- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Rental property depreciation calculation seems incorrect?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property depreciation calculation seems incorrect?

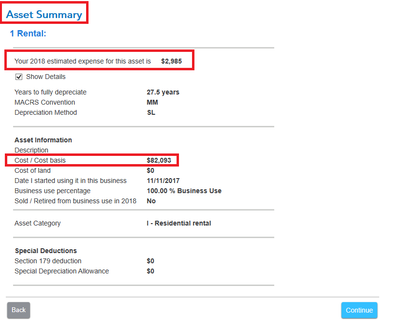

My residential rental property was placed in service in 2017. Value of building subject to depreciation is $82,093. (Yes, this is the amount entered in TurboTax). Given the 27.5 year recovery period, I would have expected TurboTax to calculate the 2018 depreciation as $82,093 / 27.5 = $2,985? Instead, the software calculates the annual depreciation for 2018 to be $3,046. Does anyone have an explanation for the apparently incorrect calculation?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property depreciation calculation seems incorrect?

@Argyle wrote:

...I would have expected TurboTax to calculate the 2018 depreciation as $82,093 / 27.5 = $2,985? Instead, the software calculates the annual depreciation for 2018 to be $3,046. Does anyone have an explanation for the apparently incorrect calculation?

Yes, it most likely has to do with the prior depreciation. if I plug in your figures and a placed-in-service date of 11/11/17, I get the following:

Check the screen where your prior depreciation is entered and make sure the placed-in-service date and accumulated depreciation entries are correct. If all else fails, delete and re-add the asset.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property depreciation calculation seems incorrect?

First, understand that depreciation is not *simple* math. Not even close for the first 2-3 years. For the first *FULL* year of depreciation, it depends on when it was placed in service the prior year, which also dictates which convention is used in that first year - be it HY (Half Year), MQ (mid-quarter) or MM (Mid-month) convention.

Then I would expect that for 2018 your did indicate the property was rented "the whole year" with absolutely no personal use days what-so-ever. Vacant periods between renters does count as days rented, provided you did not live in the property as your primary residence or 2nd home for one single day during those periods of vacancy between renters.

Bottom line is, if you entered the data correctly, then the program figures the depreciation correctly. THe math is not simple division either.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ljkauffman6

New Member

frank1618

Level 2

HardtoKeepUp

Level 2

FoundlingsAreOurFuture

Level 2

de_mo

New Member