- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Depreciation shows $0 for my new rental house

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

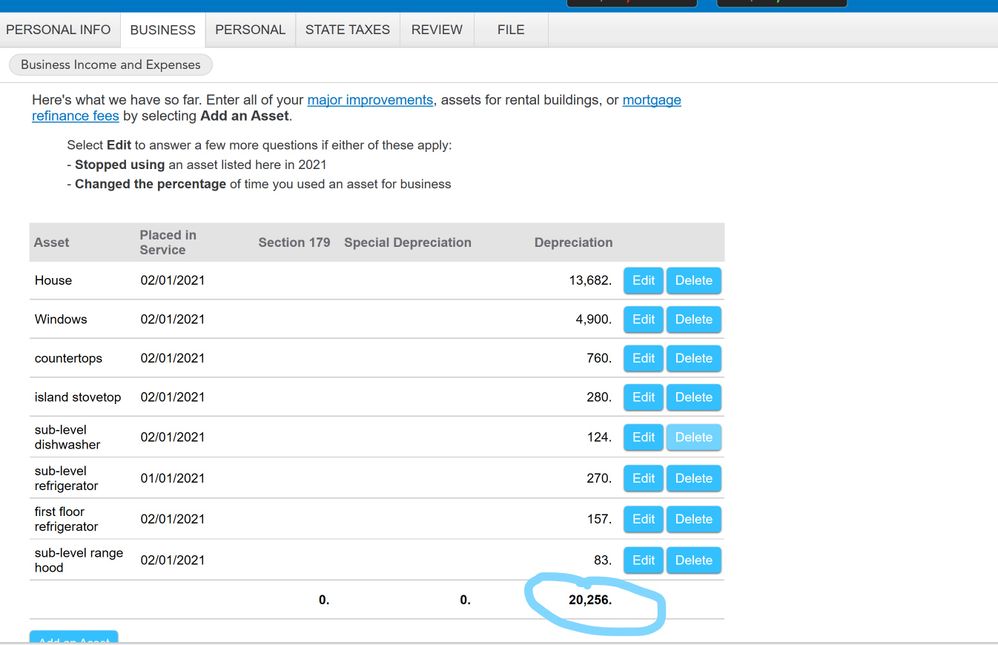

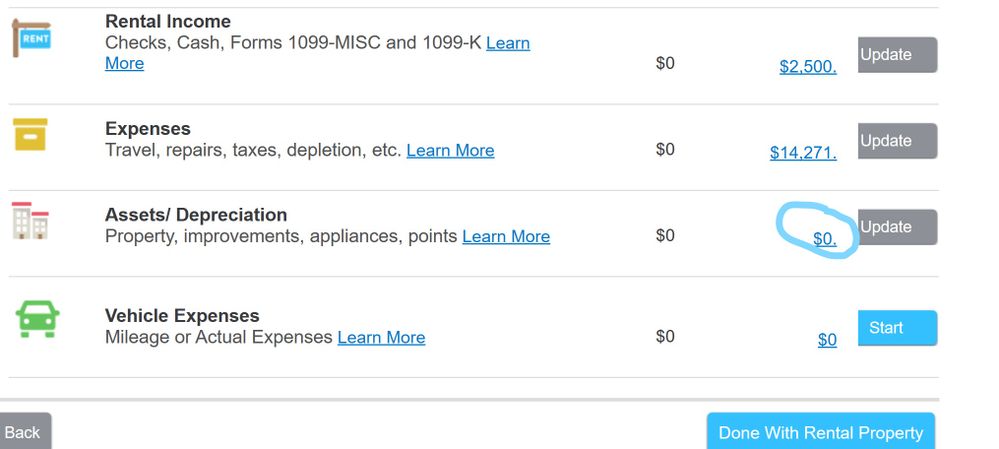

So I have a house that was for all intents and purposes converted into a rental house for the 2021 year. It was previously our second house for the past 13 years. It was supposed to be sold, but we got no great offers so we rented out the house later on in the year. So I put down rental days as 153 days, and I put down around 20 days in January for personal use, since that's when we were there busy renovating the house in December 2020 up thru mid-January 2021. So in December 2020 and January 2021, we made all kinds of improvements - windows, countertops, refrigerators, dishwashers, cooktop, etc. So I put all of these down, along with the house itself, and I chose the option to spread out the deductions over several years. So the depreciation for all these items added up to around $20K on Turbo Tax for 2021, but the Schedule E on Line 18 for this property shows $0. I renovated another rental property and added some new items and those depreciation $$ showed up in Sched E. What gives?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

