- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I am 50% owner of rental property in year 1. I input 50% ownership. Will Turbo Tax discount the value of the house/asset when I enter the asset cost by 50%?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am 50% owner of rental property in year 1. I input 50% ownership. Will Turbo Tax discount the value of the house/asset when I enter the asset cost by 50%?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am 50% owner of rental property in year 1. I input 50% ownership. Will Turbo Tax discount the value of the house/asset when I enter the asset cost by 50%?

What a great question.

It should but there appears to be a bug for depreciation expenses. It seems to work correctly for regular expenses. Or perhaps there is a reason TT does it this way, but if so the questions should be much more clear and should expressly tell you to enter only your share in the asset entry questions.

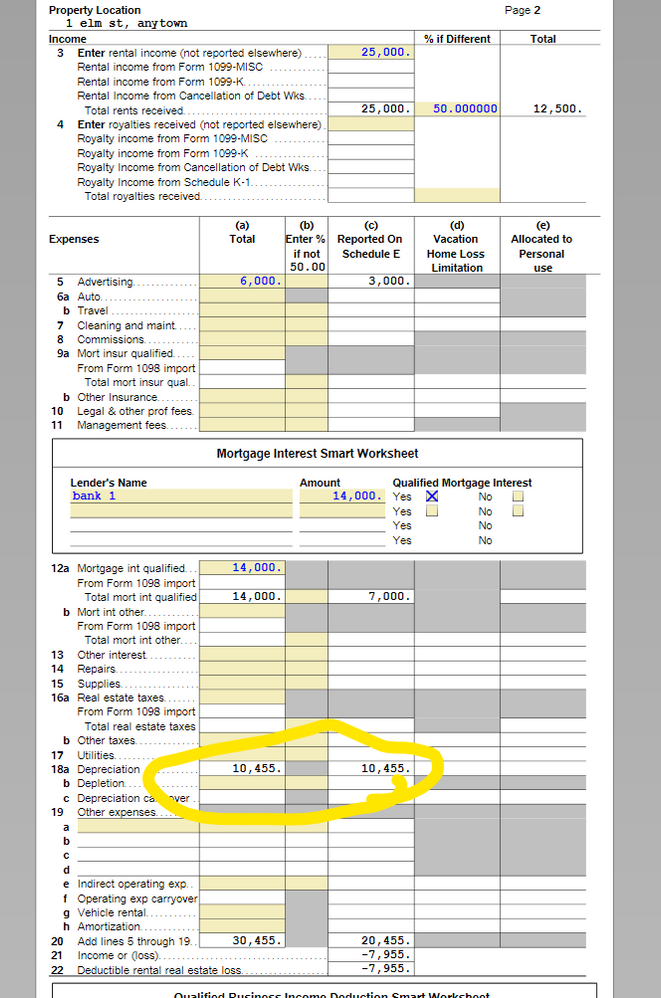

The way to check is to review the "Schedule E Wks" (easy to do in TT Desktop in forms mode, otherwise you may need to pay TT and generate a review PDF. See https://ttlc.intuit.com/turbotax-support/en-us/help-article/import-export-data-files/save-2021-turbo... )

My suggestion is that you enter the assets as your % (e.g. 50% of total). But that you carefully check your Schedule E Worksheet, Schedule E, and Depreciation Report before you file to make sure the amount that winds up ion Schedule E line 18 is the correct amount.

Here is a screenshot from a test case I did using 50% of a rental property. Note that the depreciation in col a is not 50% of the total in col a.

I will try to get this reported as a bug and/or question clarification request.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am 50% owner of rental property in year 1. I input 50% ownership. Will Turbo Tax discount the value of the house/asset when I enter the asset cost by 50%?

@jtax see post in Lounge

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am 50% owner of rental property in year 1. I input 50% ownership. Will Turbo Tax discount the value of the house/asset when I enter the asset cost by 50%?

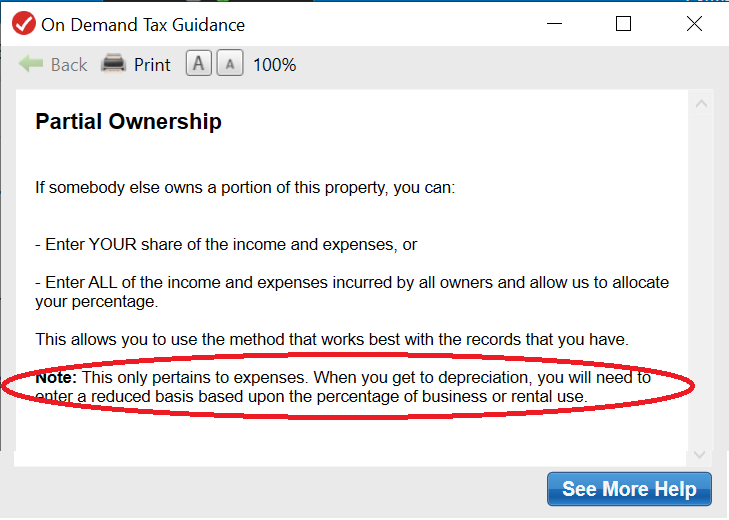

I can only assume there are programming limitations that make it non-viable to split everything. I can see that with all the possible scenarios of a multi-owner property. One thing I do note is that on the screen for "We can automatically divide your income and expenses for you" is does state it will split income and expenses. No mention of assets or depreciation. However, upon clicking the "learn more" link on that screen I see the following:

NOTE: This only pertains to expenses. When you get to depreciation you will need to enter a reduced basis based upon the percentage of business or rental use.

In my opinion (and we all know what opinions are like) that should be on the main screen, and one shouldn't have to click any links to see that. Additionally, the statement is incomplete. It should also include "percentage of ownership" in additional to percentage of business of rental use.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

west2east1

New Member

Simonr78248

New Member

jackiealexisoliv

New Member

shak0000

Level 1

long-shot

Returning Member