- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: De Minimus Safe Harbor

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

De Minimus Safe Harbor - Had no rental income 2020. But had renovation expenses & improvements. Sold property June 2020. Deducted rental expenses for repairs, condo fee, etc. Added cost of improvements to cost of property (fully depreciated). Do I still need to printout & sign Rental Real Estate Safe Harbor Statement?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

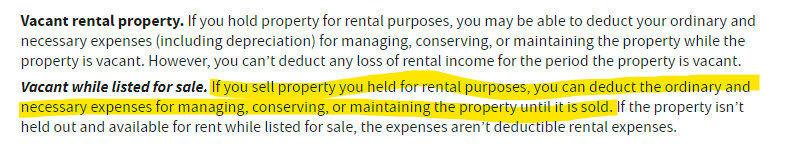

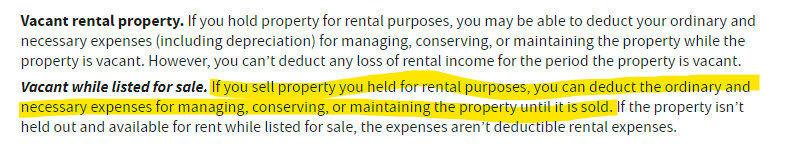

From IRS Publication 527, if the property is for sale and for rent at the same time, the necessary expenses can be deducted.

There have been numerous discussions in TurboTax about this issue for the past few years. The general con-census is that if the property is for rent and for sale, then the expenses can be deducted as rental expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

Was the property available for rent in 2020? If not, you cannot deduct typical rental expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

Safe Harbor for what? I'm not clear on that. If your property improvements were done between the time the last renter moved out and the closing date of the sale, none of your property improvements are depreciated. Of course, they still add to the cost basis. But what are you claiming "any" safe-harbor on, since there's nothing to depreciate? Maybe you listed the property as "available for rent" after the improvements were completed, and before you sold the property?

Even so, claiming a safe harbor deduction makes no sense, since you'd risk paying more tax on more recaptured depreciation in the year of the sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

Carl= Thank you so much for helping me in July 2020 towards obtaining estimate of 2020 taxes.

Now that I am in final stages of 2020, last question.

FACTS= My rental property was renovated & completed last part of 2019 but always available for renting. Jan 2020, rental fully available & in move-in condition, advertised for rent or purchase up to sold date. Although, rental income -$0-, improvements & repairs (after renovations) occurred. Sold fully depreciated property June 2020.

2 QUESTIONS= Can I utilize the Safe Harbor option which appears to allow expense of improvements if $2,500 or less to expense? All improvements individually were $2,500 +/-. Bottom line, can't property be treated as active rental as long as it is advertised for rent or purchase?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

From IRS Publication 527, if the property is for sale and for rent at the same time, the necessary expenses can be deducted.

There have been numerous discussions in TurboTax about this issue for the past few years. The general con-census is that if the property is for rent and for sale, then the expenses can be deducted as rental expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

I've always recommended that when one desires to sell rental property, to hold it for sale or rent, but make the rent being asked for high enough so you've got a better chance of selling, while still low enough to be on the high end of the fair market rental value. If you happen to actually get a renter that will pay the exorbitant rent being asked for, then by all means take it and wait another year or more for that rental contract to end, before raising the rent. Then if they move offer it for rent or sale again with the rent being the new higher rent.

I was planning on selling a paid off rental just over 2 years ago. At planning time I was getting $1000/mo for the 2BR/1BA house with a "tiny" yard. When the occupants vacated I advertised for $1300/mo and unbelievably got someone who not only qualified under my stringent "potential tenant qualificiation policy", they actually paid it.

At the end of their 1 year lease I gave them the choice of $1325/mo or vacate. They chose to vacate, and yet again here comes another that is now paying $1325/mo. Keep in mind that this is for a paid for property that I've had for about 15 years now. So it's not anywhere close to being fully depreciated yet. We'll see what happens when the rent goes to $1350/mo. If the tenant vacates, I'll up it to $1400/mo and see if we get a buyer instead of a renter then.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

Always a pleasure writing to you.

Bottom line, I can take the Safe Harbor steps and utilize the $2,500 additions & expense them.

Good! Now, can I still transmit Fed returns or must I printout everything & sign the Safe Harbor statements?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

I don't know this for a fact. But it's my understanding you can e-file the return. Then, if the IRS wants the signed statements, they will send a letter asking for them. So far, I've never heard of anyone receiving such a request for signed statements from the IRS. of course, that doesn't mean it didn't happen. But if it happens to you, then you only need to send what the IRS actually asks for, and nothing more.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

...and Safe Harbor is permitted even if there is no rental income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

Lastly, why are so many tax preparers and TT advisors in the community against using the Safe Harbor option?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

In the past,chances were higher that safe harbor will not make any difference to your tax liability. But with the additional allowance to deduct up to $25K of your passive losses from other income, (if one qualifies) has changed that for some, even if not by much.

