- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- 1099B Cost Basis - This was a gift. Do I report what is in Box 1e even though I did not purchase? For covered shares.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099B Cost Basis - This was a gift. Do I report what is in Box 1e even though I did not purchase? For covered shares.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099B Cost Basis - This was a gift. Do I report what is in Box 1e even though I did not purchase? For covered shares.

From Whom did you get the stock ? A relative ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099B Cost Basis - This was a gift. Do I report what is in Box 1e even though I did not purchase? For covered shares.

stock acquired by gift.

If the FMV on the date of the gift was more the original cost basis, use the original cost basis when you sell.

If the FMV on the date of the gift was less than the original basis, and you later sold the stock for

1) More than the original basis, use the original basis.

2) More than the FMV but less than the original cost basis, your selling price becomes the cost basis. You won't report a gain or loss in this situation.

3) Less than the FMV at the time of the gift, use the FMV at the time of the gift.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099B Cost Basis - This was a gift. Do I report what is in Box 1e even though I did not purchase? For covered shares.

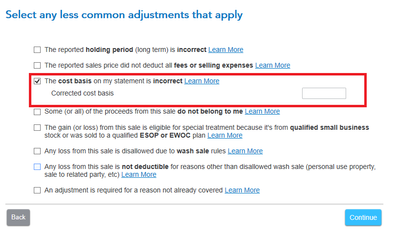

If, in fact, the cost basis needs to be corrected, then ensure that you check the appropriate box and enter the adjusted basis (see screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099B Cost Basis - This was a gift. Do I report what is in Box 1e even though I did not purchase? For covered shares.

How did the stock get into your account.?

If the broker has reported a basis (covered shares) then you must have given them a basis number earlier for them to record.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

TomDx

Level 2

frogger24

New Member

jondar99

Level 2

ChicagoJ

Level 3

serendipity

Returning Member