- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- TurboTax BUSINESS Question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax BUSINESS Question

I just started my 2019 1065 return for my multi-member LLC that holds my rental house and I'm running into an issue with the software calculated depreciation. I bought the property in April 2019 and placed it into service in May 2019. When I add it as a rental asset in Turbotax Business, and go through the various questions, it asks me to confirm prior year depreciation, even though I entered May 2019 as the placed in service date. When I look at the Asset Life History Form it's showing an amount for prior year depreciation. I don't understand why it's assuming prior year depreciation when I only bought the place last year!?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax BUSINESS Question

The Amortization/Depreciation section of the program is not complete and can not be completed until the IRS releases the *ELECTRONIC* format of the form 4562 required to complete that section. So don't bother wasting your time at this point with any assets for both rentals, business and farm.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax BUSINESS Question

@xdashdriver Did you transfer in a prior year return (e.g., from 2018 to 2019)? Also, did you make sure you entered the acquisition or placed-in-service date correctly?

After preparing a test 1065 with several rental property assets, I have been unable to reproduce the issue you are experiencing. I would suggest that you ensure you have the latest updates for the program and check your input.

Finally, if you enter Forms Mode, on which form (or worksheet) are you seeing depreciation for a prior year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax BUSINESS Question

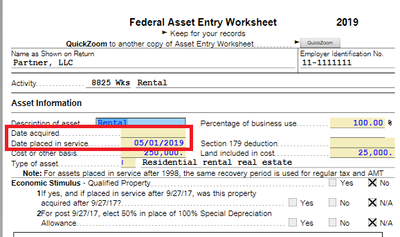

@tagteam Yes, I've deleted the asset multiple times and started again, each time entering 5/1/2019 both by typing in and by selecting it from the calendar drop down with the same result. I checked my program this morning for updates and it said it was fully up to date (2019 version)

I'm on the 8825 Asset Entry Worksheet. If I click on the quickzoom to Asset Life History then it shows an amount on the top line for 2018, even though the date placed in service on the main Asset Entry Worksheet shows 5/1/2019.

And no, no prior year returns were transferred in. Here's a screenshot:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax BUSINESS Question

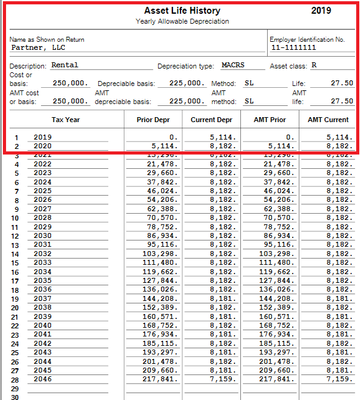

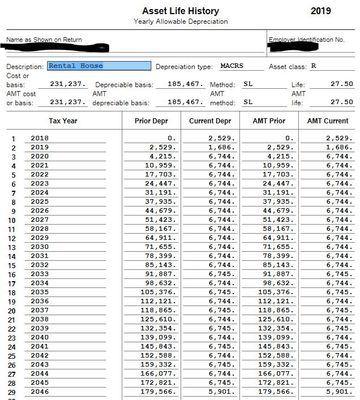

@xdashdriver Your screenshot did not make for it, for some reason (perhaps you need more posts or something). I have included a couple of screenshots below depicting an asset I entered in a test return. As you can see, the top line is for 2019.

Regardless, I suspect something went awry during your asset entry in Step-by-Step (i.e., the interview questions) because you should not have been asked anything relating to prior year depreciation after entering a placed-in-service date of 5/1/2019. You might want to try deleting the asset entirely and then adding it again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax BUSINESS Question

@tagteam thank you for your help. As mentioned in my last post, I have deleted the asset entirely and started again multiple times, all with the same result. I will try post another screenshot in a bit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax BUSINESS Question

@tagteam Sorry for the multiple pings. I started a new return and cannot replicate the same issue with it, so I deleted the original return. I have no idea why it bugged out on me but that was the only way to fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax BUSINESS Question

Some sort of file corruption, perhaps. Regardless, I am glad you were able to resolve the issue.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

randy5419

Level 3

emnem

New Member

mjmoor60

New Member

4taxhelp

New Member

burner718

Level 2