- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: STANDARD DEDUCTION HIGHER THAN AGI ON FORM 1040

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

STANDARD DEDUCTION HIGHER THAN AGI ON FORM 1040

Hi Guys.

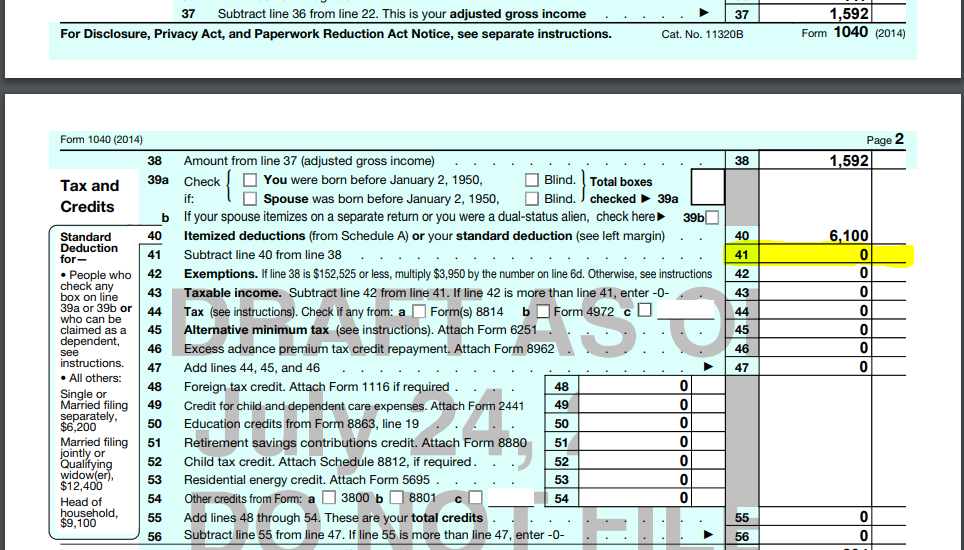

If my standard deduction (single) is higher than adjusted gross income my taxable income is 0.00. Can i obtain a refund, how does its works?

what will be the amount on line 41, form 1040?

Best regard.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

STANDARD DEDUCTION HIGHER THAN AGI ON FORM 1040

If the standard deduction exceeds your AGI, then Line 41 is zero, yes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

STANDARD DEDUCTION HIGHER THAN AGI ON FORM 1040

Your standard deduction filing single is the "LESSER" of $6,100 or your earned income plus $350.

This has nothing to do with a refund. You can not get back more taxes than you paid in, as shown on your W-2 in box 2. You are never refunded social security and medicare (boxes 4 and 6).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

STANDARD DEDUCTION HIGHER THAN AGI ON FORM 1040

If your taxable income is zero, you'll get any withholding refunded back, but having zero taxable income doesn't give you a refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

STANDARD DEDUCTION HIGHER THAN AGI ON FORM 1040

so, then my line 41 is is equal 0,00, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

STANDARD DEDUCTION HIGHER THAN AGI ON FORM 1040

If the standard deduction exceeds your AGI, then Line 41 is zero, yes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

STANDARD DEDUCTION HIGHER THAN AGI ON FORM 1040

thanks

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Tax_Lego

New Member

olegyk

Level 1

Arielbarth

New Member

Skajs

Returning Member

mentoraz

New Member