- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I sold a vacation home in 2018 that we rented to others for income. What factors determine if I enter this under Personal Investment or sale of Business property?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a vacation home in 2018 that we rented to others for income. What factors determine if I enter this under Personal Investment or sale of Business property?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a vacation home in 2018 that we rented to others for income. What factors determine if I enter this under Personal Investment or sale of Business property?

If you rented your place to a person at the fair rental price and rented for more than 14 days during the year, you are considered renting out as a business. By selling it, you will report it as a sale of business property on a Form 4797.

If you charged a rent under the fair rental price or rented for less than 14 days, it is not considered as a rental business. You will report it as a sale of a personal investment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a vacation home in 2018 that we rented to others for income. What factors determine if I enter this under Personal Investment or sale of Business property?

If you rented your place to a person at the fair rental price and rented for more than 14 days during the year, you are considered renting out as a business. By selling it, you will report it as a sale of business property on a Form 4797.

If you charged a rent under the fair rental price or rented for less than 14 days, it is not considered as a rental business. You will report it as a sale of a personal investment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a vacation home in 2018 that we rented to others for income. What factors determine if I enter this under Personal Investment or sale of Business property?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a vacation home in 2018 that we rented to others for income. What factors determine if I enter this under Personal Investment or sale of Business property?

I have the same exact quandary. It's been a vacation rental property for years but was sold in 2018 before there were any rentals, so TT forces me to delete it as a rental, then when I try to sell it as a second home, it asks if it **ever** was a rental and TT starts chasing its tail.

Will someone Please answer where to enter a Sched E rental for years with $0 rent in the year of sale?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a vacation home in 2018 that we rented to others for income. What factors determine if I enter this under Personal Investment or sale of Business property?

Generally, real estate that is utilized to produce income is a business property sale. That would be things like rental property, as well as raw land if you ever rented out that land to someone else for their use. One example of the latter would be raw land that you rented out to an individual and they used it for placing a storage shed on.

Real estate that is held and not sold until it's value increases would be an investment. A flip would also fall into the investment category. For example, if you purchased a house then fixed it up and sold it, that would be termed as a flip. It's also an investment because it wasn't used to actually "produce" income during the period of time you owned it. So it's a sale of an investment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a vacation home in 2018 that we rented to others for income. What factors determine if I enter this under Personal Investment or sale of Business property?

@Lonny wrote:

before there were any rentals, so TT forces me to delete it as a rental.....

Will someone Please answer where to enter a Sched E rental for years with $0 rent in the year of sale?

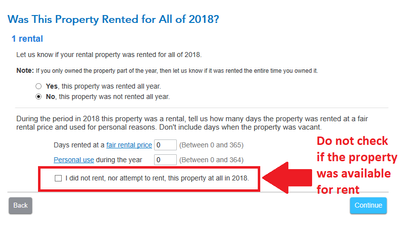

I think your issue could be that you are checking the box on a screen in the rental section (see screenshot below). If the property was not rented but available for rent, do not check that box.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

cinmay1120

Level 2

DLK59

Returning Member

toodeep1

New Member

chriscdf

New Member

sandrawa

Level 2