out in early 2021 and you were supposed to say you got it. You cannot get the 2nd stimulus check twice--so since you received it before you filed and had it on your tax return on line 30, the IRS took it away.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone help me understand why the irs reduced my refund amount by $1719. They list in details the reason being one of 5 reasons But don’t tell which one is the cause

I actually called into turbo tax to ask them about this when I filled it and confirm I did it right. They said everything was correct. So I’m not sure what to say other then there was a flaw in the system. But either way you are saying what the irs did was right and I don’t need to progress further trying to get that $1719 as it was not a mistake on the irs side

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone help me understand why the irs reduced my refund amount by $1719. They list in details the reason being one of 5 reasons But don’t tell which one is the cause

Nope---it was not a mistake on the IRS end. Lots of people made that same mistake and had the stimulus on line 30 by mistake. That is one of the big reasons there were so many delays for 2020 refunds. The IRS has had to cross check every return with an amount on line 30 to see if you really should get that amount. Since you received both stimulus payments you were not entitled to get it again and it should not have been on line 30. Just leave well enough alone.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone help me understand why the irs reduced my refund amount by $1719. They list in details the reason being one of 5 reasons But don’t tell which one is the cause

@Critter-3 Don't you have a TT screen shot showing that it says the second one is received Dec-Jan?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone help me understand why the irs reduced my refund amount by $1719. They list in details the reason being one of 5 reasons But don’t tell which one is the cause

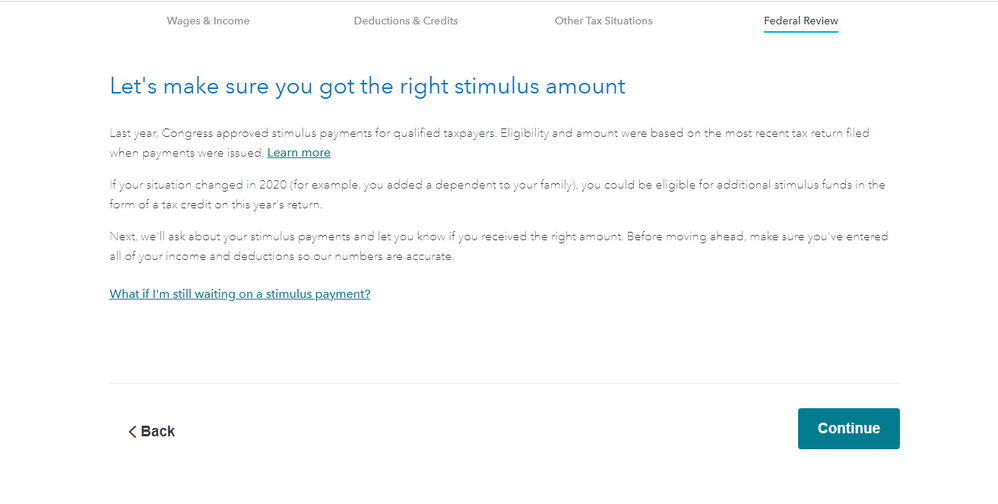

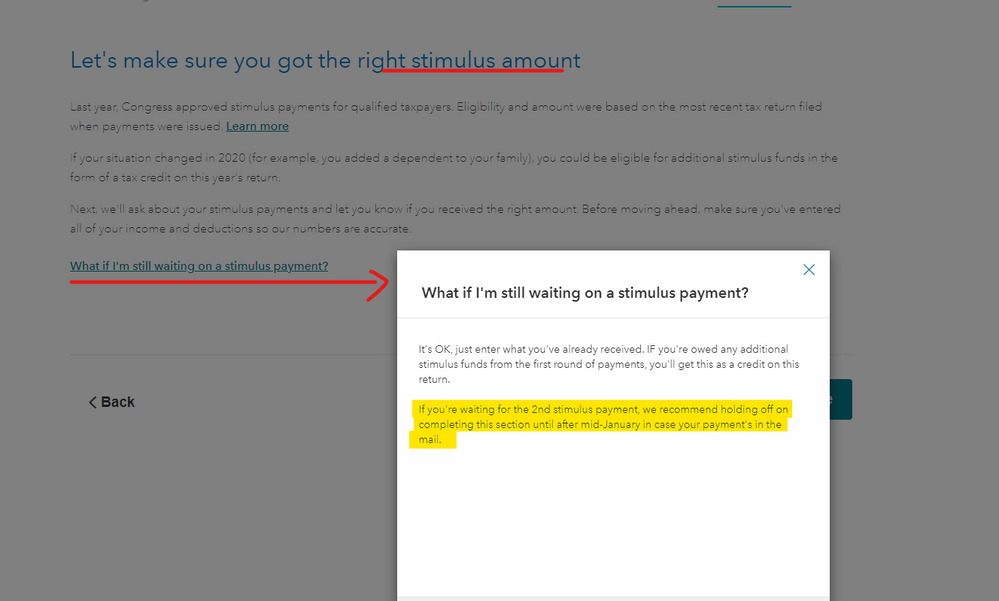

The second stimulus payments were supposed to all go out by the end of January however many took much longer ... the program told you to wait a bit to see if you got the second one if you were filing early but if you did not and the payment was sent after you filed the IRS corrected the credit on the return automatically which is what happened to you. These are the screens you should have seen ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can someone help me understand why the irs reduced my refund amount by $1719. They list in details the reason being one of 5 reasons But don’t tell which one is the cause

Thankyou. for the screen shots.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

LCM4

Returning Member

cfharp

Level 2

mrgallien

New Member

MD68

Level 2

JJ_DMB

Level 1