- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Confused about rental property sale

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

We purchased a home in 12/2008 and used it as a personal residence until 11/2013, at which point it became a rental property. Sold it to its last tenant in 7/2020.

TurboTax H&B 2020 makes it less than clear, in my opinion, about how a rental property converted from a personal residence should be handled in disposition, but apparently it can't be done through Step-By-Step.

I found a Help topic (or maybe a thread here...) that explains I have to use an "Enterable 4797" form, but there was more to it...some other form I needed to delete and some other instructions...and now that I'm circling back to it, I can't find it.

It probably also explained how I am supposed to determine depreciation when it converted to rental and as of sale date.

Can anyone point me in the right direction?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

TurboTax H&B 2020 makes it less than clear, in my opinion, about how a rental property converted from a personal residence should be handled in disposition, but apparently it can't be done through Step-By-Step.

It most certainly can be done via step-by-step. Two issues.

1) Most people don't read the small print on each screen as they work it through. This becomes obvious when they inform us they marked the property as sold, but were never asked for sales price information.

2) In my personal opinion (and we all know what opinions are like) the program does not provide the necessary clarity on the data entry screens for even a "basic" sale of rental property. Especially if that property has more than one asset listed in the assets/depreciation section for that property.

Here's the basic guidance for a "simple" sale (which is what you appear to have, based on the information you have provided thus far).

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion. Take note here @JeffV that you do not qualify for the exclusion since the property was not your primary residence for any period of time during the last 5 years you owned it, counting backwards from the closing date of your sale.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2020". Select it. After you select the "I sold or otherwise disposed of this property in 2020" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even if it's zero. Then you MUST work through the "Sale of Property/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1 on some assets. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1 on some assets.

Basically, when working through an asset you select the option for "I stopped using this asset in 2020" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

Carl, thanks for your reply.

It's done. Thanks for the help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

If you "sell" each of the non land/building assets(such as fence, roof) for a gain as was the entire property sale (more than cost) I don't see how you benefit ie. recovering the cost that you paid for.

Ex= 27.5 k for new roof depreciated over 27.5 yrs, got 5 yrs into so 5k was depreciated and then sell the rental property - is the remaining 22.5 k is then added to the "cost basis of the building" or a "selling expense" or what so that I benefit from installing a new roof.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

you benefit from the cost because your gain is reduced.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

So what do I do with the $22.5k balance in the roof example ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

So what do I do with the $22.5k balance in the roof example ?

The guidance I provided can't be made any clearer really, and it does require a small bit of comprehension on the reader's part. You report it as sold or otherwise disposed of, assign the remaining selling price, and you're done.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

in Turbotax when you have multiple assets for a rental property - building, land, roof, fence, plumbing whatever each asset must be indicated as sold and a sales price (based on FMV) and related selling costs assigned. most professional software, not Turbotax, make this simple because all the assets can be linked as if there was only 1 asset and then the total sales price is selling costs are indicated for only one asset. as stated, sadly Turbotax doesn't offer this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

I hope I am not intruding here, but I am working through Premier. My rental was initially a primary residence as well and not is completely depreciated out. I do not see it on asset summary, so am really puzzled as to what to do. Also, do I include the land as basis since it was not depreciated?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

Sorry for the error. My rental is completely depreciated out. It was previously a primary residence. I am not taken to any section to enter costs to fix up to sell. It was not rented in 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

In some instances, in your first year of dealing with the rental property on taxes, you need to manually enter the property in the assets/deprecation section.

COST: What "YOU" paid for the property in full. This figure can include the purchase price and the cost of any property improvements done between the date you purchased it and the date you converted it from personal use to residential rental property.

COST OF LAND: That portion of the total amount in the COST box, that is allocated to the land.

do I include the land as basis since it was not depreciated?

See "COST" above. The program (not you) will "do the math" based on the figures you enter for COST and COST OF LAND and only the value of the structure will be depreciated over 27.5 years. The below information is provided for clarity, as there are a number of things the program does not clarify to the level I think it should.

Rental Property Dates & Numbers That Matter.

Date of Conversion - If this was your primary residence or 2nd home before, then this date is the day AFTER you moved out, or the date you decided to lease the property – whichever is later.

In Service Date - This is the date a renter "could" have moved in. Usually, this date is the day you put the FOR RENT sign in the front yard.

Number of days Rented - the day count for this starts from the first day a renter was contracted to move in, and/or "could" have moved in. That would be your "in service" date or after if you were asked for that. Vacant periods between renters do not count for actual days rented. Please see IRS Publication927 page 17 at https://www.irs.gov/pub/irs-pdf/p527.pdf#en_US_2020_publink1000219175 Read the “Example” in the third column.

Days of Personal Use - This number will be a big fat ZERO. Read the screen. It's asking for the number of days you lived in the property AFTER you converted it to a rental. I seriously doubt (though it is possible) that you lived in the house (or space, if renting a part of your home) as your primary residence, 2nd home, or any other personal use reasons after you converted it to a rental.

