- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: multi member llc for rental property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

multi member llc for rental property

My husband and I put a home in an LLC for rental purposes and to protect other assets. The mortgage company insisted we make the LLC multi-member. We are 50/50 owners. Where on Turbotax Business do we list the basis for the rental house? Should it be added to the Partner/Member section that asks about cash and property "contributions" each owner put in? Do you also list the mortgage as a liability in that section? Many thanks in advance for help.

#multimemberllc

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

multi member llc for rental property

If this is your first 1065 then RUN to a local tax professional to get this done as the partnership return is now LATE and accruing late filing penalties each month at the rate of $420 per month. Get educated on how to file the 1065 and set up your books.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

multi member llc for rental property

It's also possible that your 1065 is not as late as one may think, or even late at all. It depends on when the multi-member LLC was created. But assuming you created the LLC in 2021, you are late and are accumulating late filing fees at a cost of $200 per month, per member. So that's $400 a month late filing penalty.

Weather late or not, I always recommend professional help for the very first year so that things are done correctly from the start. Even the tiniest of mistakes can (and usually will) grow exponentially over time. Then when you catch the mistake (usually years down the road when you sell the property) the cost of fixing it will be expensive and make the cost of professional help seem like a pittance in comparison. Especially if your state also taxes personal income. Please seek professional help ASAP.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

multi member llc for rental property

@mharrisonhcm: Do you happen to reside in a community property state?

Regardless, you should definitely seek professional guidance for your first year, particularly since it appears as if your return (1065) is late.

See https://taxexperts.naea.org/listing/service/partnerships

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

multi member llc for rental property

@mharrisonhcm wrote:

Where on Turbotax Business do we list the basis for the rental house?

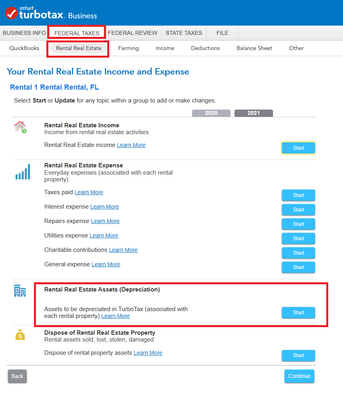

You first need to indicate that the LLC has rental real estate activity in the Business Info section under the About Your Business tab.

Then you will add it in the Rental Real Estate section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

multi member llc for rental property

Thanks for your input. I filed an extension back in March.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

multi member llc for rental property

If you filed an extension back in march then the return was due 9/15/22 and the return is now very late and the failure to file penalties have been adding up since march at the rate of $200 per month per partner. File ASAP and WHEN (not if) the late filing bill arrives you can beg for an abatement of the penalty siteing stupidity and promise to never to it again (they usually allow the first time to be forgiven).

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

pwash

New Member

SelenaP

New Member

gvl2024

New Member

roypimjasmine2485

New Member

karlameyer

Level 1