- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: NexChap-Thank you very much for your super-quick response...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@308Tom You're correct. In the past, K-1 providers didn't reflect this in their sales schedules, and it was incumbent on the filer to properly work through the mechanics. As of this year, it looks like at K-1s coming from TaxPackageSupport.com have introduced unified basis into their sales schedules. Hopefully, this is a sign that all of the K-1s coming out will do the same.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

My last K1 used weighted average basis(unified basis). Each lot sold was divided between LT and ST. IF you want to change lot selection, you are required to contact the K1 preparer and ask for a diff method. That is what I was told by the K1 preparer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@GoodShip I just checked my first K-1 of the season and saw the same: unified basis seems to be the new default. I edited my response above to reflect the improvement.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

I was also looking to find where to enter the "AMT GAIN/LOSS AJUSTMENT" amount in TurboTax. I finally typed it into line 6a of form 4797 AMT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@nexchap I am new to MLP K-1 here and I am so grateful to your knowledge sharing and guidance to this Forum. I have spent quite some time reading through this threat. May I ask two questions and hopefully you will be able to help - (A) I had a partial sale of EPD units (all short-term) in 2020, and got EPD 2020 K-1 yesterday. As expected the initial cost basis on the Sales Schedule (using "unified basis I assume) is different (not dramatically though) than my Fidelity 1099-B which is correctly using the two lots I instructed to sell. Following your earlier comments (~2 years ago), I called taxsupportpackage.com and asked them to correct. I was put on hold for 50 mins while a staff was trying to figure out how to do it and she finally gave up and told me someone will call me. I am wondering, seeing your above comments about the "new norm" of using unified basis, can I or should I still request K-1 preparer to use the correct lots for the sold units? (B) I received ~$900 RoC from the 1000 units I sold in 2020, the K-1 Sales Schedule shows -$1900 Adjustment, and $1849 "Gain subject to recapture as ordinary income". Should I be concerned that I will eventually need to pay tax on the $1849 Ordinary Gain even I only received $900 RoC? Thank you in advance for the help and guidance?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@rona11 Welcome to the exciting intricacies of MLPs! On your questions:

a) Prior to this year, taxpackagesupport defaulted to FIFO, which was virtually never right. So correcting lots was almost always a requirement. Now that they've defaulted to supporting 84-53 (unified basis), its shouldn't be necessary to change anything unless you've got guidance from a CPA who believes that 84-53 shouldn't apply. So I'd leave the K-1 alone, but try and correct what Fidelity did so you're brokerage account and taxpackagesupport account are in sync. Note that, if Fidelity is difficult about that it probably won't matter (since they don't report cost basis info to the IRS), but if you're at all OCD it will be a discrepancy that will bug you.

b) In a "normal" stock, if you bought for $10, collected $2 in dividends, and then sold for $15, we'd all agree that you'd pay taxes on $7 (cap gain of $5 and dividends of $2). And, because "normal" tends to be simple, you'd easily see those numbers: the $5 would show up on Sched D and the $2 would be on Sched B. Well, in a MLP (using the same numbers), you would also still wind up paying tax on the same $7. But it would be spread all over the place. You'll see "Gain Subject to Recapture" showing up on one form, Cap Gain (of a number you had to calculate per this thread) on Sched D, recognition of passive losses on Sched E, potentially some interest and dividend income showing up on Sched B (but not the $2 -- that's ROC -- so its random int and divs that the partnership earned), maybe some foreign tax stuff, and if you're lucky their may even be some charitable contributions made on your behalf. BUT, if you add everything up over the years, it will still be $7 in total wealth being taxed. So long answer short, you shouldn't be "concerned" about the Ordinary Gain (since you'll have some Sched E losses to offset it), but you should try to be cognizant of all the spots your K-1 deposits money on your return. Ultimately, the only way to be sure you've used TT correctly is to have a good understanding of what it should be doing, and then double-checking (trust but verify!).

