- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

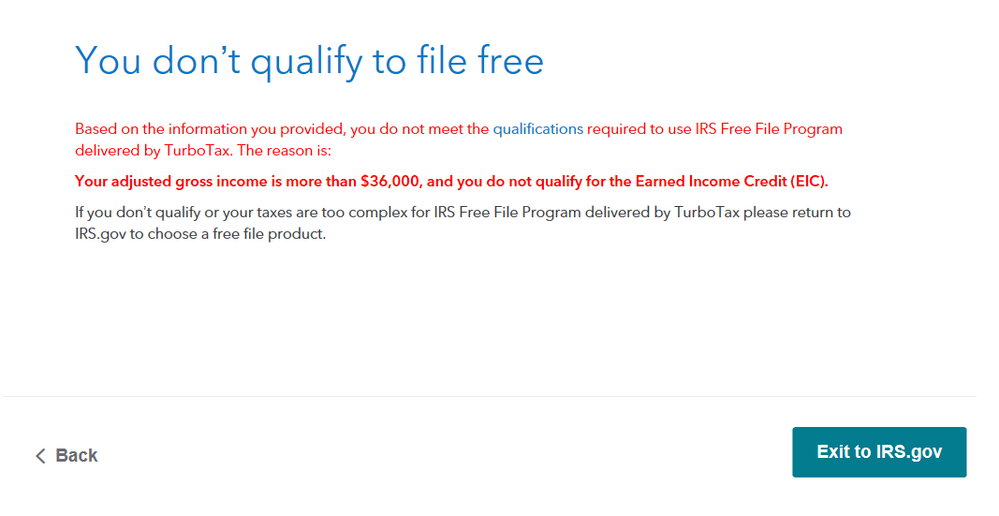

How do I make the military discount work? I put everything in & when I got to the end it gave me this error:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

Did you also check the box for military pay on the "Do any of these uncommon situations apply to this W-2?" screen after you entered your W-2?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

You are in the Irs.gov site. This is not where military should go to file for free. Go to Turbotax.com - Click on products and pricing - then click on Military. This will bring you where you need to file for free, if you are military.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

My husband is active duty military but I paid $80 yesterday to file our taxes within the app. Can I please be reimbursed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

Here is the customer support contact number to work any refund issues.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

So, if I got out in June 2019 I can't get the discount? I was active duty for half of 2019, I feel like I should get the discount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

This year TurboTax will recognize your W2 as Military Pay and apply the discount.

@Courtneywedeles

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

It did not automatically apply it to mine. I clicked on the military option in the uncommon situations section (turbotaxonline.intuit.com) as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

I suggest rechecking your answers in the "My Info" section concerning military service. Be sure to indicate "Current or Former" military and continue all the way through the questions about your rank as well. Be advised the Military Free file is for enlisted ranks.

Also be sure as mentioned above when you enter your military pay W2 that in the follow on question you have indicated that the pay is "Active Duty Military Pay".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

Your response led me to the right direction. I had all of that filled out. I decided to try something though that may helps others: if you have filled everything out, unclick and reclick everything. Not sure if that will help someone else - rather be safe than sorry.

Thank you for your response. Wouldn't have clicked on those pages without your push!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

I am a retired military and also a retired civil service employee. This year I bought my Turbo Tax from Amazon.com and was downloadedto my lap top. How can I get a discount?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

@khj2tv wrote:

I am a retired military and also a retired civil service employee. This year I bought my Turbo Tax from Amazon.com and was downloadedto my lap top. How can I get a discount?

The military discount is only for active military.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

Turbo tax is trying to charge me $40 when I go to file. I am military. It has always been free. Please advise. I did not use any special upgrades

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

Yes, we do offer a military discount! Please see the link here for further instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"