- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Sale of rental property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property

After some navigation on this community forum I was able to figure out how to indicate the sale of my rental property. I have listed all the assets of my rental property since I have acquired this property in the asset summary section. I have a few questions pertaining to the sale of this property.

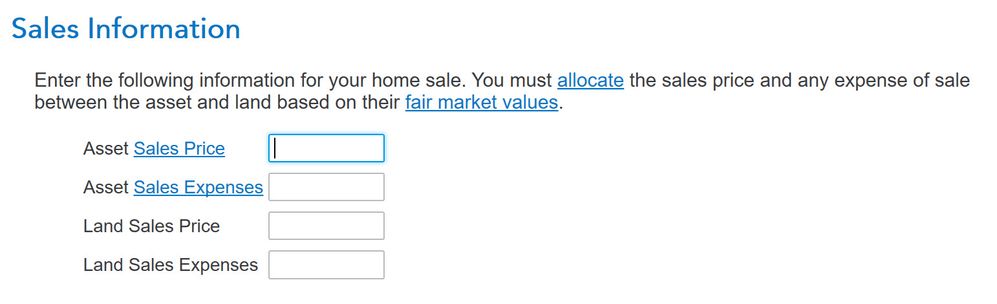

Once I am in the summary asset screen I go to edit the rental property "Duplex" and follow the questions through to the point of where I am supposed to enter the Sales Information.

I am unsure what values to enter here for the

Asset Sales Price

Asset Sales Expenses

Land Sales Price

Land Sales Expenses

Finally when I did just enter the Sales Price of the Asset and Asset Sales expenses, it then calculates the taxes I owe for the difference between the initial price and the sales price ...

But over the course of the term of owning this duplex, I installed new windows on the upper and lower units, installed new siding and a new roof. These items were entered into Turbo Tax as assets and depreciated over the years. But with the initial cost of the duplex and the investments I have made to the unit, where do I add those values to adjust the cost basis so as to reduce the capital gains.

Meaning for example

Purchase price of the duplex was 100,000

Sold the duplex for 230,000

capital gains of 130,000

But purchased new roof / siding (30,000) + Upper unit windows (12,000), Lower unit windows (12,000) = 54,000

So really how do I reduce my capital gains from 130,000 down to 76,000

If possible I would like someone to call as this could be a very detail response.

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property

You need to provide some clarity here.

I have listed all the assets of my rental property since I have acquired this property in the asset summary section.

Rental assets, which includes property improvements should be entered in the assets/deprecation section on the tax return for the tax year the asset is placed "in service". So are you saying you had property improvments done in prior years that you are "just now" entering for the first time on your 2019 tax return? If so, you have a major issue.

Now I'm not clear on just exactly what it is you don't understand. The screen you posted clearly states, "You must allocate the sales price and any expense of the sale between the land and the asset"

So what is your sales price for the land?

What is your sales price for the asset that is on that land? (The actual structure/house/building)

One thing I will note is that the program doesn't do a very good job of providing what I consider to be "pertinent" details. In once sense it's understandable as an effort to reduce "information overload". In another sense, it leaves to much leeway for an incorrect interpretation. So it's six of one, half dozen of the other.

Perhaps the below guidance will help you. This is something I wrote up years ago and so far, it seems to work every year for TurboTax users. Just remember, this is "GUIDANCE", not step-by-step. No to situations are the same. So it's just not possible to provide a step-by-step that would cover all possible scenarios without writing a multi-volume encyclopedia Britannica .

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2019". Select it. After you select the "I sold or otherwise disposed of this property in 2019" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even it it's zero. Then you MUST work through the "Sale of Assets/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1

Basically, when working through an asset you select the option for "I stopped using this asset in 2019" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property

Champ,

Thanks for the detailed response.

My confusion is, listing the sales price for the land and the building isn't something that was noted on the Sales paperwork. It was a duplex that was 'just' sold. the Land and building were all sold as one item for 228000

I did include other items in my assets as such

Added a new roof and siding as one whole complete job - 35,000 (in 2015)

Added new windows to the lower unit - 12,000 in 2001

Added new windows to the upper unit - 14,000 in 2014

So how do I get these 'improvements' to be included in the cost bases

It was purchased for 105,000 so w/out those asses (228-154) has me at a capital gains of 74,000

But shouldn't the roof/siding,upper windows,lower windows somehow be included to offset the capital gains?

