- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: 1099-MISC For Rents Paid...Self-Employment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC For Rents Paid...Self-Employment?

I will be receiving a 1099-MISC for rents received on farm equipment I own. The company issuing the 1099-MISC said that the amount would be reported in Box 1 (Rents). I simply bought the equipment for a passive investment for the lease/rental income. Will the IRS see this as self-employment income since it is reported on a 1099-MISC? This seems to be a gray area, especially with the income being reported in Box 1.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC For Rents Paid...Self-Employment?

The IRS will see it as rental income, which is what it is.

Starting in 2020, self-employment income is reported on Form 1099-NEC, not Form 1099-MISC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC For Rents Paid...Self-Employment?

Rental income *is* passive income. That's why it's reported in box 1 of a 1099-MISC. Non-passive income would be reported on a 1099-NEC. So there's no problem or issue here. All your rental income, expenses and depreciation will be reported on SCH E as a part of your personal 1040 tax return. This is no big deal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC For Rents Paid...Self-Employment?

@Carl wrote:

All your rental income, expenses and depreciation will be reported on SCH E as a part of your personal 1040 tax return.

Rental income from the rental of personal property, such as equipment or vehicles, is not reported on Schedule E.

See https://www.irs.gov/instructions/i1040se#idm140048554558688

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC For Rents Paid...Self-Employment?

@tagteam Does TurboTax software have the capability to generate a Form 4562 for depreciation expenses, along with Form 8582 (Passive Activity Loss Limitations), and input the result on line 24b of Schedule 1? (NOT Schedule E or Schedule C). Line 24b of Schedule 1 allows for deductions for expenses related to rental of PERSONAL property (NOT real estate) that is engaged in for profit that's not a business (OTHER INCOME). I have been unable to do this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC For Rents Paid...Self-Employment?

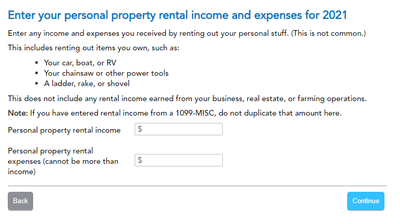

You can enter income and expenses (see screenshot), but I believe you are on your own with respect to generating the other forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC For Rents Paid...Self-Employment?

No, not in the occasional rental of personal property. You must make the calculations yourself and enter them as shown in the image provided by our awesome Tax Champ @tagteam.

The chart you can use against the cost or fair market value (FMV) of your equipment is attached below. Use the percentage times the depreciable basis. If the equipment was converted to rental use, then you should use the lesser of cost or FMV on the date of conversion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC For Rents Paid...Self-Employment?

I bought this equipment new for rental purposes. It is also not occasional rental. It is in use and rented 365 days a year, and I receive rent payments quarterly (1099-MISC). Does this have an effect?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC For Rents Paid...Self-Employment?

@tagteam I know it is not a common situation. I have gotten conflicting answers on how to handle the situation too. Most say to use Schedule E, but as you have said (which I agree with), this is not real estate or any activity related to rental real estate, so using Schedule E is not correct. This personal property I am renting (5-year depreciable property), costs well over $100K to purchase, so it is essential that I am able to depreciate it. Since it doesn't fall under Schedule E or Schedule C, I assume it must go on Schedule 1 (Other Income). It makes me a little nervous that I am on my own to do this, and it appears that no software is unable to generate the forms I need in this situation and input the deductions on line 24b of Schedule 1. I know the amount that is allowed for the depreciation deductions, but if I don't have the correct forms (4562 and 8582) submitted to substantiate the amount, it is going to lead to an audit. Since the software is unable to accommodate this situation and I am on my own, I suppose I have no choice but to file a paper return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC For Rents Paid...Self-Employment?

@sidekickin wrote:

Since the software is unable to accommodate this situation and I am on my own, I suppose I have no choice but to file a paper return.

Are you using a desktop version of TurboTax? You might be able to do this in Forms Mode.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

dsaucier88

New Member

victoriad_2022

New Member

zafira11

New Member

hnybrnz

New Member

vbruckert

New Member