- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Water heater replacement scenario (safe harbor minimum, bonus depreciation, or Section 179 options??)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Water heater replacement scenario (safe harbor minimum, bonus depreciation, or Section 179 options??)

I have owned a residential rental property since 2007, and I had a new water heater installed in April 2021. There is 0% personal use of the rental property. The pre-tax cost of the project was $2,632.66 (material & labor), so I do not think I can "1-year deduct" the cost under the Safe Harbor Minimum (limit $2,500). Please correct me if I am wrong.

Also, I do not think I can take a special 100% same-year bonus depreciation because the system is categorized under "plumbing" with a 27.5yr recovery period (limit 20yrs). Once again, please correct me if I am wrong.

I have reviewed Section 179 depreciation rules for tangible personal property used "to furnish lodging or in connection with the furnishing of lodging" based on the 2018 Tax Cut & Jobs Act expanded criteria. Can I treat the water heater as tangible personal property (not real property)? I am struggling to find IRS documentation stating I can not treat it as tangible personal property. Also, this linked article explicitly states water heaters are now included in Section 179 for residential landlords (www.firmofthefuture.com/content/higher-section-179-limits-and-enha[product key removed]ciation-in-ne.... The decision to use Section 179 would not create a loss for the business. If I cannot use Section 179 then are there other options for me to deduct this full cost in the first year of service? Depreciating a $2,633 project over 27.5 years seems inefficient.

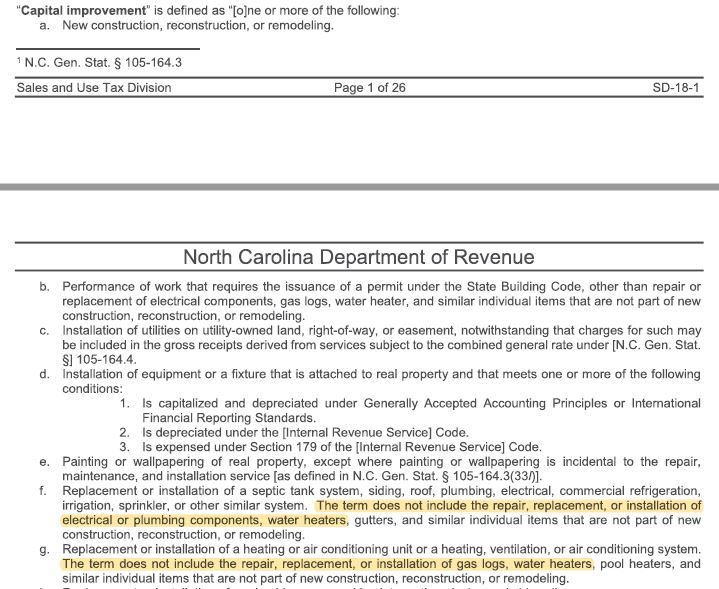

I even wonder if I should be capitalizing this project at all because the NC Department of Revenue does not categorize the replacement of a water heater as a capital improvement (see highlighted sections 'f' & 'g' below). This 'stretch-argument' would have me expense the project as repair/supplies.

Thank you for your time and your consideration of my question.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Water heater replacement scenario (safe harbor minimum, bonus depreciation, or Section 179 options??)

You've got to depreciate that because it becomes part of the real estate and you can't use Sec 179 for residential rental real estate anyway.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Water heater replacement scenario (safe harbor minimum, bonus depreciation, or Section 179 options??)

Here's my interpretation of the tax statues on this.

Anything classified as "Residential Rental Real Estate" under MACRS is not eligible for SEC179. Period,

Additionally, while other things may qualify for Special Depreciation Allowance, or Safe Harbor, The actual structure and those components that become a physical part of the structure do not. They get classified as Residential Rental Real Estate and depreciated over 27.5 years.

The plumbing system is without question, a physical and permanent part of the structure. Likewise, the water heater is a permanent and physical part of the plumbing system. Therefore, SEC179, Special Depreciation and safe harbor is not an option for the water heater regardless of it's cost. It gets classified as residential rental property and depreciated over 27.5 years.

Now I've known others to clasifiy a water heater as an appliance that gets depreciated over 5 years and then take the SDA on it so they could depreciate it completely in the first year. By my interpretation of the tax statutes, that's not right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Water heater replacement scenario (safe harbor minimum, bonus depreciation, or Section 179 options??)

Now I've known others to clasifiy a water heater as an appliance that gets depreciated over 5 years and then take the SDA on it so they could depreciate it completely in the first year. By my interpretation of the tax statutes, that's not right.

Which statutes did you interpret? I've read the main statute and it seems like a water heater would qualify for bonus depreciation BUT many authorities say that's not so and it needs to be depreciated as real estate. Anyway the statute is NOT AT ALL clear on that.....AND it hardly makes sense to take depreciation deductions on the likes of a water heater for a rental unit....an item that could cost as little as around $600 installed......over 27.5 years. What??? Take a $22/yr depreciation deduction? That's just nuts and I assume why they have bonus and de minimis in the first place.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Water heater replacement scenario (safe harbor minimum, bonus depreciation, or Section 179 options??)

It does not qualify for the De Minimis, Bonus, or Section 179. It needs to be depreciated.

State law does not affect how Federal is taxed, and the citation that you used from your state is from the SALES tax law, NOT income tax. Rules for Sale Tax do not necessarily affect the rules for income tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Water heater replacement scenario (safe harbor minimum, bonus depreciation, or Section 179 options??)

Have the contractor invoice you separately for the water heater and the installation. Better yet, buy the water heater yourself, then pay a plumber to install it. Then you have two separate invoices that you can deduct the under $2500 expense.

De Minimis Safe Harbor Up to $2500. You may use the safe harbor to deduct amounts up to $2,500 per invoice or item (as substantiated by invoice). https://www.irs.gov/businesses/small-businesses-self-employed/tangible-property-final-regulations

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ozzy032

Level 1

Tomc63

Level 1

cparke3

Level 4

wendyle1993

Level 3

femi_

Level 1