Typically, rental property will operate at a loss every year. Especially if the property has a mortgage on it. As I'm sure you're aware rental income is passive, so rental expenses are passive also. Passive losses can only be deducted from passive gains (without taking into consideration the $25K mentioned above.) So once your passive losses gets your taxable passive gain to zero, that's it. You're done. Any remaining losses are just carried over to the next year.

So with each passing year it's perfectly possible that the passive loss carry over will just continue to grow. Those losses can't be realized until the property is sold or otherwise disposed of.

Typically, when you add up the deductible rental expenses of mortgage interest, property taxes, property insurance and add that to the depreciation you're required to claim each year, those items alone will generally exceed the total rental income received for the year. Add to that the other allowed rental expenses one can deduct, and you're almost guaranteed to have a loss every year.

Therefore, claiming the de-minimus safe-harbor so you can expense a qualified property improvement, doesn't always help reduce your taxable income in the year you claim the safe-harbor. It just gets added to the carry over losses and carried over. It just won't come into play until the tax year you sell or otherwise dispose of the property.

Additionally, when you expense something that you would otherwise depreciate, if that 'Something" is lost, destroyed, damaged, etc, the loss does not reduce your cost basis in the property - which if it did, would in turn reduce the amount of depreciation you are required to take each year *if* you had capitalized it.

Basically, there's pros and cons both ways. But it's up to the tax filer to figure out if the pros are more beneficial than the cons are hurtful.

Finally, keep in mind that just because something that qualifies as an asset cost less than $2,500, does not mean it qualifies for safe-harbor. The cost aspect is only one of the requirements that need to be met for an item to qualify under safe harbor.

Then there's the other "safe harbor" that has absolutely nothing to do with the above. That's the one for QBI which is addressed in IRS Revenue Procedure 2019-38 at https://www.irs.gov/pub/irs-drop/rp-19-38.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

Again, thank you very, very much for the generous sharing of your taxation knowledge.

I'm a bit hesitant as I'm sailing through uncharted territories of taxation. Note, thanks to you, I feel very privileged & confident in filing but with the additional precautions & knowledge I've read coupled with what you've shared I again summarize my position & ask one more time . . .

In summary,

FACTS= My rental property was renovated & completed last part of 2019 but always available for rent or sale. Jan 2020, rental fully available in move-in condition & advertised for rent or purchase up to sold date. Rental income -$0- in 2019/2020. Entered in TT that improvements were available after renovations which is 1/2/2020. Additional but routine repairs (after renovations) did occurred in 2020 before sale. Sold fully depreciated property June 2020. Rental income -0- in both yrs was passive & per TT questions w info, qualifies as Qualified Business Income- even though -0-. Again Premier TT informs within question, that passive rental income is QBI. Taking the Safe Harbor route, I saved about $1K in taxes. Just about all improvements were allowed to be deducted as expense for the yr. 2020. Again, I have no rental income & +/- $10K in improvements based on TT shown options appear to be permitted as a expense for the yr.

QUESTION= With all the facts presented, the only obstacle I have in filing right now is the question of -0- rental income for 2019/2020. Am I permitted to take Safe Harbor steps if -0- rental income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

My response does seem rather rude. But it's not at all intended that way. My intention is to get your thinking on a track that matters.Based on the information provided thus far, you're digging holes in water and are wondering how long it's going to be before you get to the bottom.

Am I permitted to take Safe Harbor steps if -0- rental income?

Yes. But why bother if you sold the property? All carry over passive losses which can include QBI, are released in the year of the sale. Since you sold the property in 2020, once your passive rental losses get your taxable passive rental income to $0, any remaining losses are deducted from "other" ordinary income. With no rental income in 2020, your taxable rental income is $0 before you even get to passive losses, deductions, or QBI. So why are you wasting time and effort on something that isn't going to matter anyway? Your QBI deduction is going to be zero for 2020 anyway.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

You were never rude. Your answers were pure & true like the baby pictured by your name. And I appreciate that. I'm just stupid, scared, frustrated, & just don't know how to communicate better. Much apologies for my approach & unintentional bad remarks & inquires.

I did my taxes several times & when adding improvements to cost of property sold I would pay hundreds in Fed & thousands in State taxes. When I took advantage of the Safe Harbor ruling & utilized expenses rental losses to reduce my capital gains (Schedules 1, D (carryover capital losses), & E) reflected huge expenses which significantly reduced my capital gains & taxes overall which yield a $1,000 diff in my favor.

I want to do the right thing but the only obstacle I have is from the IRS & Turbo Tax language which hints reduction of rental income only by the losses which leads me to think rental income is mandatory. But entries to Turbo Tax leads me into different scenarios which all leads me to the same question, "is rental income required before use of the Safe Harbor"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimus Safe Harbor

Carl! I didn't mean to repeat question. You've already answered the income issue. I just wanted you to know why I was drilling holes in water (good one!). It saved me a $1,000 in taxes via reduction of agi/taxable income. I'm going to relax & reader our correspondence exchange. And thank you again. The baby picture by your name is very relaxing. Best to you & yours!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Marx2

New Member

lydiagp7090

Returning Member

a-concerned-user

Returning Member

adamsweld

Level 2

Andri

Returning Member