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@nexchap Thank you so much for the quick response and all the explanations and answers !!! So to confirm my understanding: For question 1), I will leave the K-1 sale lot arrangement (Unified basis) as it is. I will contact Fidelity to see if they can change their side of the records to align with K-1 Sale Schedule Breakout (although this way I will end up paying some cap gain tax, instead of a loss, but that's OK). If Fidelity refuses to change, I guess it's OK as I will need to adjust the basis and calculate the proper cap gain anyway (using the methods you repeated several times on this thread), is that true? That's assuming that for the EPD sale transaction on 1099-B (cost-basis not reported to IRS), Fidelity will only report the sale proceeds (and perhaps the # of units), but not cost-basis or the gain/loss as shown on 1099-B. One minor point, I saw your discussion on 8949 Column G. When I manually input the 1099B transaction for EPD during the interview using my own calculated new basis, Column G is empty. I guess if I do the Form mode and adjust, column G will be populated. For question 2) another (related) point I just noticed is that K-1 "L" filed shows a big "Current year net loss" (about $5000, ~10% of my overall investment, btw I started with EPD in 2020), this is on top of the "withdraw & distribution". Given this, am I right that my account tax basis will reach 0 much faster (I was assuming that if the distribution rate is 10% annually, it will take 10 years for the base to go to 0)? BTW, will this $5000 "current year net loss" offset my other ordinary income (eg interests/dividends)? Thank you once again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

1) You've got it, except that I don't think column G (on 8949) matters unless you're adjusting a 1099 where the broker reported the cost to the IRS. In this case, they didn't.

2) Yes, you're basis will approach 0 much faster than you expected. But all those losses will accumulate and be available when you completely sell your EPD holdings, or to offset income from the partnership or Ordinary Gains on partial sale. You can see the mechanics in Form mode, if you look Section A of the K-1 that TT populates.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@nexchap Again, appreciate your quick reply and confirmation! For 2) above, it just makes me think (or realize) that MLP investment may have additional tax "gain" (large amount of business loss to offset other passive income), as well as the tax advantages of deferred tax on the regular distributions. I just did a test using TT (only EPD K-1, and some bank interest), it shows that the bank interest is "absorbed" by the business income loss from the K-1 (Box 1 - Ordinary Gain to Recapture). BTW, this seems not requiring a complete sale of all units.

I started to work on my 2nd K-1 (USO), which is a simpler case - 100% sale, all short-term. K-1 Sales Schedule does not have the column for "Gain subject to Recapture", so I assume it is 0. I tried both methods (using the TT K-1 interview, or your method) and seems the results are the same. One more question though - on K-1 Sales Schedule, there are two lines (for two sales dates, but the units sold on each line have different purchase dates). On my 1099-B, there are 4 lines for the same total amount of units (corresponding to 4 buy and 2 sell transactions). How should I enter the sales in TT during K-1 interview (in 2 transactions?)and/or 1099-B (in 4 transactions?)? I guess it depends on what info IRS is receiving from Broker and MLP, and expecting to see from the Return. Any guidance is very much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@rona11 Probably simplest to enter the Cap Gain info in the 1099-B, and just split the correct amounts proportionally among the extra transactions.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@nexchap Thank you! Did you mean that I just group the transactions as 1 line item in 1099-B reporting? or still report multiple transactions (as reported in 1099-B from Fidelity, and spread the calculated "Capital Gain" among them?