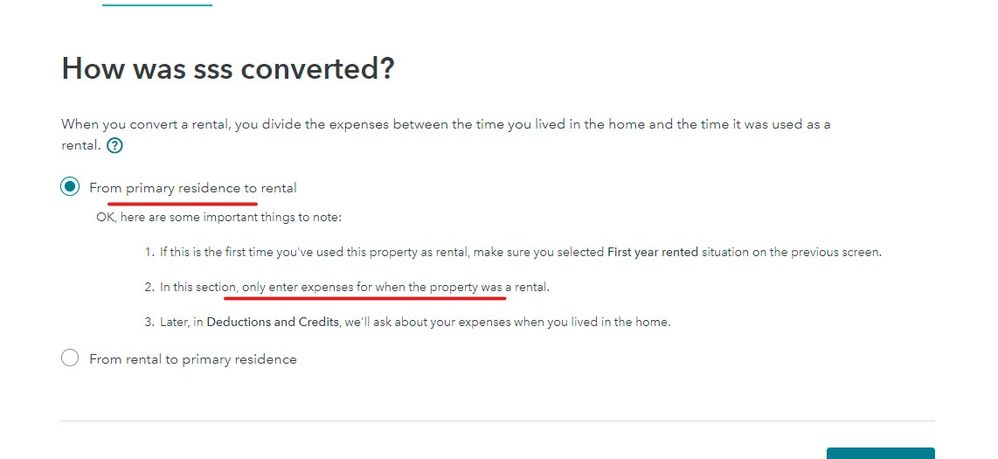

Once you placed the property into service you had NO personal use days and you will need to prorate all the common expenses yourself as the program really doesn't do that well for you. Did you complete these screens correctly ... the program interview screens were changed this year to help users avoid certain pitfalls ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

yeah I think I said too much information. Your suggestion doesn't work. This almost feels like a "losses" limitation of some sort that is not clearly stated in TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

Do not enter personal days if you have not used the property for personal use since converting it to a rental. Property that is a mix between personal and business use is treated differently by the IRS than a property that is exclusively used as a rental, even if it was converted during the year.

If the property is used both as a rental and for personal use, as with a vacation rental, operating expenses for the property, such as repairs and taxes can be deducted in their entirety, but you can only take depreciation as an expense if there is still income from the rental property after the operating expenses have already been deducted. The remainder of the depreciation that you do not take in this year carries forward to future years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

I did stay in the house for personal reasons for a good part of January. Just to lay things out, I stayed in the house for personal reasons with my family in January (while renovation was going on). House was empty available for rent (or sale), no takers, starting Feb 1 until it was rented out August 1. But should the depreciation be at $0? Seems like it should be some number > $0, but what do I know?

As long as it's not a Turbo Tax bug, I guess I'm ok. Do I need to do anything special to have all this depreciation carry over to 2022? I'm assuming that since I didn't claim any one-time deductions and spread everything out, I should have the depreciation the following years?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

No the depreciation should not be zero. It's important to point out as noted by @RaifH and @Critter-3, that once the property was converted to rental (February 1st), there was no personal use.

TurboTax asks the date the property was placed in service. There should be no days of personal use entered because there was none after it became available for rent. This is the intent to make sure the appropriate depreciation is calculated.

Once this is complete you should see the depreciation as part of your rental expenses. On your screen image attached it clearly shows depreciation figures for each asset.

The entire rental loss could have limitations as noted for the phaseout rule.

- Phaseout Rule: The maximum special allowance of $25,000 ($12,500 for married individuals filing separate returns and living apart at all times during the year) is reduced by 50% of the amount of your modified adjusted gross income that’s more than $100,000 ($50,000 if you’re married filing separately). If your modified adjusted gross income is $150,000 or more ($75,000 or more if you’re married filing separately), you generally can’t use the special allowance. This is because the special allowance is reduced to $0 since the modified adjusted gross income is over the $100,000 amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

I give up. Once I make the one change to the property to "property used for the full year", my tax bill goes up over $3K. I didn't even make that much in rental income for this house. There's no point in me declaring any of these expenses. I already have another post in which the same thing happens for one of my other properties, if I put in any expenses on the rental property, my tax bill goes up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

You may have an earned income or similar credit that decreases as your income decreases. That could result in your tax going up as you add more rental expenses. You can check on this by looking at line 27(a) on your tax form 1040.

