- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Roth IRA excess contributions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

Hello,

I made the mistake of contributing to my wife's and my Roth IRA accounts in 2018 and then subsequently filing separately to reduce her student loan repayment (she should qualify for PSLF in another 5 years). I did not realize at the time that filing separately changed the Roth IRA limits. It is obviously too late to withdraw the excess and avoid a penalty (I believe that window closed on Oct 15th 2019?).

Can someone explain exactly what I need to do now to withdraw the excess contributions and how to alert the IRS to this withdrawal.

Also - am I correct in understanding that I could have contributed the same amount to a trad IRA and then immediately re-characterized the contribution to a Roth IRA? and if so would I be able to do that going forward and essentially make the same contributions as in 2018 without a penalty? (and if so, isn't this ridiculous? Perhaps I have misunderstood the rules for re-characterizing).

Many thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

To avoid a new separate 2019 6% excess contribution penalty, you must make a normal distribution of the excess before the end of 2019. You will receive a 2019 1099-R that you report on yiur 2019 tax return. When asked by the 1099-R interview for your prior Roth contributions not previously withdrawn, enter those, including the 2018 excess contributions. There is not tax or penalty to withdraw your own contributions.

If you did not report the 2018 excess on your 2018 tax return and pay the 2018 6% penalty then you need to amend 2018 and add the Roth contribution in the IRA contributions interview. TurboTax should tell you that it is an excess and prepare a 5329 form with the penalty.

If you did enter the Roth contribution in 2018 and the excess carries over to 2019 and you remove the excess before the end of 2019 then go back through the 2019 IRA contribution interview for Roth and when it asks of there was a prior year excess delete the amount that was carried over. (If never entered in 2018 then there will be nothing that carries over to 2019.)

And, yes, if you have no Traditional IRA account whatsoever then a non-deductible Traditional IRA contribution can be converted to a Roth, but there are pitfalls in doing a "backdoor Roth" that you should investigate first.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

As an afterthought, you can also fix the excess by amending your separate returns to a joint return if your joint MAGI allowed a Roth contribution. (You cannot amend a joint return to separate returns, but you can amend separate returns to a joint return.) Whether that would be advantages or not depends on the facts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

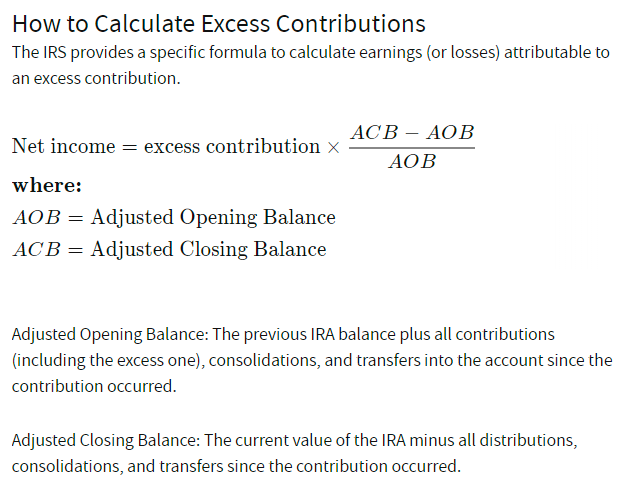

Thank you for the quick and thorough reply! Would you mind helping me with a few more details? I actually made the contributions in 2018 when the IRA was with Vanguard, I then moved it to Fidelity in 2019. Now I don't think I can use either Vanguard or Fidelity's "Return excess contribution" forms because the contribution was made into a Vanguard account but the money is now in a Fidelity account. So my understanding is I need to run the formula outlined in this article and then submit 1099-R with our 2019 return(s), is that correct?

I'd rather not amend the tax return to file jointly as the loan repayments would go up more than $600/month and I assume that would then be backdated for all of 2019. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

As you noted in your original post, it is to late to ask for a "return of contributions". At this time you can only withdraw the excess as a normal distribution. You do not need to withdrew any earnings since you will owe the 2018 6% penalty on the excess - the earnings, if any, can stay in the account. Only a "return of contributions" done before the due date if the return, or extended due date require the earnings to be removed and it is too late to do that for a 2018 excess.

