- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Re: I have reviewed my W-2 and I have entered the correct amounts in the specified boxes. I am mi...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have reviewed my W-2 and I have entered the correct amounts in the specified boxes. I am military and my state(KY) does not collect state taxes for military but it says I owe money to Kentucky and t

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have reviewed my W-2 and I have entered the correct amounts in the specified boxes. I am military and my state(KY) does not collect state taxes for military but it says I owe money to Kentucky and t

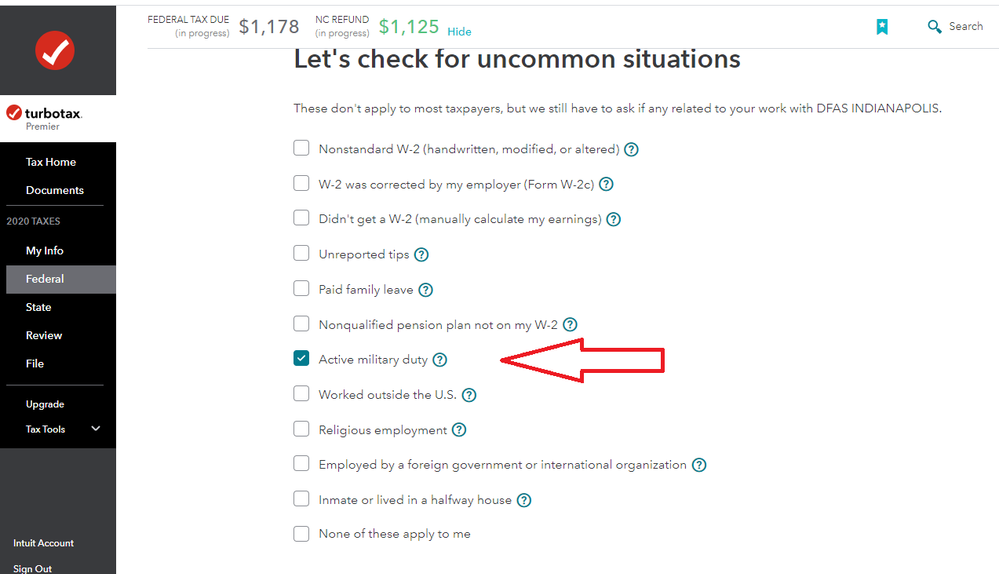

So you put that you were active duty military in your Personal Info or My Info section, answered the related questions, and you also indicated on the screen after entering your W-2 that this W-2 was active duty pay, right?

Did you have any other income in Kentucky besides your active duty pay? Are you married and did your spouse have income in Kentucky?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have reviewed my W-2 and I have entered the correct amounts in the specified boxes. I am military and my state(KY) does not collect state taxes for military but it says I owe money to Kentucky and t

I am in a similar situation, but in Illinois. Illinois also does not collect income tax from military income. Turbotax keeps telling me that the military income exemption does not apply, when it in fact does with regard to the State of Illinois. I need to file a schedule M, but the system will not allow me to create one. As it is now, I'll have to do my state tax return on my own, because TT is not allowing me to create the schedule M that is required to do this correctly.

Also, going back to the federal section, there is no question regarding whether a W2 was for military pay after you enter it. I've gone through it at least half a dozen times so far.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have reviewed my W-2 and I have entered the correct amounts in the specified boxes. I am military and my state(KY) does not collect state taxes for military but it says I owe money to Kentucky and t

1) First...edit your Name in the Personal Info/My Info section and make sure you indicated you were in the military during 2020 as a part of those questions....that MUST be completed first

2) Then...go edit the W-2 again, and on one of the pages AFTER the main w-2 form there is a page with a whole series of checkboxes...the Military W-2 selection is in the middle of that page. But #1 must be done first or t won;' show up in the checkboxes.

_______________________________________________

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

cyp54ress

New Member

jaxgab

Returning Member

jessicamullins30

New Member

dktroutt

New Member

dsaucier88

New Member