- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Section 179 limitation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 limitation

I am confused about section 179 and think I might have a glitch in Turbo tax.

I am a real estate investor with rental income and W2 income.

Suddenly my section 179 deducations are limited to my W2 income, meaning my section 179 deductions cannot exceed my W2 income amount.

I believe this is line 11 in Form 4562, called the "Business income limitation," it matches my W2 income total but it doesn't show where it is getting this number from.

I am very confused because I thought section 179 deductions have limits in the $500,000-$2,000,000 range and I have plenty of extra depreciation I want to claim to offset my rental income.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 limitation

179 is limted

The amount allowed as a deduction for any taxable year shall not exceed the aggregate amount of taxable income of the taxpayer for such taxable year which is derived from the active conduct by the taxpayer of any trade or business during such taxable year. for some reason Congress decided that w-2 wages are business income but passive income like rental is excluded.

from line 11 instructions; The total cost you can deduct is limited to your taxable income from the active conduct of a trade or business during the year. You are considered to actively conduct a trade or business only if you meaningfully participate in its management or operations. A mere passive investor is not considered to actively conduct a trade or business.

the active conduct of a trade or business for 179 taxable income limit is not the same as material participation under the Section 469 passive activity rules. yjis limit requires meaningful (undefined) participation in the business's management or operations reg 1.179-2(c)(6)(ii) as follows:

(ii) Active conduct. For purposes of this section, the determination of whether a trade or business is actively conducted by the taxpayer is to be made from all the facts and circumstances and is to be applied in light of the purpose of the active conduct requirement of section 179(b)(3)(A). In the context of section 179, the purpose of the active conduct requirement is to prevent a passive investor in a trade or business from deducting section 179 expenses against taxable income derived from that trade or business. Consistent with this purpose, a taxpayer generally is considered to actively conduct a trade or business if the taxpayer meaningfully participates in the management or operations of the trade or business. Generally, a partner is considered to actively conduct a trade or business of the partnership if the partner meaningfully participates in the management or operations of the trade or business. A mere passive investor in a trade or business does not actively conduct the trade or business.

for a real estate professional real estate rental is not a passive activity so one would think if that box is checked the 179 deduction should be allowed. not so in desktop deluxe. even as a real estate professional with profit from rental activities business income shows up as zero so no 179 allowed. I also tried checking the "active" and or the "material participation" boxes on the rental with no luck

however, there is a work-around that's better. skip the 179 and allow the maximum 168k depreciation to be computed - 168k does not have a business income limitation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 limitation

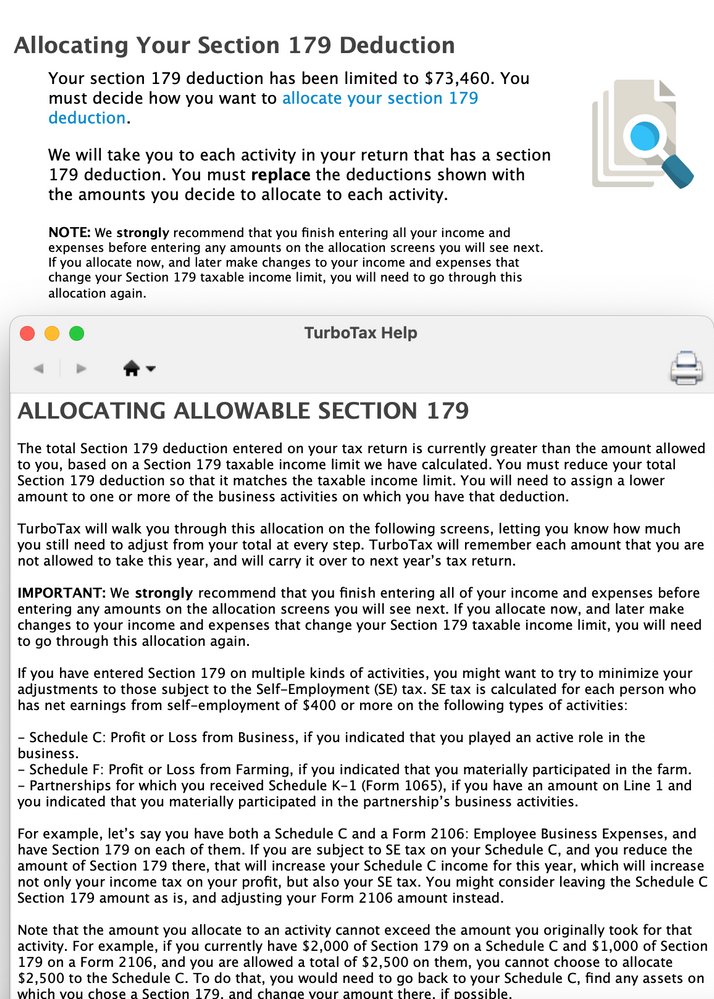

Attached is the screenshot from turbo tax, why is it limiting my section 179 deductions to my total W2 income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 limitation

179 is limted

The amount allowed as a deduction for any taxable year shall not exceed the aggregate amount of taxable income of the taxpayer for such taxable year which is derived from the active conduct by the taxpayer of any trade or business during such taxable year. for some reason Congress decided that w-2 wages are business income but passive income like rental is excluded.

