- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No option to choose "State and Local tax refund" on 1099-G page.

Only available options are:

- Taxable grant

- Agricultural program payment

- Market gain on CCC loans

- Reemployment trade adjustment assistance (RTAA) payment

- Business or farm tax refund

Topics:

June 6, 2019

2:35 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

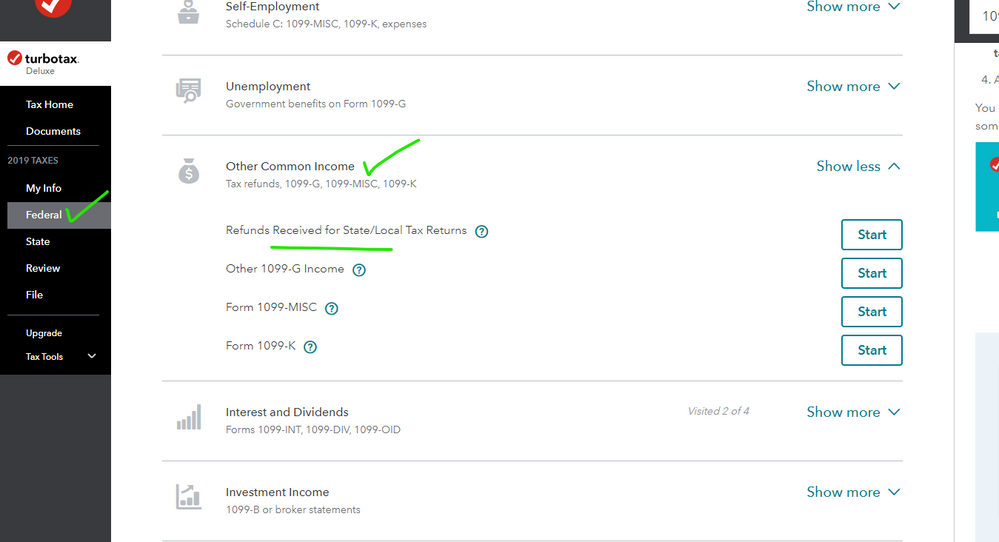

To enter a state or local tax refund (Form 1099-G) -

- Click on Federal Taxes (Personal using Home and Business)

- Click on Wages and Income (Personal Income using Home and Business)

- Click on I'll choose what I work on (if shown)

- Scroll down to Other Common Income

- On State and Local Tax Refunds on Form 1099-G, click the start or update button

Or enter state refunds in the Search/Find box located in the upper right of the program screen. Click on Jump to state refunds

June 6, 2019

2:35 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

This solution does not work in 2019 TT. Help!

"state tax refund" is not an option listed under 1099-G

I'm trying to report Box 1 refund. I repeatedly find the same erroneous solutions!! Please help!

February 25, 2020

9:45 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

You are in the WRONG 1099-G entry section ... follow this FAQ : https://ttlc.intuit.com/community/entering-importing/help/where-do-i-enter-a-1099-g-for-a-state-or-l...

February 25, 2020

9:51 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Click on the FEDERAL tab ... Wages & Income ... scroll down to Other Common Income ... Refunds...

February 25, 2020

10:00 AM

1,835 Views