The 1099-R you will receive should have a code "J" in box 7 if you are under the age of 59 1/2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

The earnings can stay in the account indefinitely with no penalty? So I just make a withdrawal of $5500 (the amount contributed in 2018) and pay 6% on that, that's it?

edit: Or I guess I'd pay 10% on that amount as an early distribution? But it's actually withdrawing a contribution so wouldn't normally be penalized? I don't see how that would then be 'flagged' as correcting an excess contribution, it seems too easy... I thought excess contribution and earnings combined were suppose to accrue 6% penalty every year until removed from the account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

@ytt wrote:

The earnings can stay in the account indefinitely with no penalty? So I just make a withdrawal of $5500 (the amount contributed in 2018) and pay 6% on that, that's it?

edit: Or I guess I'd pay 10% on that amount as an early distribution? But it's actually withdrawing a contribution so wouldn't normally be penalized? I don't see how that would then be 'flagged' as correcting an excess contribution, it seems too easy... I thought excess contribution and earnings combined were suppose to accrue 6% penalty every year until removed from the account.

Yes, once the 2018 6% penalty is paid any earnings stay in the account. You just withdraw the original excess amount. The excess contribution (not earnings) are indeed subject to a 6% penalty each yer until removed. As of now you have one year (2018) that applies. If removed before the end of 2019 then the penalty will not apply to 2019.

You do not pay an early distribution penalty since you are removing your own contribution which is tax free.

Also note that if you are filing jointly in 2019 and CAN make a Roth contribution then you can apply the 2018 excess to a 2019 contribution and not remove it at all if you otherwise qualify to make a 2019 Roth contribution.. You just indicate that in the IRA contribution interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

Thanks a lot, think I have it straight now!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

In 2019 I contributed $7,000 (I'm over 50) but now that I am preparing my 2019 Tax Return in 2020 my modified AGI only allows me to only contribute $2,380. I instructed my financial institution to reapply the excess contribution ($4,620) and the earnings ($797) to tax year 2020. Now that I am back to preparing my 2019 Tax Return the earnings of $797 gets reported on f1040 line 4b which increases my modified AGI, which then reduces my maximum Roth IRA contribution limit to $1,820, so now I have over contributed $560. This is a vicious cycle. What do I do? Do I just pay the 6% tax on the $560 excess contribution ($34), form 5329 and address in tax year 2020, or is there a way to avoid paying this $34 tax? I am already paying a tax of $80 on the $797 (10% penalty for the earnings)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

@Kotkin007 wrote:

In 2019 I contributed $7,000 (I'm over 50) but now that I am preparing my 2019 Tax Return in 2020 my modified AGI only allows me to only contribute $2,380. I instructed my financial institution to reapply the excess contribution ($4,620) and the earnings ($797) to tax year 2020. Now that I am back to preparing my 2019 Tax Return the earnings of $797 gets reported on f1040 line 4b which increases my modified AGI, which then reduces my maximum Roth IRA contribution limit to $1,820, so now I have over contributed $560. This is a vicious cycle. What do I do? Do I just pay the 6% tax on the $560 excess contribution ($34), form 5329 and address in tax year 2020, or is there a way to avoid paying this $34 tax? I am already paying a tax of $80 on the $797 (10% penalty for the earnings)?

You have discovered the problem of being in the Roth contribution phase out range. Adding the returned earning increases the MAGI with makes more excess. You can again remove the excess plus some extra to account for the MAGI increase, OR, just pay the 6% 2019 penalty and remove the excess contribution (not the earnings) before the end of 2020 to avoid another 6% penalty. (Paying the 2019 penalty allows the earnings to remain in the IRA).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

Thank you for the reply. If I pay the 6% 2019 penalty ($34) on the excess contribution of $560, instead of removing the excess contribution, can I just apply the excess to 2020? By going this route it seems that I can avoid the penalty in 2020 and have a jump start on the 2020 contribution of $5,180 (the $4,620 excess contribution, which I instructed my financial institution to apply to 2020, plus the additional $560, due to my new MAGI). If I can go this route, I believe I can just address this using f5329 when filing my 2020 tax return instead of involving my financial institution, correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

I have a somewhat similar situation to Kotkin007 but with some key differences and am unsure of how to handle this. In 2018, I overcontributed to a Roth IRA. My MAGI was unusually high that year due to capital gains. I did not realize this overcontribution until filing my 2018 taxes in 2019, so I withdrew the entire excess contribution and applicable earnings in 2019 before the 2018 tax deadline. However, I failed to include the taxable earnings ($455) in my 2018 return. This year, I got my 2019 1099-R with the $455 in earnings showing as taxable in 2018.

