- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: This would be in the Rental Section. Here's how: Income...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my car that is used 40% for business (rental property) and purchased a new one in 2018. How do I enter this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my car that is used 40% for business (rental property) and purchased a new one in 2018. How do I enter this?

This would be in the Rental Section. Here's how:

- Income & Wages

- Rentals & Royalties...update

- Edit your rental

- Vehicle expenses...update

- Edit your vehicle

- Then add a new vehicle

If you have other questions about this, ask in the comment section below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my car that is used 40% for business (rental property) and purchased a new one in 2018. How do I enter this?

I am not the original author of the question but have the same concern. I have 4 rental properties. I have claimed vehicle mileage expense. I traded in the old truck in 2019 and bought a new one. InTTax, on the first rental property I indicated that I had sold the vehicle. I then entered the original purchase price and the trade-in received. Do I do all of this for the other three rental properties as well?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my car that is used 40% for business (rental property) and purchased a new one in 2018. How do I enter this?

That is acceptable as long as you got all of the mileage and depreciation equivalents accounted for to determine the gain or loss on that vehicle.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my car that is used 40% for business (rental property) and purchased a new one in 2018. How do I enter this?

Sorry but I don't follow that. I started using the truck in 2013 in support of the rentals. I used estimate mileage each year; TTax calculated the deduction based on that. I did not take any explicit depreciation unless it was contained in the standard mileage rate that TTax applied.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my car that is used 40% for business (rental property) and purchased a new one in 2018. How do I enter this?

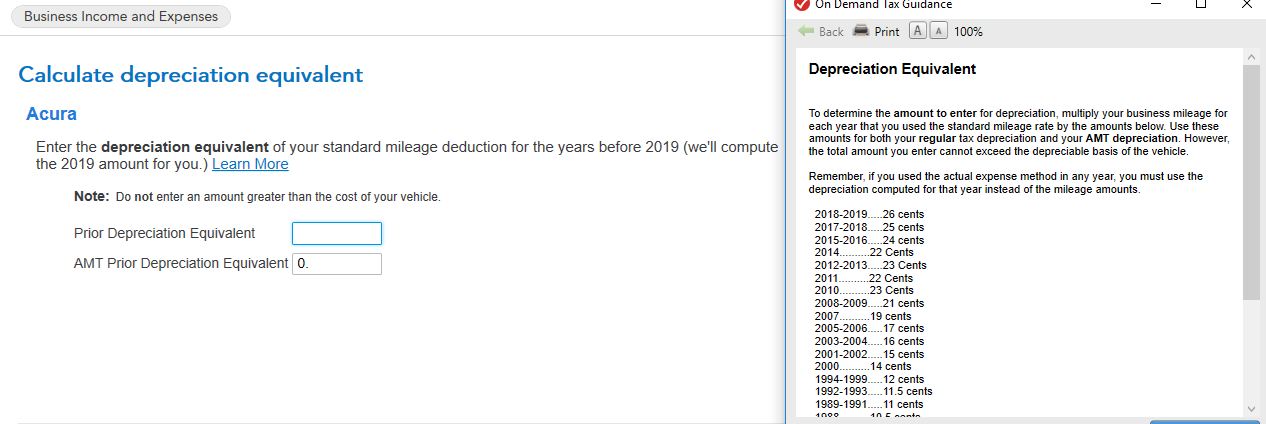

When you report the sale of the vehicle in TurboTax, you will be asked for the "depreciation equivalent", which is the depreciation portion of the standard vehicle deduction you take each year.

You will see this screen:

You calculate the depreciation equivalent by using the cents per mile allowed for the years you used the vehicle in your business, as listed in the table on the right.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my car that is used 40% for business (rental property) and purchased a new one in 2018. How do I enter this?

So is the depreciate equivalent equal to the annual business mileage times the mileage deduction for each year?

What is the difference between depreciation equivalent and AMT depreciation equivalent?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my car that is used 40% for business (rental property) and purchased a new one in 2018. How do I enter this?

The depreciation equivalent is a percentage of the total business mileage claimed for the year. In 2018, it was .25 per mile.So if you claimed 1,000 business miles, your depreciation equivalent for that year is $250.

As far as the difference between depreciation equivalent and AMT can get complicated. The amount of depreciation for AMT purposes may be different than the prior depreciation if you are subject to AMT. The most simple explanation is if you took and Special Depreciation allowance or Accelerated Depreciation on the asset in prior years, that special (or excess) amount would be deducted for AMT purposes. If you did not do this, then AMT Depreciation would be the same as regular depreciation. This would only be relevant if you are faced with an AMT situation this year. Most people are not.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

beckymitros

New Member

kare2k13

Level 3

NICAAC

Level 1

Mike2959

New Member

lllbby

Level 2