Business Use Percentage. 100%. I'll put that in words so there's no doubt I didn't make a typo here. One Hundred Percent. After you converted this property or space to rental use, it was one hundred percent business use. What you used it for prior to the date of conversion doesn't count.

RENTAL PROPERTY ASSETS, MAINTENANCE/CLEANING/REPAIRS DEFINED

Property Improvement.

Property improvements are expenses you incur that Improve, restore, or otherwise “better” the property. Basically, they retain or add value to the property.

Betterments:

Expenses that may result in a betterment to your property include expenses for fixing a pre-existing defect or condition, enlarging or expanding your property, or increasing the capacity, strength, or quality of your property. An example of a pre-existing condition or defect in this context would be something such as foundation repair (slab jacking) or some other, hidden and costly, anomaly.

Restoration:

Expenses that may be for restoration include expenses for replacing a substantial structural part of your property, repairing damage to your property after you properly adjusted the basis of your property as a result of a casualty loss, or rebuilding your property to a like-new condition.

Adaptation:

Expenses that may be for adaptation include expenses for altering your property to a use that isn’t consistent with the intended ordinary use of your property when you began renting the property. Adding a wheelchair ramp would be an example.

Expenses for these types of costs are entered in the Assets/Depreciation section and depreciated over time. Property improvements can be done at any time after your initial purchase of the property. It does not matter if it was your residence or a rental at the time of the improvement. It still adds value to the property.

To be classified as a property improvement, two criteria need to be met:

1) The improvement must become "a material part of" the property. For example, remodeling the bathroom, new cabinets or appliances in the kitchen. New carpet. Replacing that old Central Air unit.

2) The improvement must retain or add "real" value to the property. In other words, when the property is appraised by a qualified, certified, licensed property appraiser, he will appraise it at a higher value, than he would have without the improvements.

There are rules that allow you to just flat-out expense and deduct some property improvements instead of capitalizing and depreciating them, if the total cost of the improvement was less than $2,500. It’s referred to as “safe harbor di-minimis” But depending on the specific situation, this may or may not be beneficial. Just be aware that not every property improvement that cost less than $2,500 qualifies for this. If this interest you, the rules can get complex. So a good place to start reading is on the IRS website at https://www.irs.gov/businesses/small-businesses-self-employed/tangible-property-final-regulations. The stuff on di-minimis starts about one page down.

Cleaning & Maintenance

Those expenses incurred to maintain the rental property and it's assets in the usable condition the property and/or asset was designed and intended for. Routine cleaning and maintenance expenses are only deductible if they are incurred while the property is classified as a rental. Cleaning and maintenance expenses incurred in the process of preparing the property for rent are not deductible.

Repair

Those expenses incurred to return the property or it's assets to the same usable condition they were in, prior to the event that caused the property or asset to be unusable. Repair expenses incurred are only deductible if incurred while the property is classified as a rental. Repair costs incurred in the process of preparing the property for rent are not deductible.

Additional clarifications: Painting a room does not qualify as a property improvement. While the paint does become “a material part of” the property, from the perspective of a property appraiser, it doesn’t add “real value” to the property.

However, when you do something like convert the garage into a 3rd bedroom for example, making a 2 bedroom house into a 3 bedroom house adds “real value”. Of course, when you convert the garage to a bedroom, you’re going to paint it. But you will include the cost of painting as a part of the property improvement – not an expense separate from it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2020". Select it. After you select the "I sold or otherwise disposed of this property in 2020" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even if it's zero. Then you MUST work through the "Sale of Property/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1 on some assets. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1 on some assets.

Basically, when working through an asset you select the option for "I stopped using this asset in 2020" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

I have followed the directions, but cannot find where to enter the details for the sale of my rental property. The links cited are not present in TurboTax Premier 2020 or at least I cannot find them. The property is depreciated out as have rented since 1980.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

I'm sorry the guidance I provided isn't helping you. Unfortunately, I can't make them any more simplified than they already are.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about rental property sale

@Peggytas wrote:

I do not see it on asset summary, so am really puzzled as to what to do.

Locate the Rental Properties and Royalties section of the program and start at that point.

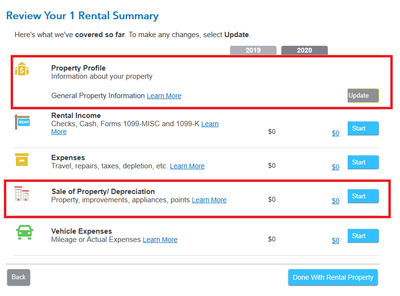

You will indicate that you sold the rental property in Property Profile and then enter the transaction in Sale of Property/Depreciation section (see screenshot).

Note that "fix up" (for the purposes of a sale) expenses are not deductible.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

karlameyer

Level 1

Mike2959

New Member

cinmay1120

Level 2

wufibugs

New Member

lnk-fr

Level 2