I went through one of the items (the roof/siding) and indicating it was sold on the same date and the tax due went up as if it added the sale of the roof and siding to the capital gains. I thing I am probably doing something wrong.

Is it possible to call someone on turbotax support to quickly walk through this ?

Does this make sense in what I am trying to explain?

Thanks and looking forward to your feedback

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property

Understand that my comments are not intended as rude or insulting in any way. I'm just keeping it brief and to the point. Quit over thinking this.

My confusion is, listing the sales price for the land and the building isn't something that was noted on the Sales paperwork.

It's you who is creating a confusion that really doesn't exist. You can allocate your sales price across the land, structure and other assets *any* *way* *you* *want* within the confines of the guidance I provided earlier. It's perfectly okay to produce a self induced thought.

For example, as the guidance says, if you sold the property at a gain (and it appears you did) then you *MUST* show a gain on every single asset listed. For example;

Structure cost basis: $50,000

Land cost basis: $25,000

New roof cost basis: $15,000

TOTAL cost basis is $90,000

So I sold the property for $150,000. I'm going to produce a self-induced thought here on allocating my sales price across the three items listed above, ensuring I show a gain on each individual item. That means my sales price allocated to each item *MUST* be more than my cost basis-- even if only $1 more.

Structure sales price: $120,000 - I'm showing a $70,000 gain on the structure.

Land sales price: $30000 - I'm showing a $5,000 gain on the land.

Now keep in mind that land is not a depreciated asset. So the land has *NEVER* been depreciated. Therefore I can not allocate any of that land sales price to any other asset that is depreciated. However, the structure is a depreciated asset and I have "in fact" taken depreciation on that asset over the years.

The new roof is a depreciated asset and I have "in fact" depreciated that asset over the years.

Therefore I need to allocate a portion of my structure sales price, to the roof sales price. After allocating, I *MUST* still be showing a gain on the structure *and* the new roof. Therefore I'm going to remove $20,000 from my structure sales price and allocate it to my new roof sales price. Now now I have this:

Structure sales price $100,000 - A $50,000 gain

Land sales price: $30,000 - Still showing the sale $5,000 gain on the land.

New roof sales price: $20,000 - I have a $5,000 gain on the sale of the roof.

Total sales price adds up to $150,000 which is correct since that's my total price I sold it for.

Most cost basis total on all assets is $90,000, subtract that from my sales price of $15,000 and I have a gain of $60,000.

I can also allocate other ways and the bottom line end result gain on the sale will not change.

Structure sales price: $50,001 - This shows a $1 gain on the sale of the structure.

Land sales price: $25,001 - This shows a $1 gain on the sail of the land.

New roof sales price: $74,998 - This shows a $59.998 gain on the sale of the roof.

$74.998 plus $25,001 plus $50,001 equals my original $150,000 sales price. Subtract my total cost basis of $90,000 from that and I show the same exact gain of $60,000.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property

Thanks. This is very helpful. I have a similar situation. However, I'm wondering how to get my original land value. I know my original price for my rental was $149,000 15 years ago. Can I make my own assessment based on percentage of land value in my area? Do I use the latest town assessment for the property and come up with a percentage of land/asset?

Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property

Can I make my own assessment based on percentage of land value in my area?

You can. But I only recommend that option be considered last.

Do I use the latest town assessment for the property and come up with a percentage of land/asset?

That's what you should do, so if questioned on it you have factual information on a physical piece of paper (the tax bill) to back it up with.

Now if this is rental property, then your values should already have been determined and set in the tax year you placed the property in service. So you wouldn't need to figure it now, in the year of the sale, unless your FMV when placed in service was lower than what you paid for it in the year you purchased it. In such a case, you can't report the sale in the SCH E section of the program anyway.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property

I have my depreciations 'sold' with values greater than original price (since I'm selling the property higher than original) as you instructed in this post. (all depreciations along with dwelling and land add up to total sale). However, I never depreciated the actual dwelling before (in previous years). Not sure if that messed up my values. During the final Fed check, my 'AMT prior depreciation' is apparently too large. It states that the depreciation is 'exceeding business basis'. Maybe because I added the dwelling (building) even though it's being sold?? I'm not sure how to resolve this AMT prior depreciation issue.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

karlameyer

Level 1

Mike2959

New Member

cinmay1120

Level 2

wufibugs

New Member

cparke3

Level 4