- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- 1099-R Traditional to Roth

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Traditional to Roth

My son funded his 2018 IRA in 2019. He initially put it all in a Traditional account, and then found that part of it would not be deductible, so he directed the custodian to move that part to a Roth (within a day or so, and there were no earnings involved to move). He included a statement with his 2018 return explaining the portion of the initial contribution that was moved to the Roth. He received a 1099-R for 2019 for the amount that was moved, as an early distribution. When he enters the 1099-R info, with exception code 2 and "distribution from an IRA/SEP/Simple" checked, it tells him he owes no additional tax, but the amount TurboTax says he owes jumps. (If he removes the 1099-R, it goes back down.) What's going on? Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Traditional to Roth

A code 2 does not indicate a "move" of funds by the custodian to a Roth, it indicated a taxable distribution to the plan owner. A move, (switch the contribution for a Traditional IRA to a Roth as if the Traditional IRA contribution never happened but was a Roth contribution instead, is a recharacterization and should have been reported on a 1099-R with a code R in box 7.

You should talk to the IRA custodian to find out what was actually done and why there is a code 2 and not the proper code R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Traditional to Roth

Thank you. Lots of phone calls. The investment division has been sold to another national firm. Old Firm first says New Firm will have to handle the issue; New Firm says Old Firm has to. Old Firm also says it's a conversion rather than a recharacterization (because it was done in Feb 2019 for a 2018 IRA), which I think is wrong. Old Firm says there's no-one to talk to about it, but will see about having a manager return the call in 4-5 business days.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Traditional to Roth

They are incorrect. IRS Pub 590A says:

https://www.irs.gov/publications/p590a#norecharacterizationsofconversionsm-550dcfb7

Recharacterizations

You may be able to treat a contribution made to one type of IRA as having been made to a different type of IRA. This is called recharacterizing the contribution.

To recharacterize a contribution, you generally must have the contribution transferred from the first IRA (the one to which it was made) to the second IRA in a trustee-to-trustee transfer. If the transfer is made by the due date (including extensions) for your tax return for the tax year for which the contribution was made, you can elect to treat the contribution as having been originally made to the second IRA instead of to the first IRA. If you recharacterize your contribution, you must do all three of the following.

-

Include in the transfer any net income allocable to the contribution. If there was a loss, the net income you must transfer may be a negative amount.

-

Report the recharacterization on your tax return for the year during which the contribution was made.

-

Treat the contribution as having been made to the second IRA on the date that it was actually made to the first IRA.

Since this was a 2018 contribution made in 2019 before the April 15 due date of the 2018 tax return and recharacterized a few days later (which I assume was also before April 15, 2019) then it meets the IRS time limits for a recharactorization and should have a code R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Traditional to Roth

Not making a lot of progress. Old Firm apparently says they just do/did everything as conversions, but that it shouldn't matter, and that they aren't going to go back and change anything for a 2018 contribution. Still working on them, but if they don't budge, how does he fix this?

Does he need to amend his 2018 return? Since he didn't claim the excess as a deductible amount on his return, would he "correct" it to a non-deductible traditional contribution? (Would he use form 8606?) The 1099-R is for 2019, so does he need to show a conversion in 2019, rather than 2018?

Or is there a way for him to take care of it all with his 2019 return? Can he attach some kind of explanation statement? TurboTax doesn't add the additional tax if he enters the 1099-R with a code R instead of a 2, but we're not finding any way to get it not to add the tax otherwise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Traditional to Roth

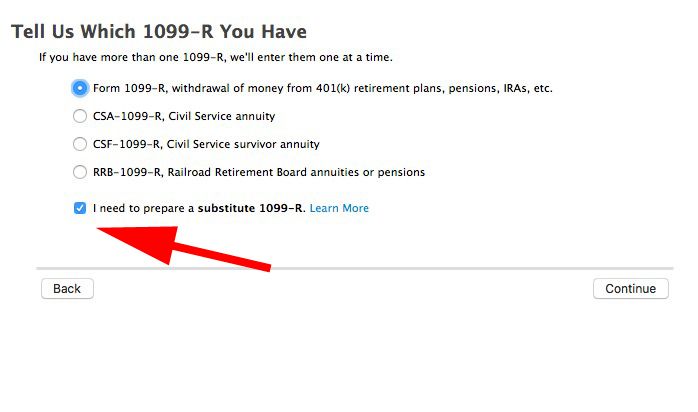

If he reported the recharacterization on his 2018 tax return with an explanation then about the only thing that can be done about the improper 1099-R now, if the financial institution will not cooperate, is to file a substitute 1099-R exactally the same at the the one receives but with box 1 and box 2a 0. TurboTax will ask for an explanation of what the substitute and what steps were taken to get the financial institution to correct the error. Just explain as you did in this thread.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Traditional to Roth

