- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Updated guidance for complete sale of PTP for 2019/2019 TT?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@GoodShip: I agree with your reading of the tax code: unified basis seems to be pretty explicit in the way its written, which implies that a partial sale should be treated as a pro rata sale of each lot. But implementing that still requires providing lot specific information:

1) The total adjustments to basis and the ordinary gain that is reported on the K-1 is based on the lots the partner uses for the sale. So if they use LIFO, you'll get a different K-1 than if they use FIFO. So the first challenge is to get an accurate K-1. I do this by informing the K-1 preparer how many shares of each lot I sold. If I sold 33% of my holdings, then I report that I sold 33% of each lot.

2) As for the broker, I just try to keep their records in sync with the partnership records, so I give them the same splits.

With that said, I don't think many people actually adhere to this. The brokers don't seem to care, and the K-1 preparers default to FIFO even though that definitely doesn't adhere to a 'unified' interpretation. And to make it worse, one of the two major preparers (I don't remember which at the moment) doesn't generate a K-1 for anything other than LIFO or FIFO, making the unitholder do their own best-guess calcs.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

nexchap. do you contact your K1 preparer before the K1s are prepared and sent out(usually in March) , or after you receive them, to request any changes on how units are sold, per a revised K1? You are right in that very few tax prepares are doing this correctly, and the problem is sysetmic. Tax software like Gainskeeper, is NOT designed to do proforma lot selection, and treat MLP units sales like everything else, LIFO, FIFO, HIFO, or specific lot selection. Then when you begin to add in Wash Sales, wash sale attachments, etc, it often goes from difficult to impossible. Also, I am unaware that the brokers are sending the lot selections to the K1 preparer. I thought the K1 has your database of purchases and sales , and uses its own "lot selection method" to determine cum adj and ordinary gain on the sales schedule, usually defaulting to "unified basis".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@GoodShip: I contact the K1 preparer after they generate the K-1. It may be possible to do it ahead of time, but they're able to send out a revised one within a day or two so it hasn't been an issue.

As for brokers, I didn't mean to imply that they're sending lot information to the K1 preparers. They're not (though they do provide dates and amounts for purchases and sales). I just prefer to make sure my broker's lot records match my own. It doesn't really make any difference, but MLP tax calculations are chaotic enough so this let's me impose just a tiny bit of order on the process.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

I used the method described by nexchap in this thread last year, due to the fact that I had both long term and short term sales. This year I sold a couple of MLPs with all long term transactions. So I decided to try it out both ways. So I created two TT files, and processed one using the method described in this thread, and one using the standard interview process.

In the file using the standard interview process, the 8949 auto-generated by TT showed all of the MLP sales as ‘Short-term transactions not reported to you on Form 1099-B’. That flaw caused a major difference in taxes due to different tax rates used for Long Term Capital Gains vs. Short Term Capital Gains. But other than that difference, both results came out the same (within $1).

Just a heads up to everybody . . . If you don’t provide both a Purchase Date and a Sale Date in interview process (as opposed to typing 'Various' in the date field), TT will (on its own without telling you) assume that the sales fall into the category of ‘Short-term transactions not reported to you on Form 1099-B’.

Thanks for your help nexchap!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

Thanks for sharing some useful information from your experience.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

NEXCHAP - thanks so much for all your postings in this thread. As a seriously non-professional in the accounting/tax prep world, I've been relying on TT Deluxe for many years and am using it for tax year 2019.

This thread now is 13 pages long and contains 1099-B codes and K-1 + accompanying sales schedules references and column headings from you and other posters to that don't coincide with what I recently received from my broker or the PTP's 2019 final K-1. Furthermore, I note apparent changes in the tax code from 2018 to 2019. I'm not sure how to proceed. Updated guidance from what you originally provided on page 1 of this thread would really help!

My situation: I file jointly with my wife In 2013 she inherited a brokerage account from her father that includes units of Buckeye Partners LP. There haven't been any additional unit purchases or partial sales since then, although we have no knowledge of any previous purchases or partial sales prior to the inheritance. Last Nov, the PTP was dissolved; all partnership units were converted by Buckeye into the right to receive cash with no other rights. Using my layman's language, I consider it to be an involuntary "conversion" into cash, otherwise perhaps a "forced sale"(?).

