- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Tax Year Prior to 2020: I rented out my house in July 2019. Do I put a lower amount in box 1 of form 1098 in the deductions area if I included a portion of it in my rental property expenses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I rented out my house in July 2019. Do I put a lower amount in box 1 of form 1098 in the deductions area if I included a portion of it in my rental property expenses?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I rented out my house in July 2019. Do I put a lower amount in box 1 of form 1098 in the deductions area if I included a portion of it in my rental property expenses?

Need more info:

Was this a new rental ?

Was this a conversion from personal use to rental where you moved out completely ?

Was this your personal residence where you live and you only rented it(or part of it) for a short time but never really moved out ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I rented out my house in July 2019. Do I put a lower amount in box 1 of form 1098 in the deductions area if I included a portion of it in my rental property expenses?

Good Morning,

Yes, this is a new rental.

Yes, it was a conversion from my personal residence to a rental. I have moved out completely and now live elsewhere.

Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I rented out my house in July 2019. Do I put a lower amount in box 1 of form 1098 in the deductions area if I included a portion of it in my rental property expenses?

Good Evening,

Yes, this is a new rental.

Yes, it was a conversion from my personal residence to a rental. I have moved out completely and now live elsewhere.

Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I rented out my house in July 2019. Do I put a lower amount in box 1 of form 1098 in the deductions area if I included a portion of it in my rental property expenses?

You may have to do some kind of allocation. The rest will go to your schedule E as expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I rented out my house in July 2019. Do I put a lower amount in box 1 of form 1098 in the deductions area if I included a portion of it in my rental property expenses?

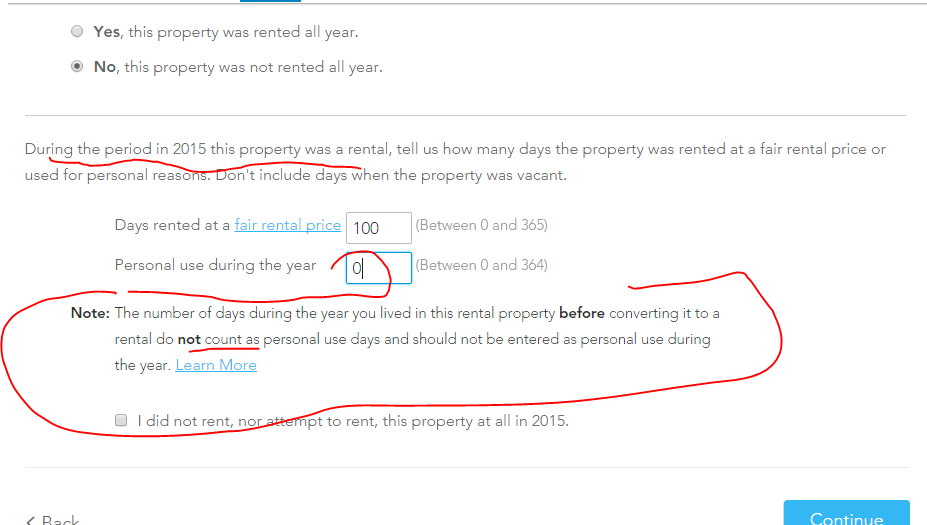

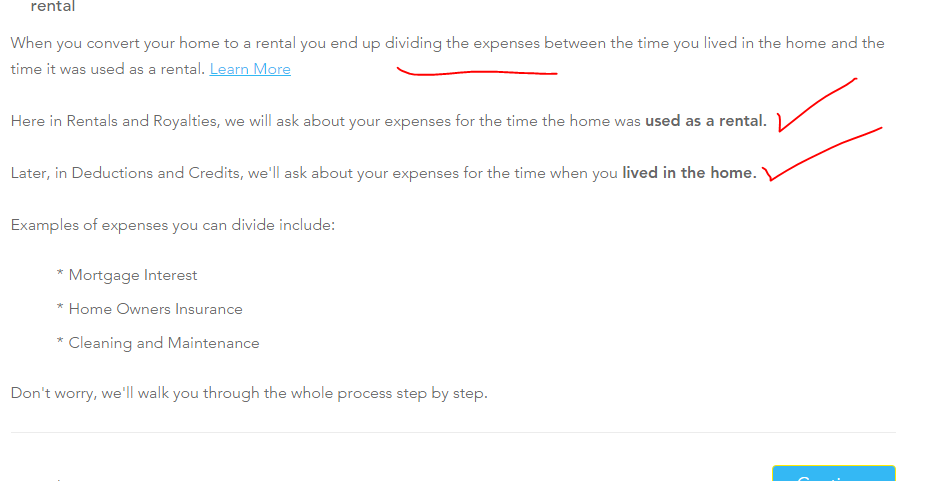

Follow the interview questions carefully ... you can either prorate the common expenses between the Sch A and Sch E yourself OR allow the program to do it for you but either way you MUST pay attention to this screen below ... your personal use days do NOT NOT NOT include the days you lived in the home PRIOR to the conversion ... mess up this screen and the entire section is wrong ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: I rented out my house in July 2019. Do I put a lower amount in box 1 of form 1098 in the deductions area if I included a portion of it in my rental property expenses?

Thank you! That helps a lot!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

romanhokie

Level 1

debraphillips130

New Member

lnk-fr

Level 2

josephine-dyliac

New Member

cinmay1120

Level 2