So I went to my 2018 filing and did the amendment, and I found myself caught in that cycle where my MAGI was increased thanks to the taxable earnings, thus resulting in more excess contribution ($170 excess to be exact). I understand that I'm stuck paying the 6% penalty on that for the 2018 tax year (so $10). But how do I deal with the $170 excess now to avoid paying the 6% penalty again for tax years 2019 and beyond? The key difference here is for tax years 2019 and 2020, I will be well within the Roth IRA contribution cutoff, so I am able to contribute the full $6,000. I have already contributed $6,000 for 2019 to my Roth IRA. If I withdraw the $170 and applicable earnings now before the July 15 deadline for 2019 filings, will I be set and all good for future years? What year are those applicable earnings now taxable in - 2018 or 2019? If it's 2018, then that means I'd be stuck in another excess contribution cycle unless I pull out enough to account for the additional excess generated. Or do the applicable earnings apply to 2019, in which case my MAGI has enough wiggle room to not go over the contribution cutoff?

Sorry if this is a confusing explanation. I would really, truly appreciate any help with this! I've been wracking my brain over this and it's hard to find resources for such a specific situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

@ck2019 wrote:

I have a somewhat similar situation to Kotkin007 but with some key differences and am unsure of how to handle this. In 2018, I overcontributed to a Roth IRA. My MAGI was unusually high that year due to capital gains. I did not realize this overcontribution until filing my 2018 taxes in 2019, so I withdrew the entire excess contribution and applicable earnings in 2019 before the 2018 tax deadline. However, I failed to include the taxable earnings ($455) in my 2018 return. This year, I got my 2019 1099-R with the $455 in earnings showing as taxable in 2018.

So I went to my 2018 filing and did the amendment, and I found myself caught in that cycle where my MAGI was increased thanks to the taxable earnings, thus resulting in more excess contribution ($170 excess to be exact). I understand that I'm stuck paying the 6% penalty on that for the 2018 tax year (so $10). But how do I deal with the $170 excess now to avoid paying the 6% penalty again for tax years 2019 and beyond? The key difference here is for tax years 2019 and 2020, I will be well within the Roth IRA contribution cutoff, so I am able to contribute the full $6,000. I have already contributed $6,000 for 2019 to my Roth IRA. If I withdraw the $170 and applicable earnings now before the July 15 deadline for 2019 filings, will I be set and all good for future years? What year are those applicable earnings now taxable in - 2018 or 2019? If it's 2018, then that means I'd be stuck in another excess contribution cycle unless I pull out enough to account for the additional excess generated. Or do the applicable earnings apply to 2019, in which case my MAGI has enough wiggle room to not go over the contribution cutoff?

Sorry if this is a confusing explanation. I would really, truly appreciate any help with this! I've been wracking my brain over this and it's hard to find resources for such a specific situation.

Since the $170 excess was not removed by the due date of the 2018 tax return yiu own a 6% 2018 penalty. You had until Dec 31, 2019 to remove it to avoid the 2019 6% penalty. Since that was not done you also owe a 2019 penalty. If it is still in the account by Dec 31, 2020 you will owe a 2020 penalty.

Removing by the tax due date only applies to the original tax year that the contributions was for (Apr 15, 2019 for the 2018 tax year in this case), for all subsequent years it must be removed in the tax year (Jan 1-Dec 31).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

Gotcha, thanks so much for your help! I really appreciate it!

As a follow-up question: Say I remove the $170 plus applicable earnings this year to avoid the penalty for my 2020 taxes. When my 2020 1099-R form comes in the mail next year with the taxable earnings, what year is that taxable in? If it's taxable for its original contribution year (2018), that will generate even more excess because of the MAGI increase, unless I pull out enough to compensate for the excess, correct? Or would it be taxable in the year 2020, the year in which the excess contribution is removed, thus not causing any excess, since I'm well within the MAGI limits this year? This would not affect my 2019 filing at all, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA excess contributions

Ahh nevermind, had to give the thread another careful read. So this whole question is irrelevant since I will not need to remove any attributable earnings, since this amount will be removed after the tax filing deadline of the original excess contribution.

Thanks again for all your help and knowledge on this topic!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mcht

New Member

mcht

New Member

jbertrevs

New Member

deadbugdug

New Member

20tflbtt20

New Member