The brokerage account's 1099-B lists the transaction as an "exchange", with "cost basis not reported to IRS - Form 8949, (X)". The 1099-B lists only the date of acquisition, date of disposal, proceeds, and cost basis. Gain/Loss is listed as "N/C". The PTP's K-1 Part II J shows all 3 percentages zeroed, and Part II L has the ending capital account at zero as I would expect. Part III 13K has an entry. The attached sales schedule shows the transaction description as "DA Sell" provides the sell date and number of units sold, and columns for initial basis amount, cumulative adjustments to basis, cost basis, gain subject to recapture as ordinary income, AMT gain/loss adjustments, and that 100% of the transaction is considered long term. The sales proceeds column is blank.

I plan to begin by entering the K-1 data in TT using the interview view and letting TT provide the 1099-B that I will ultimately edit by adding some corrected cost basis number as well as other associated forms (that I need or don't need to edit). I'm very insecure about what exactly I need to do; and apparently there are additional, new forms beginning this year. Can you please provide an updated step by step of how I need to do this task correctly, including which which type of transaction this really is (sale, exchange, etc.?) so TT doesn't raise flags on final check and so I don't cheat either Uncle Sam or ourselves on this year's taxes? Are inherited PTPs handled differently than what the thread has described?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

when you wife inherited the PTP she should have contacted Buckeye, to find out how to get the basis adjusted to to date of death value. if she did, then for all the years the k-1 profit and loss would have reflected the proper numbers to report on each tax return she needed to report the k-1 activity for all years from 2013 to 2019

Buckeye would have supplied with the final K-1 a supplemental report allowing you to calculate gain/ loss and what was ordinary income recapture based on DOD value

now lets say Buckeye was told. and the DOD

then it would only reflect the purchase price and the k-1's would not reflect any adjustment for step-up

again each year she needed to report the k-1 activity. when liquidated since Buckeye didn't know about

the death. the numbers on the supplemental schedule would be incorrect

to figure her basis it would be DOD value plus all items of income less all items of expense and distributions

to make it simple look at schedule L for 2013 to 2019

now she has her tax basis which you can substitute for what's shown on that schedule

in addition starting in 2018 she need to enter the QBI info

for 2019 she may have to report the QBI info. this would also require proper entering of any QBI loss carryover from 2018

if the k-1 info has not been entered on your returns seek professional advice,.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@Discouranged: I've been waiting for my last K-1s to come in before starting this year's return, so can't speak specifically to what may have changed in TT2019. But I also held BPL last year, so a couple points:

- BPL provided a sales schedule. They have, in column 4, the amount they believe is your original starting value. As @Anonymous pointed out, you need to make sure this is accurate, based on whatever value was determined at the time of inheritance. If this wasn't done right, its probably time for a tax professional to help straighten out that starting point.

- Regardless of how TT handles the entries, you're still doing the math outlined in this thread to figure out the correct Capital Gain/Loss. You want to do this manually just so you can verify that the right numbers make it to Sched D. Maybe TT handles it perfectly. Maybe not. You'll only know if you figure out the correct values first. You can also assume the basis on the broker's 1099B is wrong, because they don't have the K-1 adjustments.

- Even though a couple columns on the sales schedule have changed, the basic logic hasn't: your total gain/loss is your sales proceeds less your cost basis (cols 3 and 6 on the BPL schedule). And your total gain/loss is split between Ord Gain (col 7) and Cap Gain/Loss.

- Even though you were forced to exchange BPL for cash, you'd still treat it as a 'complete disposition' in TT. For tax purposes, that's what it was. That will also free up your suspended losses to offset the ordinary gain.

