- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Section 199A Income on K-1

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

When Section 199A information is reported on a K-1, TurboTax requires an entry in one of the income boxes eligible for QBI treatment. For your K-1 (in addition to the "....QBIA of qualified property" line) check the box for "....rental income (loss)" and enter a zero in the box that "opens up". That should "clear" the error message you are getting.

@Matt3CPO

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

I tried to enter nothing on the Box 20 Z and I get no opportunity to enter the correct amount (negative). I also entered the correct negative amount with the same schedule A message. I can't find a solution online that works.

Token 677950

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

I followed your instruction, but do not get asked to enter amounts. It just goes on to the next step.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

More information may help resolve your issue. For example, when you enter your code Z on the "box 20 screen" and Continue, what are the screens that follow?

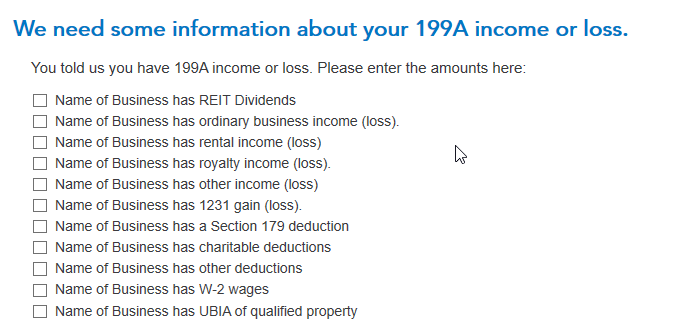

Your next screen should be "Describe the Partnership" and the the next screen should be "We see you have Section 199A income" and then you should get "We need some information about your 199A income", followed by "Let's check for some uncommon adjustments". If you get to those last two screens, when you check the box on a line, other boxes will "open up" to enter the amounts from your Section 199A Statement/STMT.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

I deleted Z on the K-1 and then entered it in again and followed your steps, and it worked. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

I have a very simple K-1 that has only a 1231 gain to report. I did what was suggested and skipped entering the gain on the first screen where we select Code Z. I then checked the 1231 gain box and entered the amount of gain in the section titled "We Need Some More Information..." (there was a box there for me, which I assume was based on the income I entered). The error is not cured by doing these steps. I then tried to enter the amount in the Quick Zoom for line 20 and that does not work. I also tried to enter on the 1231 Gain line of Sch D1.

Would you please provide a step by step guide to solving this. The alternative is a mail in return and that is not a great option.

Thank you very much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

More information may help resolve your issue. For example, what is the error message you are receiving?

After you've entered the box 10 amount for your Section 1231 gain, and the code Z for box 20, you must still check the box on that "1231 gain (loss) line on that "We need some more information about your 199A income or loss" screen. When you check the box on the "1231 gain (loss)" line, a place will open up to enter the Section 1231 amount from the Statement or STMT that came with your K-1.

But, if you used the QuickZoom button in Forms mode to enter the Section 1231 gain from you box 20 code Z statement, that amount box for Section 1231 should already be populated with the number you entered.

In Forms mode, on the K-1 Partner form, scroll way down and check Sections D1 and D2 for the amounts entered in your tax return. A box "shaded red" indicates an error in the form.

You don't need to enter your Section 1231 gain on Schedule D, TurboTax will report the gain correctly based on your box 10 entry from your Schedule K-1.

If none of these suggestions fix the issue you are having, I recommend deleting that K-1 and re-entering it using the Step-by-Step interview questions.

To get back to the K-1 summary screen and find the Schedule K-1 to edit or delete, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

Great very helpfull

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

In one case a particular K1 has12 partnerships, can all of these be aggregated into a single K1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

I am receiving an error message for line 20Z on my K-1 Input form. This is the same error as observed on last years form.

The problem should be resolved by splitting into two K-1 forms, as there is inputs on both line 1 and line 2, which I did, but the error message is still indicating, with no solution.

I have entered all the data from Schedule A provided by the LP.

How can this error be resolved?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

- THIS WORKS. BEEN DOING THIS FORM SEVERAL YEARS AND THIS IS ACCURATE

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

I think that you are entering one K-1 entry for box 1 income and a second K-1 entry for box 2 income.

Each K-1 entry will have a Box 20 entry Z-Section 199A information.

Each K-1 entry will generate the screen We see you have Section 199A income.

Each K-1 entry will require entries at the screen We need some information about your 199A income.

At the screen We need some information about your 199A income, you may need the following information:

- Ordinary business income (loss) from this business,

- W-2 wages for this business, and

- UBI of qualified property for this business.

Hopefully, this information is reported on a separate Statement A.

Are you experiencing the issue discussed in this TurboTax Help?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

Perfect instructions on how to fix Section Z 199A when it doesn't have a set value- I would like to add DO NOT ENTER ZERO if you do not have a value to enter and need to enter information to calculate the values. It's imperative to leave it BLANK so that as you continue through the interview the appropriate screen will populate that is shown the screen shot in this article.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

Thanks kentmuhl! Your suggestion worked for us after 3 hours of spinning our wheels and a call to the MLP.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 199A Income on K-1

TurboTax won't let me file because it says missing info in box 20 on K-1, section 199A. How can I file? How can I eliminate box 20 from TurboTax question (won't let me un-check the box)

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

kare2k13

Level 4

clarineted

Level 2

ESG S-Corp

Returning Member

soaring22

Returning Member

lnk-fr

Level 2