- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Investment Tax Credit showing $0 for partnership for new roof in 2019

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment Tax Credit showing $0 for partnership for new roof in 2019

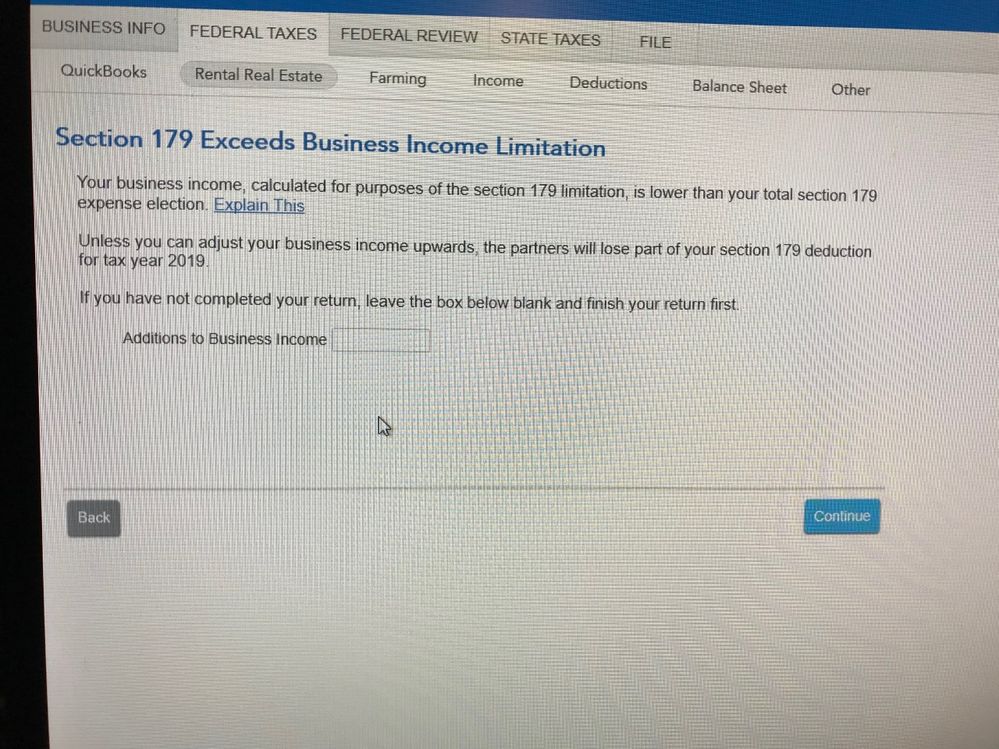

TurboTax comment explains that the investment tax credit exceeds the business income limitation and shows -$5000 for business income which is the start up costs deducted. The rental income from the commercial property with the new roof generated 5x the cost of the new roof and is the only asset of the partnership. Do I add the full amount of rental income as business income at the entry for additions to business income since it seems none of the rent is included?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment Tax Credit showing $0 for partnership for new roof in 2019

Yes, but you would not want to enter the rents on this screen- you must enter the income in the proper place (under Rental Income). You will not get the correct section 179 deduction unless and until you enter all rental income and expenses in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment Tax Credit showing $0 for partnership for new roof in 2019

I did input the rental income. The software has a bug. Likely there are issues because this tax credit is so new as applied to certain items in 2019. We will wait to see if it is fixed later.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

x_m_z

Level 3

maryjo42

New Member

MGS

New Member

carsonbd

New Member

flokey

Level 2