Hope that helps to get things started. I'll know more later in the month when my other K-1s are out.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

Thanks to both @Anonymous and @nexchap for their comments. I immediately saw I problem I should have recognized in 2014 after receiving the first (2013) K-1. The acquisition date which should have been my late father in law's DOD (and I'm sure corresponding cost basis) as recorded by Buckeye was off by a month. So, the date of acquisition on the 1099-B is correct but wrong on Buckeye's records. I guess at the least the K-1 Part II block L data from 2013 through the final 2019 K-1 is wrong! I just spoke to Buckeye and they said they will correct their records however, they can only issue an amended K-1 for 2019. I'll see what changes they have made when I receive the "corrected K-1". I suspect this is not going to be pretty as I've never done more (or know how to do) more than just transcribe K-1 data into the TT interview and then add stuff not asked in the interview view using the forms view. All previously submitted tax returns were accepted without reaction from the IRS. I fear that the fee to be charged by a competent tax preparer for such a complex issue as this will substantially exceed the dollar value of any errors I make in working this through on my own with TT and your already provided collective guidance. If IRS is unhappy, my perception is that they will provide the correct numbers and the penalty fee will be a small fraction of what the tax preparation fee would have been. UGH!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

please note that brokerages never have the correct tax basis for a PTP. this is because they don't get the K-1 and thus they make no adjustment for it. they also do not make any adjustments for partnership distributions. that is why the sale is reported in the cost basis not reported to IRS in the 1099-B section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

Thanks for the information. What about the 1250 gain? I enter that in TurboTax, but do I need to make an adjustment to the basis as done for the ordinary gain? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

nexchap - Can you help again? I've tried to follow your guidance and am getting a possible discrepancy after following your advice and what's on my K-1's sales schedule. Specifically, I've calculated my total gain/loss by subtracting the adjusted cost basis (column 5 on the sales schedule) from the sales proceeds (blank on the sales schedule but was provided on the broker's 1099-B). I believe that the column 5 number is correct. I get a positive number. However that total gain number is smaller than the positive number that's provided by the PTP in their sales schedule column 7 which is the column for gain subject to recapture as ordinary income and which you called "ordinary gain" in one of your msgs. Am I making a mistake or am I having difficulty accepting the fact that my complete disposition transaction in 2019 actually did produce income subject to taxation as ordinary income despite the arithmetic telling me that it was accompanied by a long term capital loss (following your guidance to split my total gain between the number reported in column 7 and a long term capital gain/loss, which is not explicitly specified on the sales schedule)? Thanks in advance for your comment. Also, I can't find any numbers on either the K-1 or the sales schedule that suggest I have a "1250 gain" number to enter in the relevant box in the interview. On my K-1, there's no entry for Part III box 9c. The TT help says, "For a liquidation, if the partnership indicates that any unrecaptured section 1250 gain applies, enter the amount on line 12." So, I'm assuming I should leave it blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@Discouranged: It doesn't sound like you're making a mistake. Its very possible for the 'gain subject to recapture' to be much higher (or lower) than your total gain. So if your total gain was $20, and your 'gain subject to recapture' was $50, you'd pay ordinary income tax on that $50 but also have a capital loss of $30 to partially offset it. AND don't forget, you've also been accumulating passive losses which TT will also release, and which may largely offset 'gain subject to recapture'.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

