- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- How do I claim the Indiana Military service deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim the Indiana Military service deduction?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim the Indiana Military service deduction?

Please ensure that you indicated that you are active-duty military since that should trigger the state return to apply deduction. There are two places where you might indicate that you are military active duty:

- The first is in the "My Info" section after you enter your name and occupation. You can click on "My Info" on the left and then click on "Edit" next to your name.

- The second is on the "Do any of these uncommon situations apply to this W-2?" screen, right after you enter your W-2, you can check the active-duty military box for the W-2.

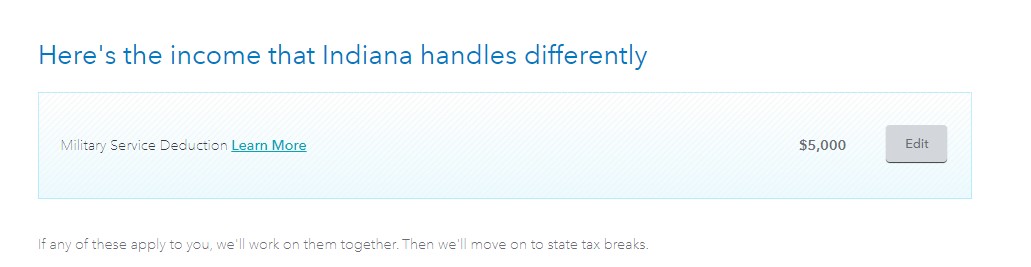

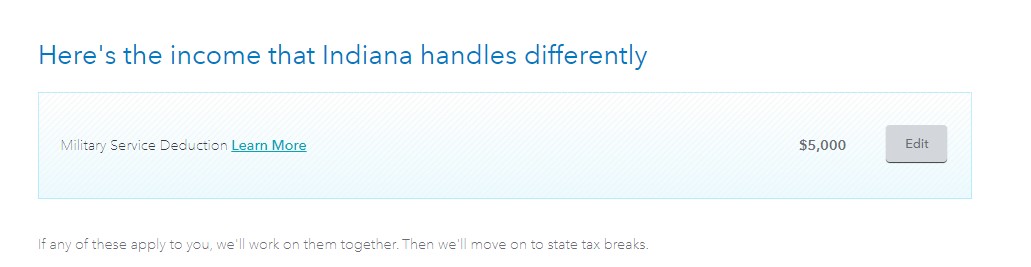

During the State interview, you should see the $5,000 military service deduction on the "Here's the income that Indiana handles differently" screen. Click on "Start" to answer questions then you should be able to qualify for the deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim the Indiana Military service deduction?

Please ensure that you indicated that you are active-duty military since that should trigger the state return to apply deduction. There are two places where you might indicate that you are military active duty:

- The first is in the "My Info" section after you enter your name and occupation. You can click on "My Info" on the left and then click on "Edit" next to your name.

- The second is on the "Do any of these uncommon situations apply to this W-2?" screen, right after you enter your W-2, you can check the active-duty military box for the W-2.

During the State interview, you should see the $5,000 military service deduction on the "Here's the income that Indiana handles differently" screen. Click on "Start" to answer questions then you should be able to qualify for the deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim the Indiana Military service deduction?

A little disappointed with the software.... why cannot we fix it rather than trick it with an inaccurate answer?

I am a reservist; I am NOT active duty, so clicking that I am active duty is not accurate, and seems deceptive.

when I get to the state of IN, it says ‘...we know that your total military pay is $0’. well, no u don’t; that is totally wrong.

then it says enter the amount from deployment; well, I was not deployed this year, but that is not a requirement for IN tax credit. However, unless you put in your amount or $5k (which ever is less), it won’t give u the credit! Ugh

so I called support; 35 min later I find out if I want to speak w a tax advisor it’s add’l $120! But your product is wrong! 🤦♂️

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I claim the Indiana Military service deduction?

For reservists the pay you receive for drill time during the year is active duty military pay, so the follow on question when entering that form W2 information should indicate active duty military pay. That will trigger the military interview in the IN state return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ataguchi

New Member

dogz5_Mom1

New Member

davidcotey

Level 1

calderad07

Level 1

gavulic1

New Member