- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Form 4797 - Sale of a rental property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4797 - Sale of a rental property

Hello,

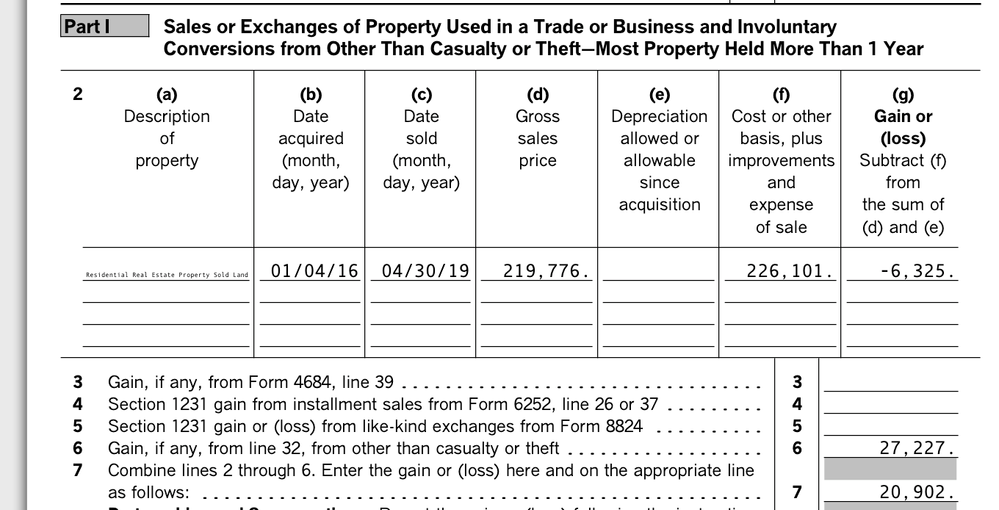

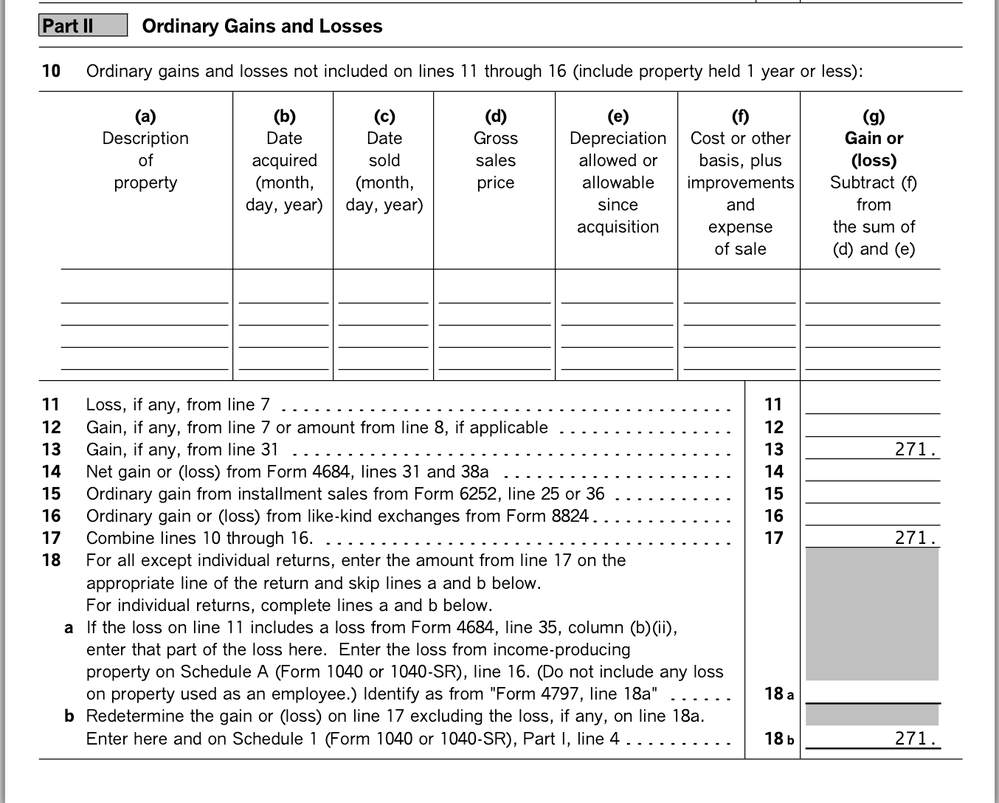

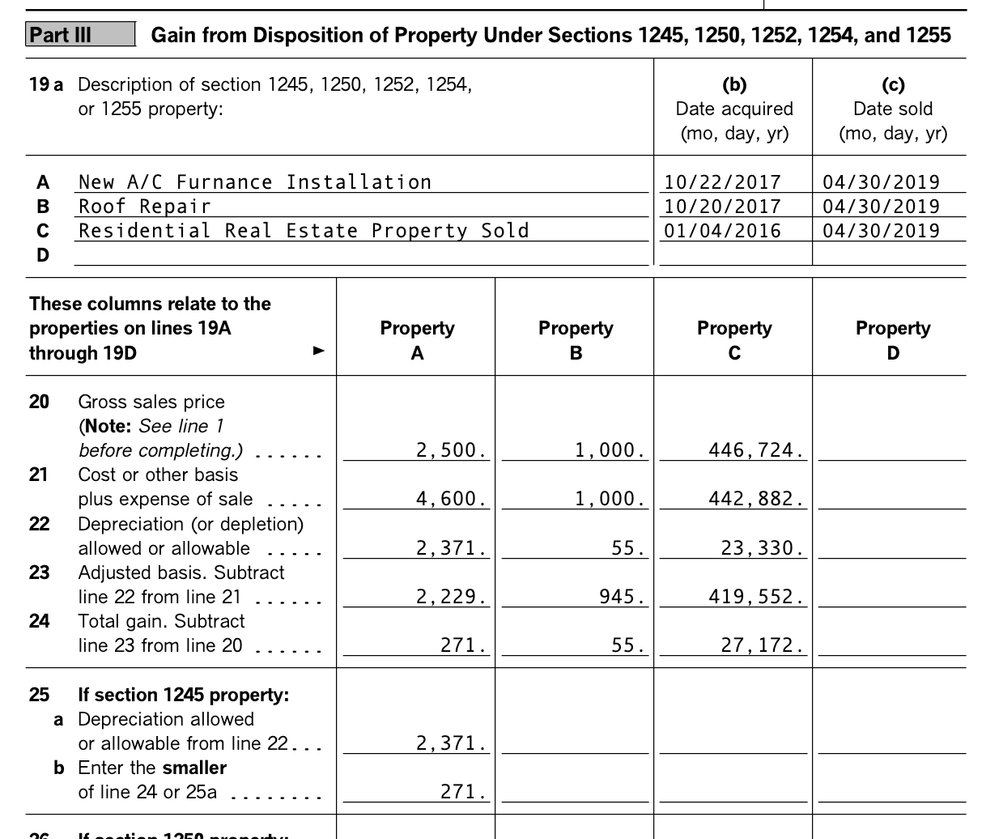

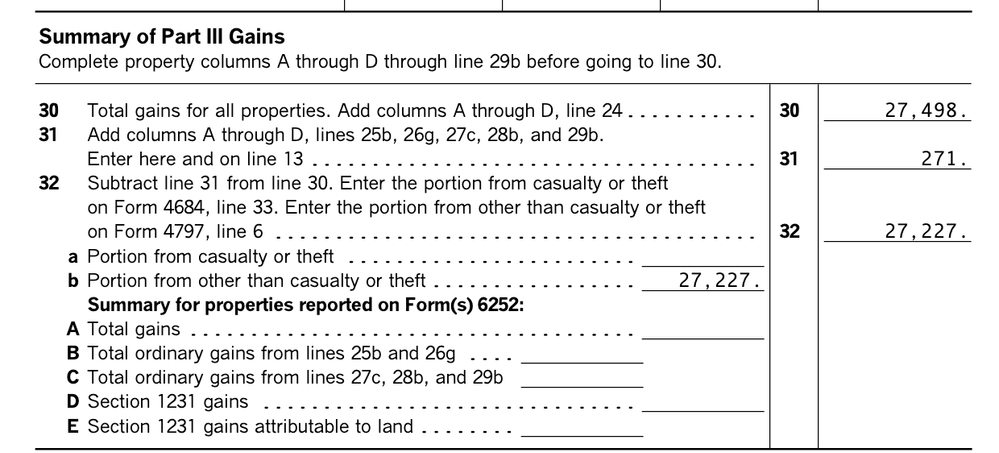

I followed turbotax instructions to record the sale of a rental property under Rental and Royal Properties section. When I open the form 4797, this is what I see it there.

Part 1 is showing just the Land cost basis and selling price.

Sorry, I am not so much good with calculations, and I appreciate your feedback/suggestions.

Question - 1.) Does this looks fine to you?

2) For some reason, these calculation seems to screw up the tax return for Maryland. Turboxtax is showing a full refund for all the Maryland taxes we paid for the year ($12K Refund)......

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4797 - Sale of a rental property

Without more details (which is hard to share here without exposing personal identifiable information) all I can do is speculate.

It "appears" to me that when you allocated your sales price across assets, you're reporting a gain on some assets and a loss on others. The bottom line is, the TurboTax program just flat out can not deal with or handle that correctly.

When you sell at a gain, you must show a gain on each and every asset - even if that gain is only $1 on some assets. Vise-versa if you sold at a loss.

When you show a gain on some assets and a loss on others, the program will not always generate an error because it "thinks" it's figures are correct, when in fact they are not.

