- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Oh..you didn't say it was a CSA-1099-R....you need to be specific and not just call it a 1099-R.

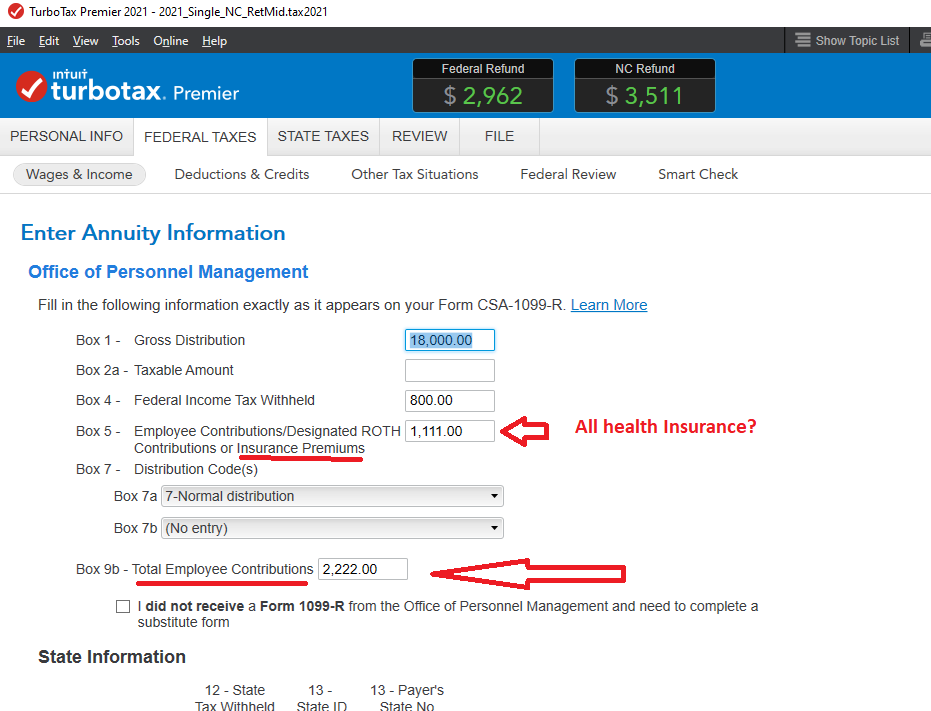

Yes...As long as yoru Ins Premiums are in box 5, you put them there...BUT you have to be sure you are using the CSA-1099-R form in the software. In the desktop software, it looks like the following:

_______________________

______________________

Then...on a later page, the software asks you to confirm that the box 5 amount was all for Health Ins premiums...and if not, indicate the sub-part that was for Health insurance.

____________________________

In the backup "worksheet" that TTX uses (Forms Mode Only), it will move the box 5 and box 9b amounts from the CSA- form to different spots it needs to do proper calculations...but that's only on the "worksheet" and not on the interview form .