- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS and TX Teacher Retirement

I owed the irs $500 for a small business I run on the side. No a huge deal; $500.

then it came time for me put my texas teacher retirement system 1099 R form in the turbo tax program and I did and now i owe $5500. what gives?? It spit out to me that I don't pay any taxes on it, then I hit continue and it goes to owing $5500. It already took taxes out, but says I owe more. This is the first time this has happened to me.

Volleygal63

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

On the 1099 for your TX Teachers retirement, are the taxes withheld reflected on the 1099R? If so, make sure you entered the taxes withheld when you entered the 1099R form. If you have entered the 1099R income and the 1099R taxes withheld, and you still owe money, it is most likely correct.

To prevent this in the future, you will need to contact TX TRS and have your withholding changed on the your retirement income. Sometimes the amount withheld on retirement is not enough.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

What TurboTax told you is that you don't pay extra taxes, i.e., an early distribution penalty (an excise tax) on the distribution. The distribution still adds to your taxable income on which you owe ordinary income tax. The amount of taxes withheld from the distribution does not take into account the actual marginal tax rate that can only be determined by preparing your tax return, so the default withholding was not sufficient to cover your marginal tax rate for this distribution. You own the additional amount of ordinary income tax with your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

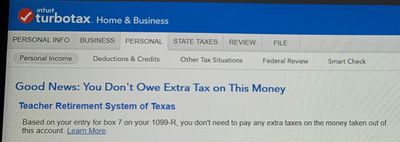

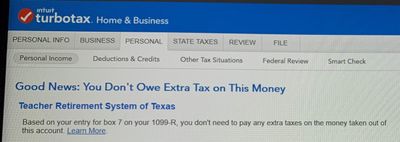

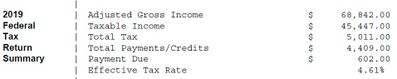

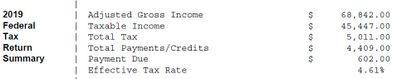

Well TT told me the way I answered box 7 I don't have to pay any extra taxes. See pic. For grins; I completed my taxes, analyzed them and it came up with total tax $5011 then total payments/credits of $4409. Then it told me I have tax rate of 4.61% and that is up from last year of 3.06%. (is the rise in the tax rate higher this year?). thank you for taking the time to answer all my questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Well TT told me the way I answered box 7 I don't have to pay any extra taxes. See pic. For grins; I completed my taxes, analyzed them and it came up with total tax $5011 then total payments/credits of $4409. Then it told me I have tax rate of 4.61% and that is up from last year of 3.06%. (is the rise in the tax rate higher this year?). thank you for taking the time to answer all my questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

TurboTax always presents the pictured page in response to the Form 1099-R having code 2 in box 7. Code 2 means that the payer knew that the distribution qualified for an exception to the early-distribution penalty, the extra tax to which TurboTax's page refers, despite the fact that you were under age 59½ at the time of the distribution. This page confuses many people who are not aware that it refers only to the early-distribution penalty. It's not clear why the TurboTax editors chose to use this legalize, referring to it by its legal definition as an excise tax, rather than than using the commonly used term 'penalty.' There are many places in TurboTax where the editors have erred by oversimplifying text to make it easier to read, to the point that it obfuscates whatever they are trying to say rather than making it easier to understand.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

So you ended up with a tax due of 5011-4409 = $602? That covers the 500 Self employment tax plus a little regular income tax on your total income. Where did the 5500 come from? You still don't owe the full tax. Only the amount after payments and credits.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Hi thank you for responding. Your answer made the most sense. I am a retired school teacher in TX. The way it works is if you serve 30 years and add your add with it and ='s to 80 then you can retire. There is no penalty for early distribution. So the other two answers did not make sense to me. Teachers are not on a normal pension plan like other pensions. It's based on age and years of service.

Part 2 is I do run a small business and it did say I owe $602. So that being all I owed, I was just gonna pay it and go on.

Part 3 is when I put in my personal income from my 1099-R then it said I owed $5011 so that is where the extra amount owed came from. But on the next screen it said based how you answered box 7, you don't have to pay any extra taxes. I answered in box 7 a #2. But the top of TT screen said I owed $50ll. So I freaked a little bec I didn't do anything different than what I did the last two years of retirement. And I got $3500 back in return. This year I owe the $602.

Part 4 so for grins I remembered the box said you don't pay any extra taxes on the amount so I completed my taxes to see what that meant and this is what I got. see the pic I included.Thanks for any help you can give me. Also are we paying a higher tax for 2019; because 2018 I paid 3.06% Thank you!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Sorry at top of message; it should of said age not add.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Hi thank you for responding. Your answer made the most sense. I am a retired school teacher in TX. The way it TX Teacher Retirement works is if you serve 30 years + your age and it ='s to 80 then you can retire. There is no penalty for early distribution. So the other two answers did not make sense to me. TX Teachers are not on a normal pension plan like other pensions. It's based on age and years of service.

Part 2 is I do run a small business and it did say I owe $602 when I completed my business portion of my taxes. So that being all I owed, I was just gonna pay it and go on. (fyi; i am using turbo tax home and business and used if for the last 5-10 years).

Part 3 is when I put in my personal income from my 1099-R then it said I owed $5011 so that is where the extra amount owed came came from. But on the next screen it said based how you answered box 7 from your 1099-R, you don't have to pay any extra taxes. I answered in box 7 a #2. But the top of TT screen said I owed $50ll. So I freaked a little bec I didn't do anything different than what I did the last two years of retirement. And I got $3500 back in return. This year I owe the $602.

Part 4 so for grins I remembered the box said you don't pay any extra taxes on the amount so I completed my taxes to see what that meant and this is what I got. see the pic I included. Thanks for any help you can give me. Also are we paying a higher tax for 2019; because 2018 I paid 3.06% Thanks again!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Is this the first time you had self employment income?

Self Employment tax (Scheduled SE) is automatically generated if a person has $400 or more of net profit from self-employment. You pay 15.3% SE tax on 92.35% of your Net Profit (If it is greater than $400). The 15.3% self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. So you get social security credit for it when you retire.

The SE tax is already included in your tax due or reduced your refund. It is on the 1040 Schedule 2 line 4 which goes to 1040 line 15. The SE tax is in addition to your regular income tax on the net profit. You do get to take off the 50% ER portion of the SE tax as an adjustment on 1040 Schedule 1 line 14 which flows to 1040 line 8a. Turbo Tax automatically calculates the SE Tax and Adjustment.

You are paying 15.3% for……

SS for employer 6.2% (up to 132,900 wages & profit)

SS for employee 6.2% (up to 132,900 wages & profit)

Medicare for employer 1.45% (on all wages & profit, no max)

Medicare for employee 1.45% (on all wages & profit, no max)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

TurboTax's calculated "Effective Tax Rate" is a relatively meaningless number. It's simply income tax divided by AGI, Form 1040 line 14 divided by line 8b. It does not take into account your deductions or other taxes such as self-employment tax. It is definitely not your marginal tax rate which is the increase in your tax liability for each additional dollar of a particular type of income at your current income level.

To understand the differences between your 2018 and 2019 tax returns you must compare Forms 1040. Comparing TurboTax's Tax Return Summaries tells you nothing.