- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Reporting an insurance claim for water damage on Rental that included replacing cabinets and ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting an insurance claim for water damage on Rental that included replacing cabinets and flooring

I had water damage on my rental condo.

The repairs were for mitigating asbestos/mold and repairing the water damaged wall and floor. It also included replacing my 2 year old laminate floor and 30+ year old original kitchen cabinets.

Can I expense all of these costs as I have seen in other posts by listing the insurance claim as income and the cost to repair as a repair cost?

Or do I break out the floor and cabinets and say they are improvements that need to be depreciated? The cabinets and flooring were of the same quality as what was there before...so not technically an improvement... hoping I can expense it all and keep it simple.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting an insurance claim for water damage on Rental that included replacing cabinets and flooring

Repairs versus improvements-

Maintaining a rental property includes fixing the building up over time. Some of these costs are repairs, and some are improvements. The basic definition of a repair is anything that puts the property back into the same condition it was in originally.

For example, if you paint the walls, fix a broken window, or change the locks on the doors, you are simply restoring it the way it was in the beginning. An improvement, on the other hand, increases the value or the longevity of the property over what it had been originally. For example, if you build a room in the basement, put a new roof on the structure, install a solar electric array for the first time, or put in a new outdoor pool, the value of the property increases or it will last longer.

The reason it is important to differentiate between the two types of costs is that repairs and maintenance costs can be expensed in the year incurred, whereas improvements must be capitalized and the expense taken over a period of years through depreciation.

Note: this may be of value to you-

The de minimis safe harbor allows you to save thousands in taxes by immediately deducting tangible property under $2,500 that would normally be capitalized and depreciated over many years.

As real estate investors, we are looking to pay Uncle Sam as little tax as possible, while at the same time simplifying our record keeping process.

The de minimis safe harbor helps us do both!

What is the De Minimis Safe Harbor?

Typically, you must capitalize and depreciate capital improvements. But the de minimis safe harbor allows you to make an annual election to immediately deduct tangible property (i.e. appliances) under a certain dollar threshold.

If you have an applicable financial statement (AFS), usually an audited financial statement, the de minimis safe harbor threshold is $5,000. However, for most of us without an AFS, the threshold is currently $2,500 (as of 2018).

The de minimis safe harbor threshold applies per invoice, or per item should multiple items appear on an invoice. If additional costs such as shipping or installation fees appear on the same invoice, you must use a reasonable method for applying the cost to each item. But, if these costs are on a separate invoice, you don't have to include them.

Example

You receive an invoice with the following items:

- Refrigerator - $1,299

- Stove - $377

- Dishwasher - $299

- Delivery & Installation - $199

In this case, you will need to allocate the $199 delivery and installation cost to each item on the invoice. A reasonable method of doing this is to simply divide the cost between each item on the invoice ($199/3 = $66.33). Then add $66.33 to the cost of each item.

Because appliances have a useful life of more than one year, you would normally have to capitalize and depreciate them. But under the de minimis safe harbor, you can immediately deduct these appliances because each item (including shipping and installation) is under the $2,500 threshold.

Why the De Minimis Safe Harbor is Important to Real Estate Investors

When you purchase tangible property to use in your investment real estate, the cost comes out of pocket today. And as an investor, you want to immediately deduct as many expenses as you can in order to reduce your net income, and thus taxable income.

But if the item has to be capitalized and depreciated, the cost of the tangible property will not be completely tax deductible in the period you pay for it, but instead will be deprecated little by little over its useful life.

To make matters worse, later when you sell the property, you may be subject to depreciation recapture, which means you will have to pay back 25% of the accumulated depreciation.

Also, from a recordkeeping perspective, the de minimis safe harbor saves you, or your bookkeeper, from having to keep many depreciation schedules for small items, which is often tedious and time-consuming.

The Bottom Line

The de minimis safe harbor is essential to real estate investors because it allows you to immediately deduct certain rehab expenses that would normally have to be capitalized and depreciated. And this ultimately reduces your taxable income.

How do I do this with TurboTax?

After entering your business expenses, you will go to the Assets/Depreciation area. The first screen will ask: Did you buy any items that each cost $2,500 or less in 2020? It’s asking about any items that you haven’t entered yet as expenses.

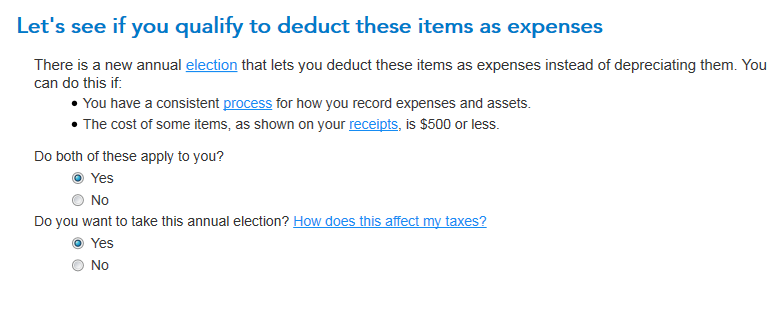

If you say Yes, here’s the next screen:

We ask a couple of questions and if you say Yes they both apply to you, we ask if you want to take the election to expense items costing $2,500 or less. If you say Yes to that question, TurboTax will add the De Minimis Safe Harbor Election form to your tax return.

The next screen in TurboTax has you review other items you bought. If every item you bought cost $2,500 or less, TurboTax will take you back to Your Business screen and you can enter those additional items in the Business Expenses area and not have to depreciate them.

If some items cost $2,500 or less and some cost more, the next screen asks you about Building Improvements. After answering the questions about Building Improvements, you can determine which items you will still depreciate and which items you choose to expense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting an insurance claim for water damage on Rental that included replacing cabinets and flooring

Thanks Rayw7

The part on the De Minimis Safe Harbor will be helpful for some of my expenses. My floor cost $3000 and my cabinets $5500, installed. So I can't use it for those expenses, but I am still hoping I can expense these two items.

My work was caused by water damage and mold...I returned the cabinets and floor to with like kind material. I am not planning to raise the rent...I just wanted to get it back to where it was. The floor was the exact same floor I had before. The cabinets were new, so they are better condition but similar quality to what I had...builder quality. I have seen other postings on using this rationale to expense these types of expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting an insurance claim for water damage on Rental that included replacing cabinets and flooring

The IRS lets you deduct ordinary and necessary expenses required to manage, conserve, or maintain property that you rent to others. A repair is anything that puts the property back into the same condition it was in originally. Capital improvements that add to the value of your rental property, prolong its life, or adapt it to new uses must be depreciated over a period of time rather than deducted as a current-year expense. This would include things like:

- Remodels and room additions (including decks and porches)

- New or upgraded landscaping, irrigation, sprinkler system

- Hardscape such as pavement, block or retaining wall, patio

- Fencing

- Swimming pool, spa

- Storm windows, doors

- New roof

- Central vacuum or security system

- Upgraded wiring, plumbing, duct work

- Central heating, AC, humidifier

- New furnace, water heater

- Filtration, soft-water, or septic system

- Built-in appliances

- New flooring or wall-to-wall carpeting

- Upgraded insulation

- Satellite dish

In other words, if you spent $8,000 on a new roof last year, the IRS won't let you deduct the entire $8,000 from last year's rental income. Instead, the $8,000 must be depreciated, which means you deduct it over a period of time instead of all at once. If you have large repair expenditures, take photos and keep detailed records to back your position of reporting an expense that may be a deemed an improvement.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

hartski1

New Member

Pgmo485926

New Member

sourav93

Level 1

audoles

New Member

gracelew

New Member