You are not supposed to pick and choose which deductions you will take on your tax return, especially if it reduces your tax when you leave deductions off. You are required to report all items of income and associated expenses on your tax return.

I suggest you look at line 27(a) in particular on your tax return and also see how the other items of income, deduction and credits change when you add or remove the expenses.

You can view your form 1040 while working in the online version of TurboTax by following these steps:

While working on your return in the Federal section of TurboTax:

1. Choose the Tax Tools icon on your left menu bar

2. Tools

3. View Tax Summary

4. Choose the Preview my 1040 on your left menu bar

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

Please read the below. The two most common reasons for your issue is business use percentage you entered is wrong, or you have personal use days you entered as more than zero, which is wrong too.

Date of Conversion - If this was your primary residence or 2nd home before, then this date is the day AFTER you moved out, or the date you decided to lease the property – whichever is later.

In Service Date - This is the date a renter "could" have moved in. Usually, this date is the day you put the FOR RENT sign in the front yard.

Number of days Rented - the day count for this starts from the first day a renter was contracted to move in, and/or "could" have moved in. That would be your "in service" date or after if you were asked for that. Vacant periods between renters do not count for actual days rented. Please see IRS Publication927 page 17 at https://www.irs.gov/pub/irs-pdf/p527.pdf#en_US_2020_publink1000219175 Read the “Example” in the third column.

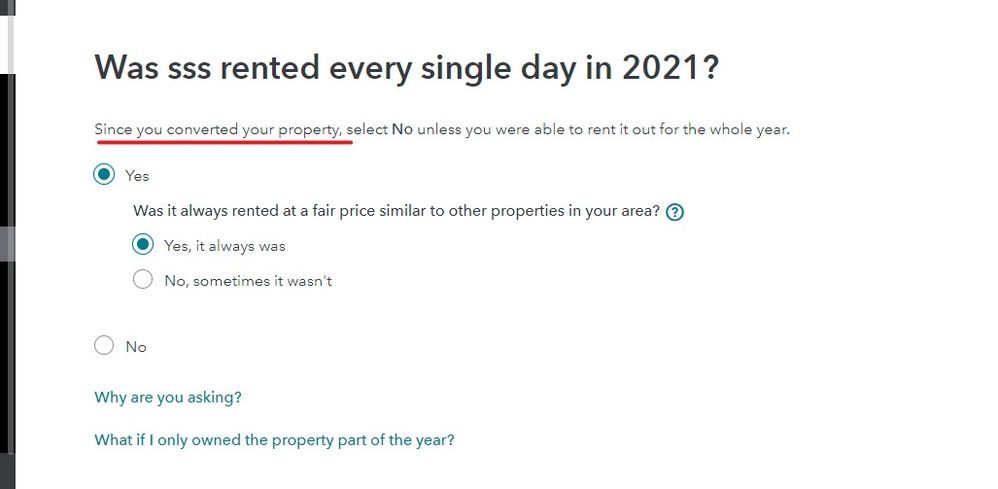

Days of Personal Use - This number will be a big fat ZERO. Read the screen. It's asking for the number of days you lived in the property AFTER you converted it to a rental. I seriously doubt (though it is possible) that you lived in the house (or space, if renting a part of your home) as your primary residence, 2nd home, or any other personal use reasons after you converted it to a rental.

Business Use Percentage. 100%. I'll put that in words so there's no doubt I didn't make a typo here. One Hundred Percent. After you converted this property or space to rental use, it was one hundred percent business use. What you used it for prior to the date of conversion doesn't count.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

This could simply be a bug. Turbotax had it last year and sent special instructions to fix it. Seems like it is still impacting some of us. (including me)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

I'm fairly convinced it is a bug, especially since I had a CPA go over my rental records and she came up with something pretty different. I probably put out red herrings out there in the beginning of my post with my scenarios, and small interpretation mistakes on my part still does not explain why the depreciation is not accounted for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

There is no bug. If there was, there would be hundreds, if not thousands of posts on this issue.

So in December 2020 and January 2021, we made all kinds of improvements - windows, countertops, refrigerators, dishwashers, cooktop, etc. So I put all of these down, along with the house itself, and I chose the option to spread out the deductions over several years.

So there is no way this house was move-in ready and "in service" before the end of Jan 2021. Your date of conversion or in service date would be one day after all that work was done. Say for example, Jan 20, 2021. So your days of personal use would be zero, and days rented day count starts on the first day a renter "could" have moved in.

I did stay in the house for personal reasons for a good part of January. Just to lay things out, I stayed in the house for personal reasons with my family in January (while renovation was going on).

