- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When do I declare my wife's pension income? The program doesn't seem to have a spot for it. Do I report it as miscellaneous income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Your wife should have received a Form 1099-R for her pension income.

To enter this in TurboTax Self-employed on the Income & Expenses tab scroll down to the line Retirement Plans and Social Security then select show more, select IRA, 401(k), Pension Plan Withdrawals (1099-R) and click on start.

Follow the screen prompts to enter your wife's pension income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

I still do not see a prompt to enter my wife's 1099 Rs. It only asked for mine (which I do not have because I am not retired). Turbo Tax just took me onto the next section instead of asking for my wife's 1099 Rs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

You enter all 1099R the same place and way. After you start entering a 1099R you pick who it is for.

The easiest way to get to the 1099-R entry screen is to simply search for 1099-R (upper- or lower-case, with or without the dash) in your TurboTax program and then click the "Jump to" link in the search results.

Enter a 1099R under

Federal Taxes on the left side

Wages & Income at the top

Then scroll way down to Retirement Plans and Social Security,

Then IRA, 401(k), Pension Plans (1099R) - click Start or Revisit

If you are filing a Joint return be sure to pick which person it is for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Enter 1099-r in the Search box located in the upper right of the program screen. Click on Jump to 1099-R

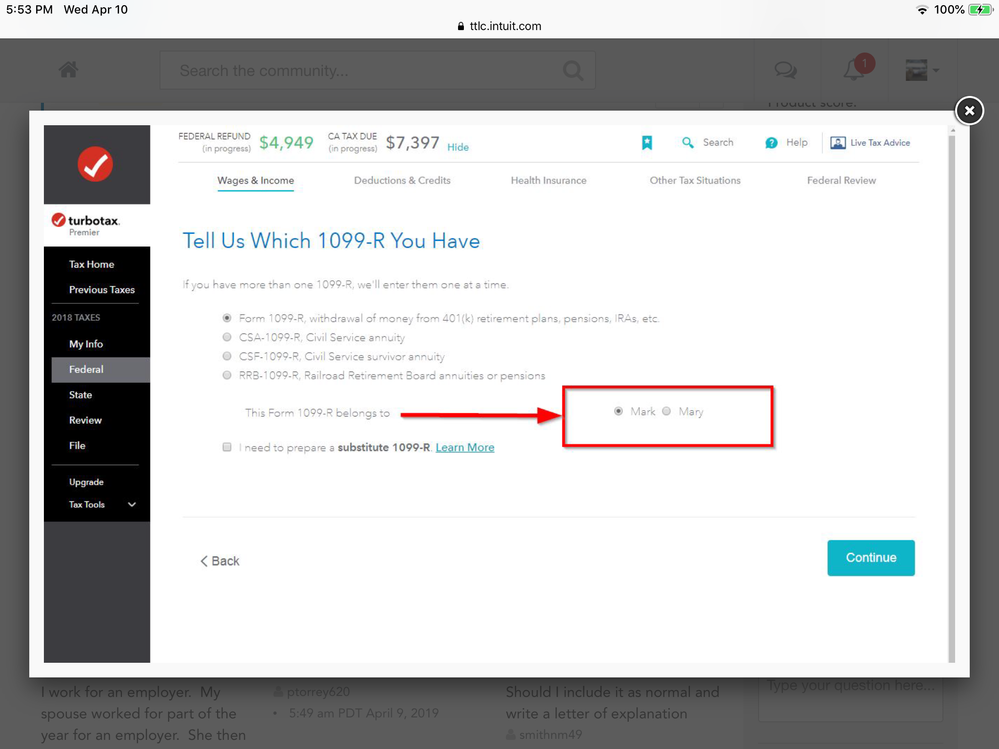

On the same screen for selecting the type of Form 1099-R that is being reported are selections for indicating who the form belongs to when filing a joint tax return. See screenshot