- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: I have received a 1099-Div for a complete liquidation with an amount in box 10, non cash liquidation distribution. I have a stock basis that is higher than the value of the units received in the ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have received a 1099-Div for a complete liquidation with an amount in box 10, non cash liquidation distribution. I have a stock basis that is higher than the value of the units received in the liquidation. How do I report this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have received a 1099-Div for a complete liquidation with an amount in box 10, non cash liquidation distribution. I have a stock basis that is higher than the value of the units received in the liquidation. How do I report this?

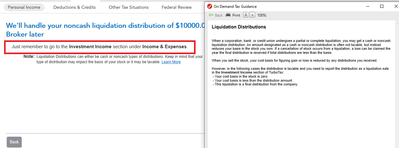

Yes, and you need to go to the right section in the program and read the On Demand Tax Guidance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have received a 1099-Div for a complete liquidation with an amount in box 10, non cash liquidation distribution. I have a stock basis that is higher than the value of the units received in the liquidation. How do I report this?

The program should handle this for you but it is generally capital gain (short or long term depending upon your holding period).

See https://www.irs.gov/publications/p550#en_US_2019_publink100010093

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have received a 1099-Div for a complete liquidation with an amount in box 10, non cash liquidation distribution. I have a stock basis that is higher than the value of the units received in the liquidation. How do I report this?

Thank you.

I don't know if my previous reply was sent. According to the IRS publication, losses are allowed if it is a complete liquidation. Do you know if this is your interpretation? Also, I entered the 1099-div and it stated that the transaction will handled later but nothing seems to have been done automatically. I may have to enter it as a Schedule D - 8949 transaction?

Thanks again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have received a 1099-Div for a complete liquidation with an amount in box 10, non cash liquidation distribution. I have a stock basis that is higher than the value of the units received in the liquidation. How do I report this?

Yes, and you need to go to the right section in the program and read the On Demand Tax Guidance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have received a 1099-Div for a complete liquidation with an amount in box 10, non cash liquidation distribution. I have a stock basis that is higher than the value of the units received in the liquidation. How do I report this?

Thank you.

I don't know if my previous reply was sent. According to the IRS publication, losses are allowed if it is a complete liquidation. Do you know if this is your interpretation? Also, I entered the 1099-div and it stated that the transaction will handled later but nothing seems to have been done automatically. I may have to enter it as a Schedule D - 8949 transaction?

Thanks again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have received a 1099-Div for a complete liquidation with an amount in box 10, non cash liquidation distribution. I have a stock basis that is higher than the value of the units received in the liquidation. How do I report this?

Did you see the earlier post? Yes, you have to enter the transaction in the Investment Income section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have received a 1099-Div for a complete liquidation with an amount in box 10, non cash liquidation distribution. I have a stock basis that is higher than the value of the units received in the liquidation. How do I report this?

Thank you for your help, I have not used the on demand tax situation before.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ange3245

New Member

diana1203-

New Member

josephetc

New Member

josephetc

New Member

tiffjbrown835

New Member