You need to get the federal reporting right before you even start the state return. You'll need to delete the state module for now and straighten out the federal. Then when you re-add the state it will import all the federal information anew.

Looking at your other 2-3 posts on this, I see you've not been provided the "general guidance" on reporting the sale correctly in the SCH E section of the program (unless I missed it maybe). So here it is. pay attention to detail, becuase the details make all the difference.

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2019". Select it. After you select the "I sold or otherwise disposed of this property in 2019" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even it it's zero. Then you MUST work through the "Sale of Assets/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1

Basically, when working through an asset you select the option for "I stopped using this asset in 2019" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4797 - Sale of a rental property

what seems unusual is that the land was sold at less than cost but the building was sold for more than cost. this is highly unusual. how did you determine the allocation of the sales price?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4797 - Sale of a rental property

what seems unusual is that the land was sold at less than cost but the building was sold for more than cost.

That's one of the things that the program just flat out can't handle correctly, and it doesn't generate any error or error codes either.

Another thing that definitely results in an incorrect 4797/SCH D is if you have multiple assets listed. Let's say the cost basis on all assets totals to $150,000 after subtracting depreciation. But the cost basis after depreciation on the property itself is $100,000. You sell it for $125,000. In total, that's a $25K loss.

You report the $125K sale price on the property only, with a $0 sales price on all other assets. That shows a gain on the property, with a loss on all the other assets. The program can't handle that. But if you add to that showing a gain on the land and a loss on the structure (or vice-versa) that "really" tends to screw things up.

From playing around with this using C++ (I think TTX uses java) the programming is a nightmare that bloats the program well beyond obesity. It also makes your head hurt. 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4797 - Sale of a rental property

My advice is to contact Turbotax for help. They provide professionals that will help you through all of it to make sure it's done correctly. I'm going to have to do this same scenario for my 2021 taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4797 - Sale of a rental property

If you used the same % on the land/house division on the sale that you used on the original asset listing AND all the sales prices over all 4 assets total up to the sales price on the 1099-S then it is very possible that you technically sold the land at a loss but due to depreciation recapture the building is a gain. If you are not sure then talk to a tax pro as already suggested.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 4797 - Sale of a rental property

Thank you for your reply, my anger/frustration level has just dropped significantly!! I will recheck my schedule E.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

roypimjasmine2485

New Member

karlameyer

Level 1

Mike2959

New Member

cinmay1120

Level 2

wufibugs

New Member