- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: How to deal with land in sale of rental property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with land in sale of rental property

Apologies if this has been explained elsewhere, but after much searching I haven't been able to find the answer. I've owned a rental property (single family home) for several years and use TT to track depreciation. I have one line item in my depreciation report for the structure -- I allocated 75% of the original property purchase price toward the initial cost of the structure. I'm now going to sell the property, and I understand how to enter the sale of this "asset". I can use the same allocation of the sales proceeds for the structure as I did for the initial purchase. So far so good. But land doesn't depreciate, so I never entered it as an "asset". I do see that there is a way to add "land improvements" as an asset, but then TT wants to depreciate it. Does the "Rental Property" section of TT provide a way to encompass the the land sale? Or do I have to handle it separately in the "Investment Income" section?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with land in sale of rental property

Are you using a desktop version of TurboTax?

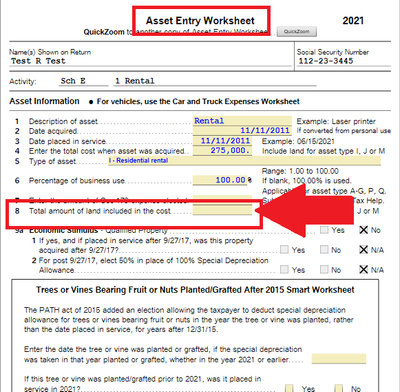

If so, probably the most straightforward method of accomplishing your objective here would be to enter Forms Mode and make entries on the Asset Entry WorkSheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with land in sale of rental property

@Steve042 , when you originally set up the asset ( residential rental property ), you would have entered $XXXX for the total price paid for the asset. Then TT would have asked you for the land price and perhaps you said this is $YYYY. Thus your depreciable basis for the property would have been $ZZZZ ( which is $ XXXX less $YYYY) with a yearly depreciation of $DDDD. Five years downstream, your basis in the property would be ( assuming no improvement costs ) $XXXX and accumulated depreciation of 5*DDDD making your adjusted basis as $XXXX less 5*DDDD. So when you eventually sell the prop. TubroTax would use the original Cost basis of $XXXX plus cost of any improvements as your basis. Then it will subtract the accumulated depreciation giving you an adjusted basis against which the sale proceeds ( Sales price LESS sales expenses including preparatory costs, sales commission, transfer taxes etc. ) to come up with the taxable gain. Note that, the portion of the gain that is due to accumulated depreciation ( i.e. all the depreciation allowable whether taken or not ) is treated as ordinary gain and the rest as capital gain.

Does this make sense ?

pk

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with land in sale of rental property

WHen you originally entered the property into TurboTax the very first time 5 or so years ago, you were asked for COST and COST OF LAND.

COST - What you paid for the property in full, when you acquired it.

COST OF LAND - That portion of COST that you allocated to the land. According to you, that would be 25% of the amount you entered in the COST box.

The program (not you) would do the math allocating 75% of your total cost to the structure, and that value is what gets depreciated over 27.5 years.

Is this *NOT* how you did this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with land in sale of rental property

Thanks, Carl! In fact, as you suspect, I did not enter the information as you lay out, and that may well be the crux of the problem. I have owned the property longer than I've been using TurboTax; 5 or 6 years ago I imported from Taxact. My recollection of the details of the import are fuzzy, but I DO have an "asset" for the land in TT; the cost was set to 0, which makes a certain amount of sense because it ensures that I've never claimed any depreciation on the land. This history is also relevant to @pk 's response, and it may well be that @tagteam is correct that Forms Mode is the way to go. That said, I'd appreciate your take on how to proceed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with land in sale of rental property

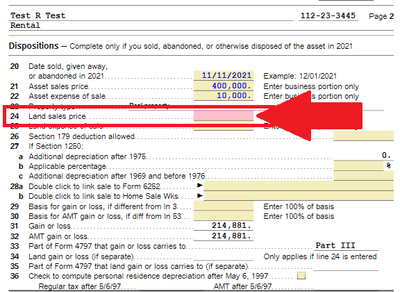

Have you checked your Asset Entry WorkSheet in Forms Mode?

If the "amount of land included in the cost" is $0, you can change that easily. Then, you can simply scroll down and enter the land sales price.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with land in sale of rental property

Thanks -- that did the trick! It seems that the land "asset" with 0 cost that showed up in the Taxact import should probably just be removed. In the worksheet mode, I updated the "asset" for the structure: I changed the cost to the full original property purchase price (it had previously been 75%), and then set the "amount of land included in the cost" to 25% of purchase price. The depreciation table now looks fine. Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with land in sale of rental property

I DO have an "asset" for the land in TT; the cost was set to 0, which makes a certain amount of sense because it ensures that I've never claimed any depreciation on the land.

First, work through the existing property asset. Write down the following information:

- Your cost basis of that particular asset

- The "in service" date of that asset

- The total amount of depreciation taken in prior years. Note that this figure will *NOT* include the 2021 depreciation. Only the the total of all depreciation taken in 2020 and all prior years.

Now, on paper add your land cost to the cost basis and get that total.

Enter a new asset in the Assets/Depreciation section. It gets classified as residential rental real estate.

When asked, enter the "original" in-service date you wrote down about.

COST - Enter the total cost you paid for the property. The total entered here will include the cost of the land.

COST OF LAND - Enter your cost of the land.

Date placed in service will be your original date you wrote down above.

Take note that the program (Not you) will subtract the cost of land from the cost to determine the structure cost to be depreciation.

Somewhere in there you'll be presented the total amount of prior depreciation already taken. The total amount of prior depreciation should equal what you wrote down above. If it's within $5 (I'm confident it will be) you can just leave it, or you can change it if you'd like it to match exactly.

On the summary screen elect to view the details. Everything should pretty much match up and be what you expect. If it is, then you can delete the other asset entries for the structure and the land.

When you view the 4562 in forms mode you'll see the property itself listed along with an amount in the "Cost (Net of Land)" column which is the structure value being depreciated, and an amount in the "Land" column which is the value of the land. Also, the "Prior years depreciation" column will have that total in it, and the "current year Depr" column will have your 2021 depreciation amount in it.

At this point, the current year's depreication will show a full year's depreciation because you have not yet reported the sale of the property.

Do/confirm all the above, and I'll provide you guidance on reporting the sale, so as to make it easier/simpler for you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with land in sale of rental property

@Carl wrote:Do/confirm all the above, and I'll provide you guidance on reporting the sale, so as to make it easier/simpler for you.

Did you actually read the latest post? The issue appears to have been completely resolved.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

karlameyer

Level 1

Mike2959

New Member

cinmay1120

Level 2

wufibugs

New Member

cparke3

Level 4