- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Estimated tax payments for 2017

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated tax payments for 2017

I'm using T. T. Home and Business program. It's asking for payments for estimated tax payments I made for 2017 (in the personal; Deductions & Credits section). I made some last year (2018) and in 2017, but none this year. Why is this important? Is this supposed to be payments for 2017 made in 2019? It doesn't change the calculated refund.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated tax payments for 2017

Are you using the right year Desktop program? You have to use a new program each year. Can you post a screen shot of that whole page including the top where it says Home & Business? Are you on Windows or Mac?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated tax payments for 2017

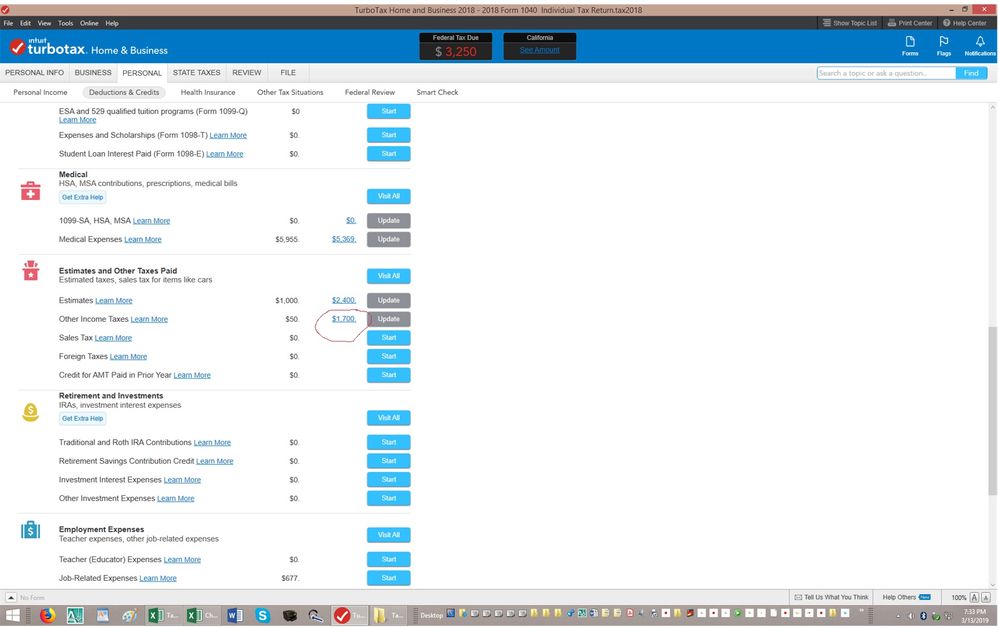

I'm using the 2018 version (for 2018 taxes). I'm on a Windows 8.1 desktop. I drew a red circle around the number in question. thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated tax payments for 2017

That screen shot is not about estimated taxes paid like on your first question. Other Taxes paid could be from many things. Like a state tax due you paid in 2018. Click on the Learn More in blue. Or click on Update and look around at what could be entered.

But as far as 2017 estimates paid that would not be for Federal. But only for State and Local estimates. Like if you paid the 4th quarter 2017 state estimate in Jan 2018. You are working on your 2018 return. Nothing to do with this year 2019.

A 2017 estimated state payment made in Jan 2018 could be an itemized deduction on your federal return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated tax payments for 2017

@MAJ wrote:I'm using T. T. Home and Business program. It's asking for payments for estimated tax payments I made for 2017 (in the personal; Deductions & Credits section). I made some last year (2018) and in 2017, but none this year. Why is this important? Is this supposed to be payments for 2017 made in 2019? It doesn't change the calculated refund.

