- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Tax Certificate for Amended Tax Return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Certificate for Amended Tax Return

Good afternoon,

I work in a Air Force Finance office and we have a member who paid a debt he should never have gotten due to an error in our accounting system. DFAS(Defense Finance and Accounting service) said they can't refund and instead issued a tax certificate with the amount($963). This tax cert is for calendar year 2018. Would the member just file an amended tax return with the tax cert? Can you explain how the process would work in TurboTax? And would he get that all that money back? Any help would be appreciated thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Certificate for Amended Tax Return

What is a " tax certificate " - never heard of such a thing?

A what does paying a debt (owed or not) have to do with a tax return?

Money lost because of bad debts are not deductible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Certificate for Amended Tax Return

I am not quite sure either. DFAS is telling me they can't refund the money he paid and only provide a tax certificate so he wouldn't get taxed as much which is what I am assuming. I am not quite sure so that's why I am asking the question on how it work. I just found this post, which seems to be like the same kind of scenario. One of the commenters there seemed to understand. I sent her a message. https://ttlc.intuit.com/community/state-taxes/discussion/this-situation-is-referred-to-as-a-claim-of...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Certificate for Amended Tax Return

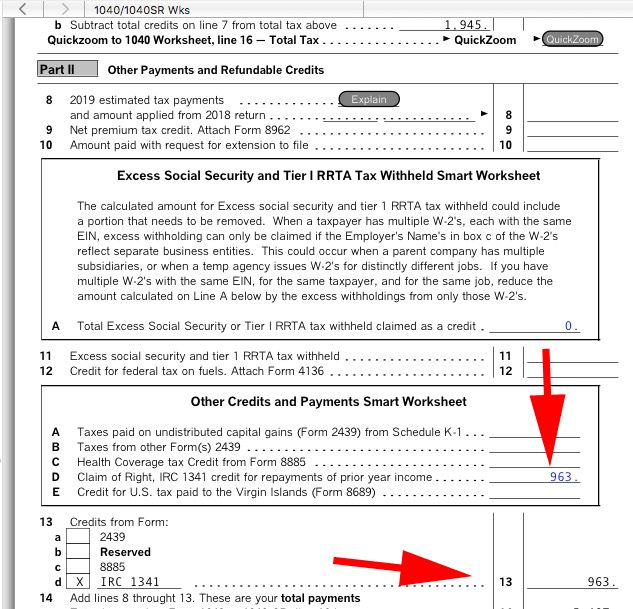

OK - If this is "Right of Claim" under $3000 then it is deducted form income on the 1040 Schedule 3, line13, box d.

IRS Schedule 3 instructins.

Line 13

Check the box(es) on line 13 to report any credit from Form 2439 or 8885.

If you are claiming a credit for repay-ment of amounts you included in your income in an earlier year because it ap-peared you had a right to the income, include the credit on line 13. Check box d and enter “I.R.C. 1341” in the space next to that box. See Pub. 525 for details about this credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Certificate for Amended Tax Return

BTW: This is not supported by TurboTax online versions, only the CD/download versions has the forms mode to enter this on the Schedule 3 worksheet for line 13.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Certificate for Amended Tax Return

As a representative working in the finance office, if you are unable to answer a member's question then you should first be taking it up your chain of command. If not possible or practical, (maybe you're a civilian employee?) then refer the member to base legal. At this time practically all base legal offices world-wide have extra staff on board for the sole purpose of dealing with military and military related tax scenarios - exactly like the one you are trying to deal with.

I would not expect a military finance office employee to be that knowledgeable on taxes - it's not in your training. It's also frowned upon for one to go "outside" of the proper channels in your capacity as an military member or government employee. So if you can't find the information you need in a military regulation (and I know you can't) you need to refer the member to base legal if your chain of command is unable to help.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

kvthompson2

Level 1

windtree4

Level 2

xxrubyxxmacxx

New Member

wvla

New Member

furandfins-outlo

New Member