- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Re: After-tax Roth Contribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

So in 2018, my investment advisor put $5,500 of after-tax cash into a Roth. 2019 and 2020 6,000. Because he erroneously thought I made above the AGI, he first put it into an IRA, then converted it to Roth. Again, this money was after-tax cash that I gave to him to invest. I have received a 1099-R for 2018 and 2019 and when I put the figures in from that form the software has me paying taxes on that amount. My advisor and his accountants agree I should not be paying taxes as I already have. These are the figures: Box 1 (5,500), Box 2a (5,500), Box 2b (X), Box 7 (2), IRA/SEP/SIMPLE (X). So is the form or a box not right? I should not be paying taxes on money that I’ve already payed taxes on. Am I filling out another form along with this so as not to be taxed. Any ideas? This is so frustrating!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

@Neurodale wrote:

Moral of the story:

Financial Advisor takes after-tax income, puts it into IRA and then converts it to Roth. He could have directly put it into Roth, but thought I made above AGI to do so.

They sent me one 1099-R. 5500 Box 1, 5500 Box 2a, X in Box 2b Taxable amount not determined.

Now as a fill in the numbers there is a box on software to check labeled “check here if all/part of the distribution was rolled over, and enter the rollover amount” If I am supposed to “check” this box. It tells me then to enter the rollover amount. If I enter 5500, the computer gives me an error that “taxable amount can not be greater than Gross Distribution minus Rollover amount”

Does this mean that I need to make “taxable amount box 2a” 0? That might make sense and then I pay no taxes on this money

At first you said $6,000 was put int a Roth but become your income was too high it was switched to a Traditional IRA. If that is correct then there should be a 1099-R showing that "switch". Was it never actually put into the Roth at a but put into a Traditional IRA instead?

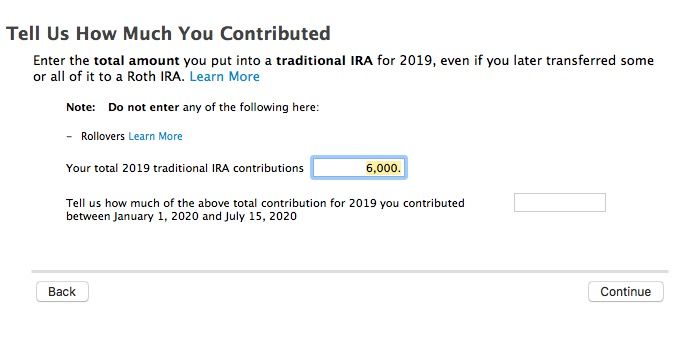

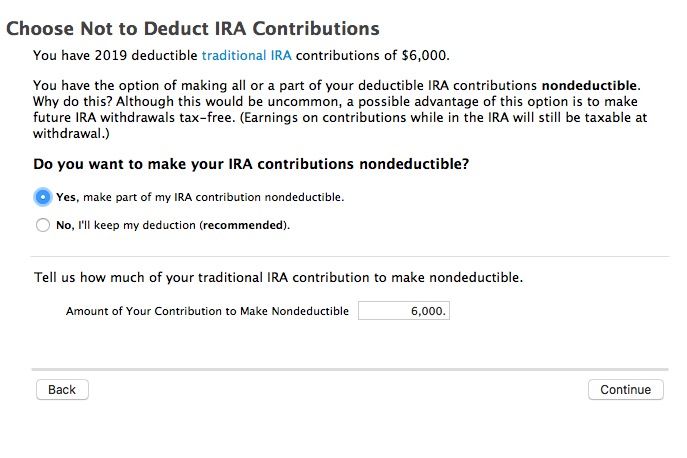

If that is what happened then enter that Traditional IRA contribution here and if the questions is asked int the interview, say that you want it all to be non-deductible.

Enter IRA contributions here:

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),

Retirement & Investments,

Traditional & Roth IRA contribution.

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "ira contributions" which will take you to the same place.

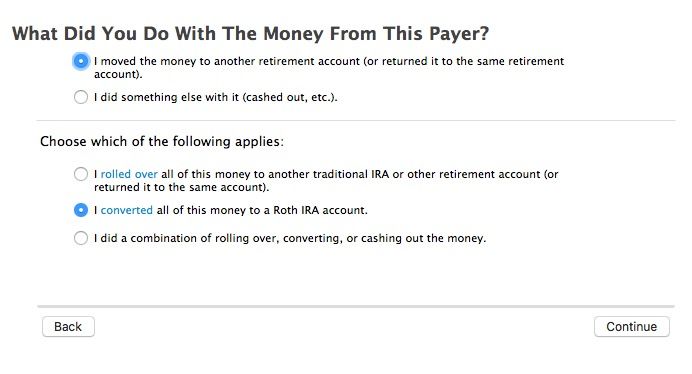

For the 1099-R answer yes, the money was moved to another retirement account and check the box that it was all converted to a Roth.

