- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Sale of Rental Property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

We purchased a home in 2015 which our daugther's family has been renting. This month they purchased the home from us for $220,000 purchase price with $46000 in gift equity so that put the price down to $174000. We had a Basis for depreciation of $126,619 on 2015 taxes. We have Depreciated $15,155 at this point. We only walked away with $64,254 after prorating taxes and closing cost which we paid the buyers as well as the sellers. And we had a mortgage on the home to pay off. What do I put down for sale price? What can we expense? And do I have to list the land the home is on separate from home in turbo tax as I believe we did that when we bought it because you can't depreciate land from what I understand. We made improvement to property and expense them over the years as well. Do I add back the depreication taken over years to cost basis/ and improvements or does Turbo Tax take that all into account for me?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

If you just follow the below guidance to report the sale in the SCH E section of the program, all this stuff is taken care of for you. Here's a bit of added clarity for your benefit, on how sales expenses are treated.

- Cost incurred for acquisition of the loan are a flat out deduction. An example would be points, as well as survey costs if the lender required a survey as part of the loan application process. As the seller, you will not have any such costs.

- Cost incurred for disposition/acquisition of the property are added to the cost basis of the property. Example of this would be title transfer fees paid at the courthouse to transfer the title out of your name, into the buyer's name. Typically the buiyer pays this cost.

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2019". Select it. After you select the "I sold or otherwise disposed of this property in 2019" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even it it's zero. Then you MUST work through the "Sale of Assets/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1

Basically, when working through an asset you select the option for "I stopped using this asset in 2019" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

In the Sale of Property/Depreciation section, do I enter the gross sale price, or do I subtract sales costs from that? If I enter gross sale price, where in the Turbo Tax questionnaire do I show cost of the sale?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

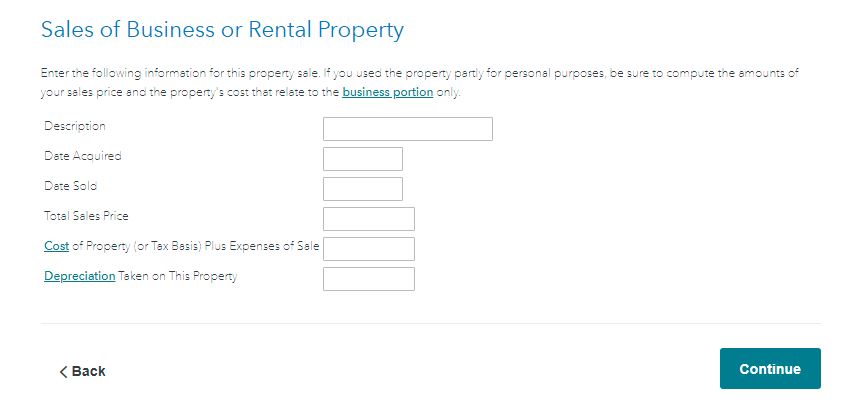

In the Sale of Business Property section, you will be able to enter the Cost of Sale as a separate category. See below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

kgraghu

Level 3

wallensplace-cha

New Member

pottermelanie12

New Member

KenjiT

New Member

ljkauffman6

New Member