Using a substitute Form 1099-R (Form 4852) to report this as a recharacterization instead of as a Roth conversion is more complicated than macuser_22 has described. A recharacterization is required to be accompanied by any investment gain or loss and the amount that the financial institution moved to the Roth IRA would not have included that adjustment. This means that, if treated as a recharacterization, the amount actually recharacterized was more or less than the amount transferred. Amending the 2018 tax return would likely still be necessary and, if there were investment gains, 2018 Form 8606 would still be necessary to show the remaining nondeductible traditional IRA contribution.

At this late stage, I think it would be far better to just accept that the movement of the money to the Roth IRA was a Roth conversion, not a recharacterization, and that some amount of basis in nondeductible traditional IRA contributions remains in your son's the traditional IRAs, amending the 2018 tax return to add Form 8606 to reflect that. If the balance in your son's traditional IRAs is relatively small, your son could just conversion all of his IRA money to Roth in 2020, pay the taxes, and let the money grow in the Roth IRA tax free once the requirements are met instead of growing tax deferred in the traditional IRA. As long as your son has a $0 balance in traditional IRAs at the end of 2020, all of the remaining basis will be applied to reducing the taxable amount of the Roth conversion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Traditional to Roth

He made the initial contribution 2-26-19. He tried to contact the financial institution online the same day, but got a message to call, which he did on 2-27-19. They said because he had just opened the account, they couldn't actually do the transfer that day; they did the transfer on 3-5-19. It's in a mutual fund, and the closing price per share was actually 15 cents less on the 5th than on the 26th (11 cents less than on the 27th), so there weren't actually any gains, correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Traditional to Roth

The gain or loss must be calculated over all of the investments in the account. If this was the only investment (probably the case since this was a new account), then the percentage loss can be calculated by simply dividing the NAV on 3/5 by the NAV on 2/26. More generally, though, the percentage loss is determined by dividing the account value immediately before the recharacterization by the account value immediately after the contribution.

If the total loss was less than 50 cents, that just gets rounded off and, for tax-reporting purposes, the amount transferred equals the amount recharacterized. However, assuming that the loss was more than that and treated as a recharacterization, the amount recharacterized was more than the amount transferred. So the 2018 tax return would still need to be amended to reflect the actual amount recharacterized that would have resulted in a transfer of the amount actually transferred. But, of course, the amount recharacterized can't exceed the amount of the original contribution to the traditional IRA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Traditional to Roth

So he contributed the money on Feb 26 (Feb 2019 for a 2018 IRA) but did not choose the mutual fund to purchase until some point after the non-deductible portion was moved. It just sat in the account and doesn't appear to have accrued any earnings/interest between the initial deposit and when it was moved. He can amend his 2018 return and remove the recharacterization entry; it doesn't appear to affect the final tax due for 2018, so we're hoping the program calculated it correctly. It generates an 8606 showing the amount he moved as his basis for the nondeductible portion. The 2018 IRA was his first (and he put all his 2019 IRA contribution into a Roth in early 2020.)

For his 2019 return, he entered the 1099-R with a code 2 (boxes 1 and 2 are the same amount and "taxable amount not determined" is marked, as is the IRA/SEP/SIMPLE box). TT says he doesn't owe extra tax because box 7 says there's an exception (for the early withdrawal penalty, I assume). He answers Yes, that he made and tracked non-deductible contributions and then he enters the basis from the 8606. He enters the 12-31-19 value, per the 5498, and -- the tax due jumps by several hundred dollars. 1) Why, since he already paid tax on the nondeductible contribution for 2018? 2) Is there something he's doing wrong or is there something he can still do to make that not happen? 3) If he has to pay it, does that adjust something else (for later?) so that he's not actually paying tax on the same money twice? Thanks for any help.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

SoCalRetiree

New Member

Linda C2

Level 2

Linda C2

Level 2

berolee

New Member

jjyoo92

New Member