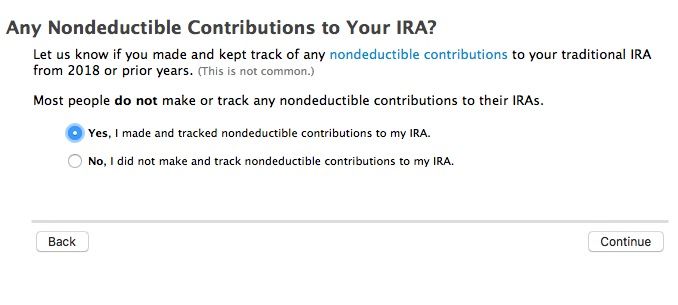

Then when asked say yes you tracked the non-deductible contributions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

What code in in box 7 for the 2018 1099-R? What is in box 2a?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

Box 7 (2) and Box 2a (5,500). It’s all in my original question though if you look.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

Your original post does not address what is asked. You said: "So in 2018, my investment advisor put $5,500 of after-tax cash into a Roth. 2019 and 2020 6,000. Because he erroneously thought I made above the AGI, he first put it into an IRA, then converted it to Roth"

The 1099-R that you described are for the Traditional IRA distribution that was converted to a Roth.

The original money "first put in a Roth" must be accounted for. How did that money get into a Traditional IRA so that it could be converted to a Roth?

There are 2 ways - a "return of contribution" that is then contributed to the Traditional IRA, or a "recharactorization" where the IRA trustee moved the money to a Traditional IRA. Each of those methods will generate a separate 1099-R box the box 7 codes will be different.

You should have two 1099-R's for what you described. How the one you described is entered depends on how the money got from the Roth to the Traditional IRA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

On all three years he took after-tax money from me and put it first in a traditional Ira (I believe) and then converted it to a Roth. He mistakenly thought that my AGI was above the threshold of contribution to the Roth, hence the conversion. When I called him about it, I asked about why my tax software was trying to tax me on after-tax money. Then I find out about the conversion because he thought I made above the threshold. When I said I didn’t, he said he would make changes in the future and make it directly to the Roth from now on, but that would not incur me to pay taxes on that money again nonetheless.

The money used in this transaction came from the more than $300,000 in cash that I had given to him to invest. The profit that I’ve made on my initial investment in short term, long term, dividends, and interest is paid with in taxes separate and forms are sent of those too.

The box 7 code on all forms is: 2

And the box 2a is those exact amounts above as well

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

Box 2a is the 3 amounts on each form for each year and Box 7 is 2 on all as well

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

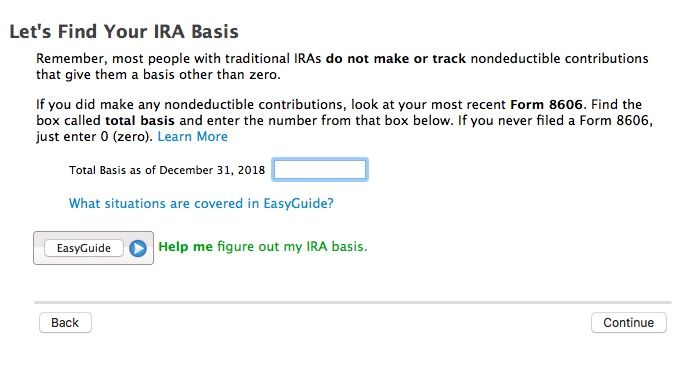

You must enter the 2019 non deductible contribution in the IRA contribution section which will produce a 8606 form with it on line 1

Enter IRA contributions here:

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),

Retirement & Investments,

Traditional & Roth IRA contribution.

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "ira contributions" which will take you to the same place.

|

Enter a 1099-R here:

If this was a rollover or conversion, answer the question that you moved the money to another retirement account (can be the same account). The screen will open up with choices of where it was moved. Say the amount was converted to a Roth.

|

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

I believe I misread your post and edited and corrected my answer. Sorry for the confusion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

No worries. Thank you for the help! I’ve tried everything I know to try to not pay the taxes following the software. I can’t find a way. I’ve spoken to another tax consultant and he says that I need to get a 1099-R corrected to show a contribution directly to the Roth because it’s the conversion that makes it taxable. I have asked the advisor to correct the status to the correct way, thereby making it nontaxable. He said that this is a backdoor way that people are doing in an attempt to get out of paying taxes and the IRS has caught on more so in recent years. Hence the software changes making it impossible legally to do this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

A "backdoor Roth" is absolutely legal and done all the time. It is a 2 part process:

1) Enter a non-deductible Traditional IRA contribution in the IRA contribution section first.

