- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

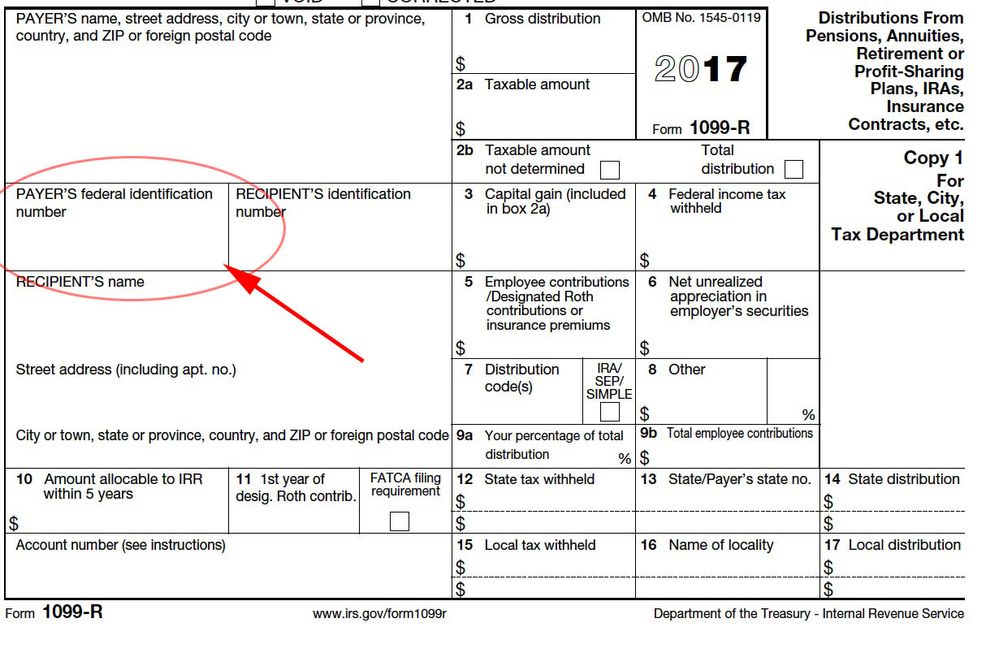

I'm trying to submit my 1099r and I can't locate the Federal ID Number on the form. Would it go by a different name like "payer's TIN"?

On the details page of the 1099r it lists the payer's TIN as Taxpayer Identification Number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

The box on Form 1099R that is labeled TIN is the payers Federal ID Number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

On the 1099R form it has Payer's TIN. I have used that as the Federal ID number and it was rejected. What should Used?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@tclandi wrote:

On the 1099R form it has Payer's TIN. I have used that as the Federal ID number and it was rejected. What should Used?

The Payer's TIN is the Federal EIN. It is 9 digits and in the format of 12-3456789. You only enter the 9 digits and the program will supply the 'dash'. If what you entered is correct and it is being rejected, the delete the Form 1099-R and re-enter manually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

I did enter the 1099-R manually and still got the rejection. So now what am I supposed to enter?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@MPURSLEY8 wrote:

I did enter the 1099-R manually and still got the rejection. So now what am I supposed to enter?

If you entered the payers EIN on the 1099-R and it rejects as an invalid EIN then contact the payer to see of they entered the wrong number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

I thank you very much for the help; however, they only had their name and address in that box. I did get the info from google.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

If your 1090-R was missing the EIN then contact the issuer for a replacement 1099-R. A 1099-R is not valid without a EIN. They are required by law to supply a valid 1099-R.