- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Is it possible to carry investment interest expense forward if using standard deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it possible to carry investment interest expense forward if using standard deduction?

Hello,

I would like to know if it is possible to carry forward investment interest expense from form 4952 if somebody uses the standard deduction for that year. For example, if investment interest expense on form 4952 is $10,000 for 2019, is it possible file this form in 2019 and carry forward this $10,000 to the 2020 form 4952 even if the standard deduction of $12,200 is used in 2019? I have researched this but it is unclear if this form can still be filed even if deductions are not itemized for a given year.

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it possible to carry investment interest expense forward if using standard deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it possible to carry investment interest expense forward if using standard deduction?

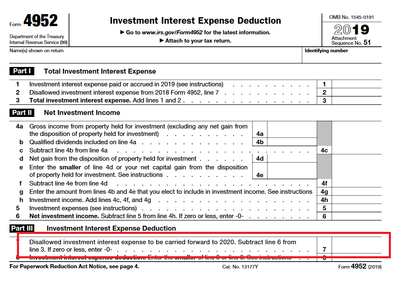

Yes, you can carry the disallowed portion to the 2020 tax year (you will find that amount on Line 7).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it possible to carry investment interest expense forward if using standard deduction?

No it is not possible to carry forward an investment expense into a future year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is it possible to carry investment interest expense forward if using standard deduction?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

zomboo

Level 6

02355

New Member

Njpl

New Member

wnetmw

Level 4

cashrn-gmail-com

New Member