2) Enter the 1099-R with the Traditional IRA distribution and say that it was converted to a Roth.

Answer the non-deductible basis questions as in my answer above. The non-deductible contribution will cancel the tax on the conversion.

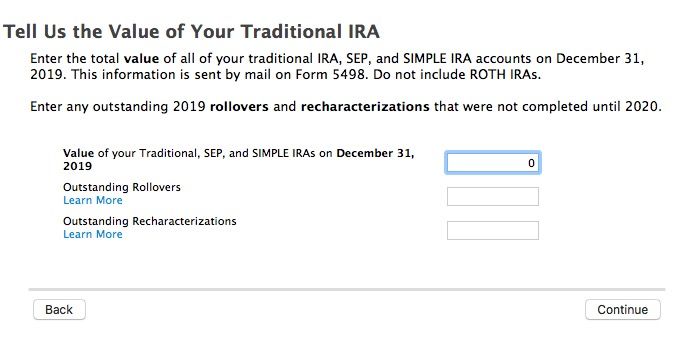

However, This so-called “back-door Roth” method ONLY works if you have NO OTHER Traditional IRA accounts. If you do, then the non-deductible part must be spread over ALL accounts and cannot be withdrawn by itself. Only if you started with NO Traditional, SEP & SIMPLE IRA and ended up with a zero amount in ALL Traditional, SEP & SIMPLE IRA accounts will this Roth conversion not be taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

@Neurodale wrote:

I’ve spoken to another tax consultant and he says that I need to get a 1099-R corrected to show a contribution directly to the Roth because it’s the conversion that makes it taxable....

.... He said that this is a backdoor way that people are doing in an attempt to get out of paying taxes and the IRS has caught on more so in recent years. Hence the software changes making it impossible legally to do this.

You must have misunderstood. A 1099-R reports a *distribution* *from* a IRA and does not show a contribution to an IRA at all. You report the non-deductible contribution on a 8606 form on your tax return by entering it into the TurboTax IRA contribution interview.

Your "advisor" is totally wrong about this not being allowed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

If I am tracking what you are saying......I have maxed my tsp contributions into a Traditional IRA of my 401k through my civilian job. As a result of this you, are saying that it doesn't matter whether my financial advisor made a mistake with the initial rollover from Traditional IRA -->Roth because he thought my AGI was too high? So that either way I will be taxed on this amount again? Are you also saying that it doesn't benefit me to make a direct contribution into a Roth instead like he could have? Can a financial advisor go back and change the method of doing these things if he finds that he made a mistake? Why would he tell me that either way, this money should not be taxed and that this is a common move done with many other of his clients?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

A Traditional IRA has nothing to do with a 401(k) at all. IRA's are personal accounts in a bank or financial institution and 401(k)'s are employer plans.

A Traditional IRA rollover to a Roth IRA is called a conversion and always results in a 1099-R being generated by the financial institution that must go on your tax return.

Any non-deductible contribution to the Traditional IRA (where the money for the conversion came form) yiu enter into the IRA contribution section and that becomes the non-taxable basis in the IRA that will offset the tax on the conversion as long as the year end value of all Traditional IRA's is zero.

That is the same thing as a direct Roth contribution - not taxable either way, but for that to happen you must first enter the non-deductible Traditional IRA contribution and then enter the 1099-R as I described in the box above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

So you’re saying that the 1099-R is correct, but in order to make it nontaxable, I fill out the (non deductible Traditional IRA contribution). Is this Form 8606? I’ve tried putting in numbers there, but none of the ways I’m doing it takes the taxes away.

At this point I’m only supposed to have 1 1099-R for the erroneous IRA to Roth conversion? Or are there supposed to be two?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After-tax Roth Contribution

Moral of the story:

Financial Advisor takes after-tax income, puts it into IRA and then converts it to Roth. He could have directly put it into Roth, but thought I made above AGI to do so.

They sent me one 1099-R. 5500 Box 1, 5500 Box 2a, X in Box 2b Taxable amount not determined.

Now as a fill in the numbers there is a box on software to check labeled “check here if all/part of the distribution was rolled over, and enter the rollover amount” If I am supposed to “check” this box. It tells me then to enter the rollover amount. If I enter 5500, the computer gives me an error that “taxable amount can not be greater than Gross Distribution minus Rollover amount”

Does this mean that I need to make “taxable amount box 2a” 0? That might make sense and then I pay no taxes on this money

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jbertrevs

New Member

deadbugdug

New Member

lollicup73

New Member

FitWit

Level 2

honeybadgerm

Returning Member