from line 11 instructions; The total cost you can deduct is limited to your taxable income from the active conduct of a trade or business during the year. You are considered to actively conduct a trade or business only if you meaningfully participate in its management or operations. A mere passive investor is not considered to actively conduct a trade or business.

the active conduct of a trade or business for 179 taxable income limit is not the same as material participation under the Section 469 passive activity rules. yjis limit requires meaningful (undefined) participation in the business's management or operations reg 1.179-2(c)(6)(ii) as follows:

(ii) Active conduct. For purposes of this section, the determination of whether a trade or business is actively conducted by the taxpayer is to be made from all the facts and circumstances and is to be applied in light of the purpose of the active conduct requirement of section 179(b)(3)(A). In the context of section 179, the purpose of the active conduct requirement is to prevent a passive investor in a trade or business from deducting section 179 expenses against taxable income derived from that trade or business. Consistent with this purpose, a taxpayer generally is considered to actively conduct a trade or business if the taxpayer meaningfully participates in the management or operations of the trade or business. Generally, a partner is considered to actively conduct a trade or business of the partnership if the partner meaningfully participates in the management or operations of the trade or business. A mere passive investor in a trade or business does not actively conduct the trade or business.

for a real estate professional real estate rental is not a passive activity so one would think if that box is checked the 179 deduction should be allowed. not so in desktop deluxe. even as a real estate professional with profit from rental activities business income shows up as zero so no 179 allowed. I also tried checking the "active" and or the "material participation" boxes on the rental with no luck

however, there is a work-around that's better. skip the 179 and allow the maximum 168k depreciation to be computed - 168k does not have a business income limitation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 limitation

Thanks @Mike9241

So, a couple follow up questions.

I do meet the qualifications of it being a business and not an investment.

I went ahead and updated all my QBI's to reflect appropriately.

I discovered I had too many section 179's declared.

So I reduced them and moved a couple big ones to special depreciation, is that what you mean by 168k?

That seemed to resolve this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 limitation

yes. special/bonus/168k depreciation does not have the business income limitation/passive income limitations that 179 has. however, sometimes because of tax brackets there can be benefits to not using these accelerated methods in the current year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 limitation

Thanks @Mike9241

One follow up Question.

I heard Section 179 is getting phased out.

Is express deprecation for 168k staying?

In real estate what are my major concerns about Section 179 getting phased out if 168k is staying?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 limitation

haven't heard that and not for 2022. maybe what your read about is line 3 on form 4562.

Line 3

For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,700,000.

For a partnership (other than an electing large partnership), these

limitations apply to the partnership and each partner. For an electing large partnership, the limitations apply only to the partnership. For an S corporation, these limitations apply to the S corporation and each shareholder. For a controlled group, all component members are treated as one taxpayer

Congress writes the tax laws (and changes them - hate to tell you how many times the depreciation rules have changed over the last 70 years). then the POTUS must sign it into law.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 limitation

haven't heard that. maybe what your read about is line 3 on form 4562.

Line 3

The amount of section 179 property for which you can make the election is limited to the maximum dollar amount on line 1. This amount is reduced if the cost of all section 179 property placed in

service in (year) is more than $2,590,000. For a partnership (other than an electing large partnership), these

limitations apply to the partnership and each partner. For an electing large partnership, the limitations apply only to the partnership. For an S corporation, these limitations apply to the S corporation and each shareholder. For a controlled group, all component members are treated as one taxpayer

Congress writes the tax laws (and changes them - hate to tell you how many times the deprecition rules have change over the last 70 years). then the POTUS must sign them into law.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 limitation

Hi, you mentioned to skip section 179, can you elaborate on how to do the 168k deduction. Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 limitation

I have a commercial rental property and I am material participate in this business, as I am entering details in TurboTax business, with only rental real estate income, I am not able to take any sec 179 deductions. I understand this is because there is no ordinary income, however, should this be different if rental property is my trade/business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Section 179 limitation

@Bamafrank wrote:I have a commercial rental property and I am material participate in this business, as I am entering details in TurboTax business, with only rental real estate income, I am not able to take any sec 179 deductions. I understand this is because there is no ordinary income, however, should this be different if rental property is my trade/business

Section 179 is only for an active "trade or business" *AND* has further restrictions because it is leased to somebody else (see link below for "leased property"). Because of these two restrictions, TurboTax automatically assumes that your rental property does NOT qualify.

If your rental DOES meet both of those requirements, you need to change line 11 on Form 4562 by using the "Forms" and directly editing the line on the Form (or if you click line 11, it will bring you to a small worksheet). You can only do that using the CD or downloaded version of TurboTax.

Leased property.

Generally, you cannot claim a section 179 deduction based on the cost of property you lease to someone else. This rule does not apply to corporations. However, you can claim a section 179 deduction for the cost of the following property.

Property you manufacture or produce and lease to others.

Property you purchase and lease to others if both the following tests are met.

The term of the lease (including options to renew) is less than 50% of the property's class life.

For the first 12 months after the property is transferred to the lessee, the total business deductions you are allowed on the property (other than rents and reimbursed amounts) are more than 15% of the rental income from the property.

https://www.irs.gov/publications/p946#en_US_2022_publink[phone number removed]

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

CMG414

New Member

aprcox20

Level 3

talonhu9

New Member

jraybe1

Level 1

CommunityGuy

New Member