- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

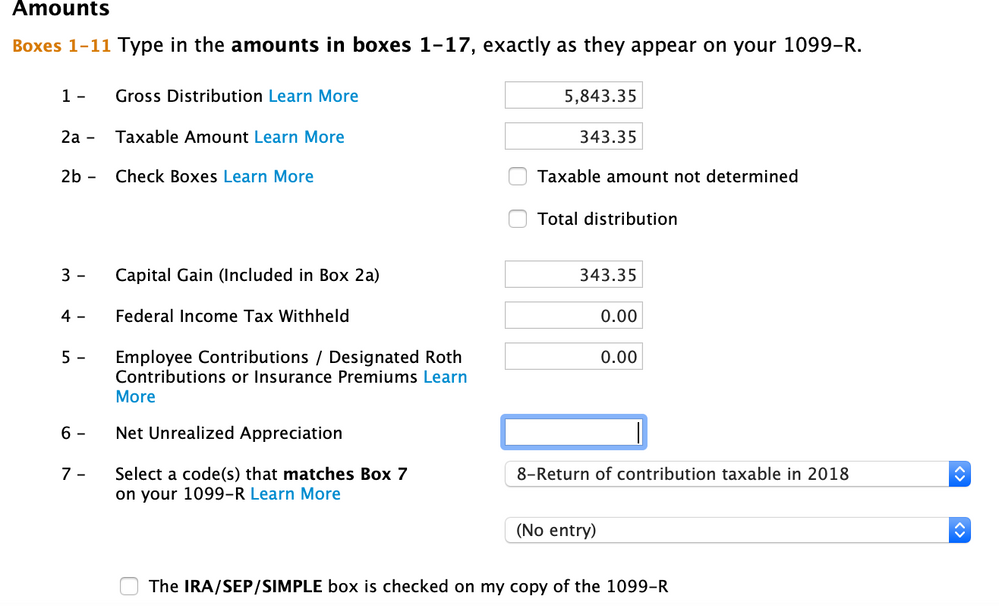

Completing 1099-R on my taxes without a 1099-R form. Am I doing this correctly?

I didn't receive a 1099-R for 2018, but need to report gains because I over-contributed in 2018.

I contributed $5,500 and my gains were $343.35. I already did an excess removal of $5,500 plus the $343.35 gains before the deadline.

Can anyone advise if I'm filling in this information correctly? When I look back at my income overview in Turbo Tax, it looks like I'm being taxed on $5,843.35 vs the $343.35 gains.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

If the distribution happened in 2019 then you must wait for the 2019 form 1099-R to report the earnings.

In the 2018 program you will only indicate in the IRA contribution section the contribution then complete the following screens to indicate you will remove the excess prior to the filing deadline.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@Critter I did already remove the excess though. Won’t I be penalized for contributing excess if I don’t report the removal the same taxable year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

But you did not contribute the earnings ... they accumulated and were properly removed and are reported as income on the tax year of the removal.