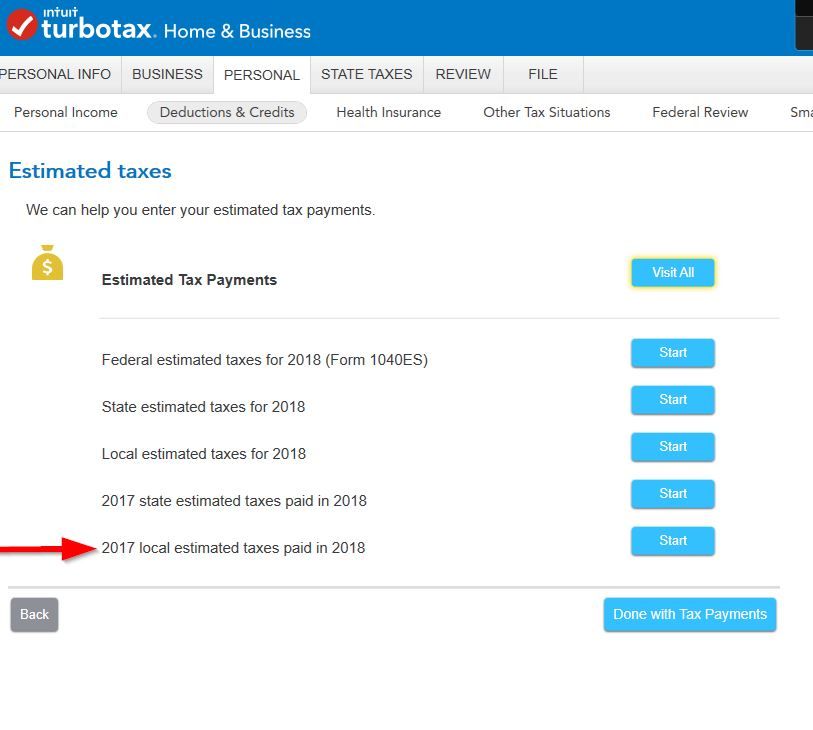

No. You are working on your 2018 return. Nothing to do with 2019. And it's only asking for State or Local 2017 estimates made in 2018. Local is not federal. You mean on this screen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated tax payments for 2017

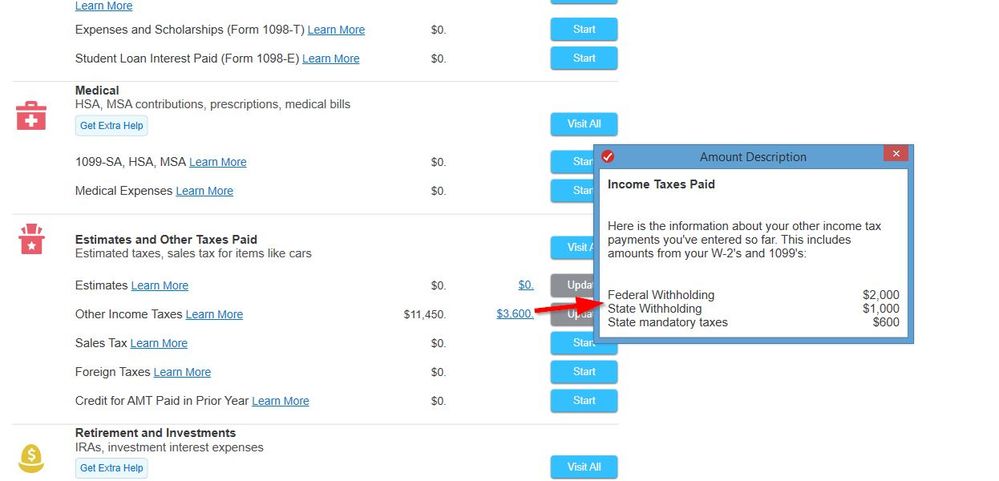

Made you another screen shot. Click on the 1,700 amount and it should tell you what it is from. See my screen shot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated tax payments for 2017

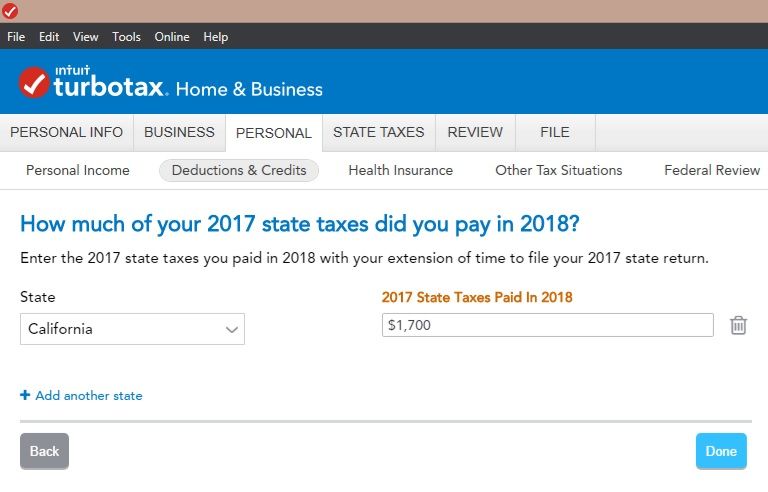

You are right, I’m working on my 2018 taxes and, yes, it’s not federal, it’s state. The number on my screen shot ($1,700) was automatically imported from the previous year’s (2017) program. (see screen shot)

thanks

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jaxgab

Returning Member

jaxgab

Returning Member

riogrande

New Member

einholz_e

New Member

jeanderson76-gma

New Member