That indicates you were there for the primary purpose of preparing the house for rent for the very first time.It does not indicate to me any type of personal use.

House was empty available for rent (or sale), no takers, starting Feb 1 until it was rented out August 1.

So it was place "in service" on Feb 1 and sat empty while you advertised, until you actually got a renter in there on Aug 1.

What you need to do, is indicate the property was rented "the whole year". You will not be asked for personal use or days rented then. The program will figure depreciation using SL/MM from your in service date of Feb 1.

Additionally, to make life easier on the tax front, the renovations/property improvements you did before Feb 1 do not need to be entered as separate assets so long as they fall under the same MACRS classification as the property itself does. You simply add those costs to the cost basis of the structure, since everything was placed in service and available for rent on Feb 1.

Windows and countertops can be added to the cost basis of the structure. the appliances can be also. But they should be separated out and classified as appliances under MACRS since those are depreciated over 5 years.

Also be aware that with appliances, if they are line itemized on the invoice and cost less than $2,500, you can just expense those under Safe Harbor de Minimis and be done with them forever. Sure beats having to track/account for depreciation later down the road.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

unfortunately it's not as easy as I painted the picture, I just laid out things just to simplify the situation. TurboTax doesn't seem to have the capability to handle a complex case, as is this case. There was still personal use of the house actually after August 1 even though it was rented out, as yes, only part of the house was rented out. Even before August 1 also I used it for personal days, although the definition of personal use could be debated either way since I was primarily there to show the house but also it is my second/vacation home. Putting it down for the whole year as "for business use only" would not be accurate.

I see that on the Schedule E worksheets, it has allocated all of my depreciation as a Vacation Home Loss Limitation, which is where the crux of the problem is - not all of it should be allocated there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

Turns out it indeed is a bug (at least for my case). I spoke with Turbotax and they confirmed it after troubleshooting my case.

So how do you get around it? Delete your current entry under "rental property" and start a new one. With a fresh entry, I got the correct depreciation amount (non-zero).

Turbotax said "Sometimes, it just needs that to refresh". Hope it helps other too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation shows $0 for my new rental house

only part of the house was rented out.

That matters. Big time.

That's a completely different ballgame. Kinda like declaring a touchdown at a baseball game when the batter hits a home run. 🙂

Start over in the rental section.

In the Property Profile section on the second or third screen titled "Do any of these situations apply to this property?" there are three selections that you must make:

- 2021 was the first year I rented this property.

- I rent out part of my home

- I converted this property from personal use to a rental in 2021

On the screen "Was this property rented for all of 2021?" select NO.

For days rented, the day count starts on the first day of the rental contract.

For personal use days, only count the days "AFTER" it was placed in service.

The sum of personal use and rented days can not exceed 365. That total also has be the same as or lower than the day count starting from the in service date, through Dec 31, 2021.

The rest of the property profile section is pretty self-explanatory. Just make sure you read the small print on each screen, in case it applies.

Now if you haven't already, enter your rental income/expenses (remember what the small print says!) and move on to the Assets/Depreciation section.

- On screen "Describe this asset" select Rental Real Estate Property and continue.

- On screen "Tell us a little more about your rental asset" select Residential Rental Real Estate and continue.

Enter the property description, full cost basis (no prorating by you, the program does that for you) and that portion of the cost basis allocated to the land. For the date acquired, that will be the date you originally purchased the property; doesn't matter if it was years ago either. Then continue.

- Select "purchased new" and select "no, I have not used this item 100% of the time for business". Below that select "I used this item for personal purposes before I started using it in this business".

On the same screen enter the date the property was available for rent.

Now the tricky part. at the bottom it asks for Percentage of "TIME". For your specific and explicit scenario, that question is wrong. It should read Percentage of "FLOOR SPACE" that is exclusive to the renter. So enter the percentage of floor space that is exclusive to the renter. The program already "knows" the percentage of time, based on the date you placed it in service.

That "should" do it, unless there are other extenuating circumstances we're not aware of here.

You can double-check the numbers by using the worksheet in IRS Publication 946 at https://www.irs.gov/pub/irs-pdf/p946.pdf

Use the MACRS worksheet that starts on page 37. The table that applies is table A-6 on page 72.

There may be a few bucks difference between what you figure manually and what the program figures. Thats fine.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ljkauffman6

New Member

johnjames9

Level 2

frank1618

Level 2

angel888

Level 3

mishelk

New Member