- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I modify the amount of income that is subject to state income tax? Military until Aug and a resident of Texas

Looks like my original question was not completely posted...

I retired from the military on 1 Aug and was a Texas resident until then - I didn't pay any state income tax and there is no way to select "TX" on my military W2. On 1 Aug, I started my retirement pay and started having SC taxes withheld. TT is calculating SC taxes based on ALL my income, not just my retirement income. How can I tell TT that only the retirement pay is taxed by SC, not the military pay?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

Your question is confusing since TX has no state income tax. So what was you SLR while you were in the military and where were you stationed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

Looks like my original post was truncated or I didn't complete it....perhaps its not confusing now.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

Simple fix ... you need to file a part year SC return so you can indicate which income is taxable to SC. In the MY INFO tab make sure to indicate you are still a TX resident but also earned income in SC for this tax year that includes the move.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

Again, I'm sorry if I wasn't clear. My residency changed to SC - I am no long a TX resident. I was TX until 1 Aug and then became a SC resident. The MY INFO reflects this, including the date I became a SC resident.

TT is considering my military income as SC state income and I can't find where to tell it that it was all earned before 1 Aug and is Texas income for state income tax purposes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

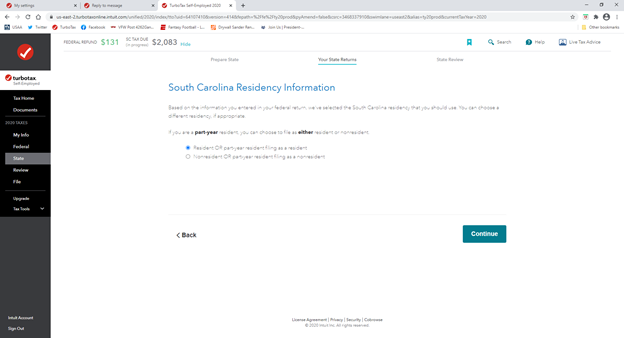

So in the SC interview you did not see this screen ???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

I did not!!! That's what I want! I notice the screen in your pic says "non-resident"... does this choice affect that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

So, I changed my selection and it didn't give me that question but it stopped using my military pay, so it worked. My concern with that selection was that I'm not a "non-resident," but it asked me if I was a resident for part-time and when.

I think this fixed it! Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

Non resident or part year resident is immaterial to your seeing that screen ... it is in both options. Review the entire fed/state return before you file later next month.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

I appreciate the assist but that's not true - at least it wasn't for me. The screen you showed never came up for me. The one that did only came up once I changed the selection. Prior to that, I went all the way through the state return and it never came up and it was showing me owing taxes for all my income. That's why I posted my question.

Why the statement about reviewing the entire return before filing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

You should always review every return before you send it since you sign it to attest to it being true and correct.

If need be go back to the MY INFO tab and indicate you were a SC resident and you had other income from TX ... then complete the state interview again ... either way the part year allocation should be indicated on the screen I posted.