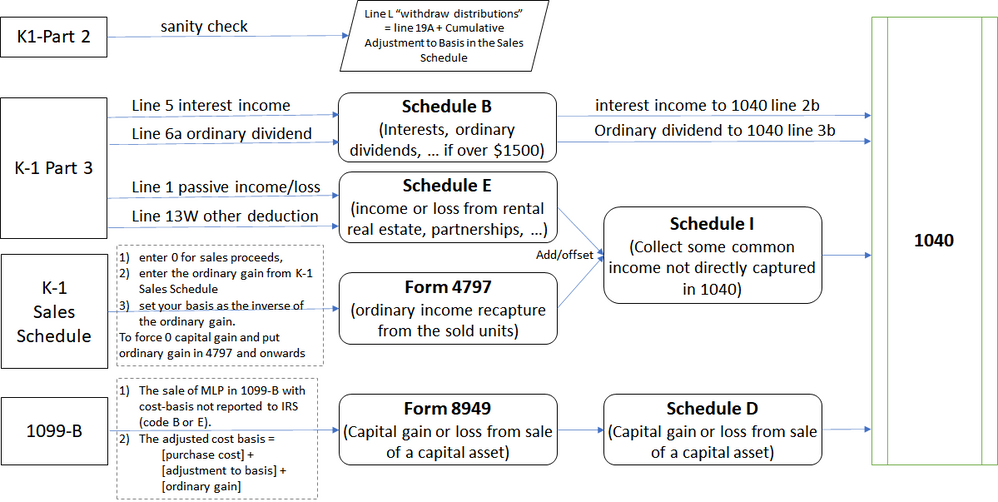

BTW, I am trying to summarize my understanding of reading this thread especially your methods, and visually capture how the numbers flow into various forms, and eventually to 1040 (help me to do "Trust & Check"). I drew a picture as attached. Pls let me know if you spot mistakes/misunderstandings.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@rona11 In general, if your broker reported the correct numbers of units and revenue, in the short term and long term categories, I just edit (proportionally) however many lots they provided to get to the right overall numbers. If the broker used different lots than the K-1, and there's discrepancies between the two, then you have to create new entries (code C or F) that are correct. You can cancel out what the broker sent just by setting cost equal to revenue (so $0 gain). Doing that (rather than deleting the entry entirely) avoids a possible question where the IRS knows that Fidelity told you about $1000 in revenue on 1099-B, but you report something different than that.

As to the flow chart, it looks good. If you get more complicated K-1s you may discover some different nuances, but in general it will be very handy as you deal with this stuff in the future.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@nexchap Thank you so much once again for the prompt reply. For your comment about "If the broker used different lots than the K-1 ...", I saw two types of discrepancy and like like to make sure I understand and process correctly.

(1) K-1 and 1099-B are consistent in terms of the total units sold and the proceeds, but inconsistent in terms of the lot grouping. Better with an example - I sold All 100 units (all short term) on two different dates. Fidelity reported 4 entries:

[sale-date-1, units 20, purchase date-1],

[sale-date-1, units 10, purchase date-2],

[sale-date-2, units 50, purchase date-3],

[sale-date-2, units 20, purchase date-4].

On K-1, they are grouped into two entries:

[sale-date-1, units 30],

[sale-date-2, units 70].

Following your comments/suggestion, should I use 1099-B reported entries, and just modify/assign the cost-basis proportionally to reach the correct total amount of cap-gain? Will IRS try to reconcile with K-1 and expect somethings different?

(2) Another type of discrepancy is, as discussed earlier, when I did partial sell of another MLP, K-1 is using "unified basis" and assign sold units across all 4 purchase lots (proportionally), while Fidelity used the two lots I wanted to sell. As discussed, I will honor K-1's assignment, and try to correct Fidelity's record. If Fidelity cannot cooperate, I just keep my own records and adjust the basis accordingly (just make sure the 1099-B entries are there with consistent proceeds reported).

I know I am asking a lot of detailed questions here and apologies for the extra burden. Hopefully next year I will be much better prepared. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

1) You're broker is splitting sale-date-1 because the units had 2 different purchase dates, and therefore 2 different purchase prices, and that's the way they report any sale. But the K-1 is combining them because its using "unified basis" (i.e., average cost) for all units and doesn't care about the differing purchase prices. So let's say your gain/unit was $10 (from your K-1). Then on your 1099-B, the 20 unit sale would have a gain of $200 and the 10 unit sale would have a gain of $100. The IRS will be fine with this, because its correct. As for the IRS trying to reconcile, at the moment they just get the revenue from the 1099-B (cost not reported, and the K-1 sales schedule not reported). But even if they received all the same documents you got, and had a question about what you reported (they shouldn't, but who knows what their computer will spit out years from now) you'll have the calculations and rationale to explain it.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I report the sale of MLP shares in Turbo Tax. I sold all shares.

@nexchap I cannot thank you enough for your patience and detailed explanation. I think I got it, and will go ahead with my K-1 tax journey 🙂

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Noxlord1234

New Member

olegyk

Level 1

jogger23

New Member

BSSE1

Level 1

ranibane0309

Level 2