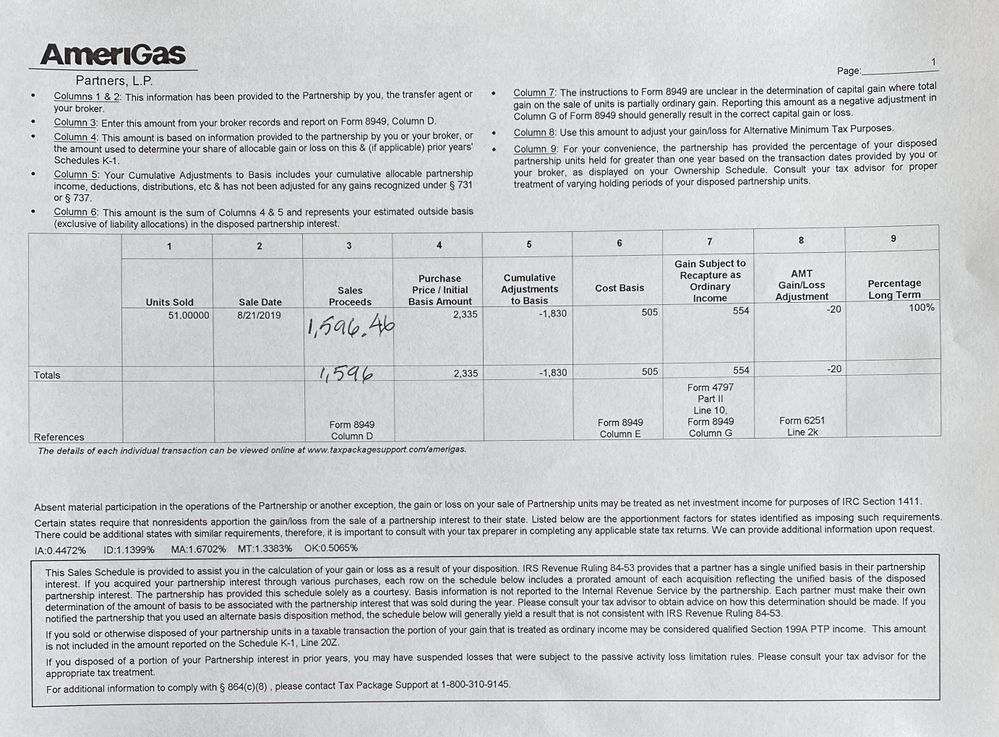

@nexchap being a frequent on this chain I bow at your will to answer all of us 🙂 I think it always benefits everyone if we look at a real life example so I'm sharing a very small full disposition of all long-term units (the easiest case) for the benefit of everyone on this forum.

My question is not so much on the mechanics - I got those (how to file so to speak) but the overall methodology (call it a philosophical understanding). In this example I gave them $2335 some years ago, throughout that time I collected total of $554 (tax free be it as it may) and then today they gave me back $1596. Looking at the cumulative adjustments to basis my adjusted cost base is $505 so that means I am on the tax hook for 1596-505=1091. Now that 1091 is diluted with both capital gains (taxed at lower rate) and ordinary gains (taxed at income level) so as the form directs (column 7) back out 554 so we have 1091-554=537. So then I pay ordinary income on 554 and cap gain on 537. But wait, I lost money on the deal? How the heck do I owe tax on money I never saw? I bought for 2335, sold for 1596 and in the mean time collected 554 fax free, the math 1596-2335+554= (-) 185? I'm 185 in the red yet I owe both ordinary income tax and cap gain tax? I see how I owe for the recapture amount 554, sure I pocketed that but the cap gain? Gain on what, my losses? LOL

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

nexchap,

Thanks for all of you answers to how to deal with the sale of MLPs. I have read through several pages of them and, because either I am a little slow or terminology and line numbers have changed over the years, I am still not clear on your two step process. Could we have a new clean explanation without the side trips of other question etc.?

I have sold several MLPs this year one of them is Enterprise Products Partners L.P. (EPD). Could we use this as an example?

1099 B - Short Term - Box B checked - From Broker

1d proceeds 428

1e Cost or other basis 420

1099 B – Long Term - Box E checked - From Broker

1d Proceeds 9502

1e Cost or other basis 9746

EPD 2019 Sales Schedule

4 Purchase price 8028

5 Cumulative adjustments to basis -3823

6 Cost Basis 4205

7 Gain subject to recapture 2729

8 AMT Gain/loss Adjustment -56

9 Percent Long Term 96%

Schedule K-1 (form 1065) Additional Information (Form K1P Addl info 2)

(With my attempt to follow your directions)

Part II Disposition of Partnership Interest

Regular AMT

5 Sales Price

6 Selling Expense

7 basis of partnership interest

8 Total gain (loss)

9 Ordinary gain (loss) -2729 -2673

10 Short-term gain (loss) 2729 2673

11 Long-term gain (loss)

12 Unrecaptured Section 1250 gain

With the above information how do I adjust the 1099 Bs?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

gredeich

New Member

kare2k13

Level 4

west2east1

New Member

terrinia

New Member

likungchuen

New Member