- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- 1120S k-1 box 17 code k

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1120S k-1 box 17 code k

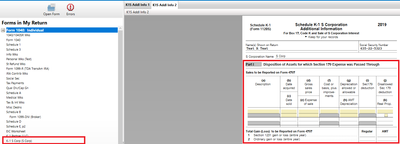

2018 form 1120S schedule k-1 box 17 code k has several assets listed. Under sale info i have cost/basis, section 179, and on a few assets AMT gain/loss adjustment and I'm not sure I am entering it correctly! Please help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1120S k-1 box 17 code k

You might have better luck entering this in Forms Mode.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1120S k-1 box 17 code k

I am having the same issue - I have a schedule K-1 Box 17, Code K - Shareholder's Disposition of Section 179 Property that has an entry under "AMT Gain/loss adjustment". There does not appear to be a line item in the "Step by Step" interview or the form to put this value.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1120S k-1 box 17 code k

@bkerkstra Yes, you are correct. The interview for Schedule K-1 does not include input for the AMT adjustment. Instead, go to Other Tax Situations >> Alternative minimum tax.

Choose "I need to make an AMT adjustment to my investment income or expenses."

Enter the amount from Sch K-1 Box 17, Code K under the appropriate section for AMT (investment income, expenses, disposition of property, etc.). If you don't know the source of the AMT adjustment, contact the company that provided your Schedule K-1 for guidance.

To review your AMT, go to Forms and search for Form 6251.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

valleybuy

Level 3

bethfly

New Member

kyondacooper

New Member

lesmir302

Returning Member

MojoMom777

Level 3