- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth IRA conversion not showing up correctly in Tax Form

Hi,

I put $6000 in my traditional account on Fidelity and next day, converted that into Roth account. (Transferred the money from Traditional to Roth). This money is from the salary I receive. I.e. it is already taxed.

On form 1099-R , 2.a (Taxable Amount) is stated as $6000 and 2.b Taxable amount not determined is selected.

However, after following the steps mentioned here : https://ttlc.intuit.com/community/entering-importing/help/how-do-i-enter-a-backdoor-roth-ira-convers...

I am still seeing 4.a and 4.b in 1040 as $6000. I.e. It seems like I am being taxed twice on it.

Any recommendations on how to fix the issue?

Tagging to get eye balls : @CatinaT1 , @JotikaT2 , @BillM223

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

When did you make the Traditional IRA contribution and conversion - 2019 or 2020? Did you enter it into the IRA contributions section and say you want it to be non-deductible?

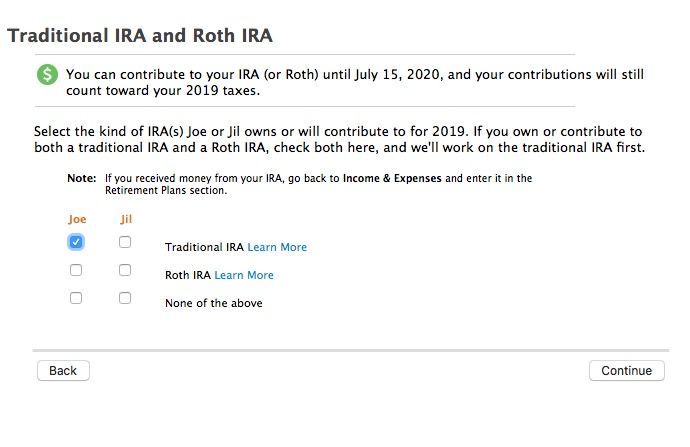

It sounds like you probably did not.Enter IRA contributions here:

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),

Retirement & Investments,

Traditional & Roth IRA contribution.

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "ira contributions" which will take you to the same place.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

The contributions were made in Jan 2019 for the year 2019.

I am using the software version of turbotax.

The closest thing I see for nondeductibe is a question stating :

Any nondeductible contributions to [person]'s IRA?

Its asking for non deductible contribuitons made in 2018 or earlier.

In my case, I perform these steps of putting taxed money into Traditional and then converting the entire amount to Roth. So, I think my basis for 2018 should then be 0?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

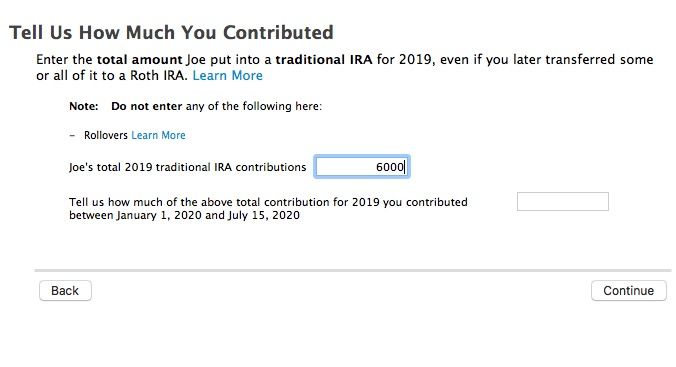

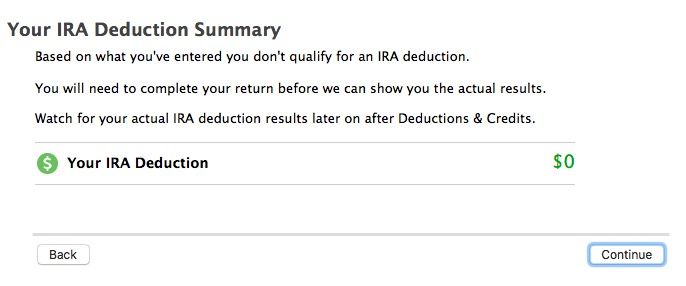

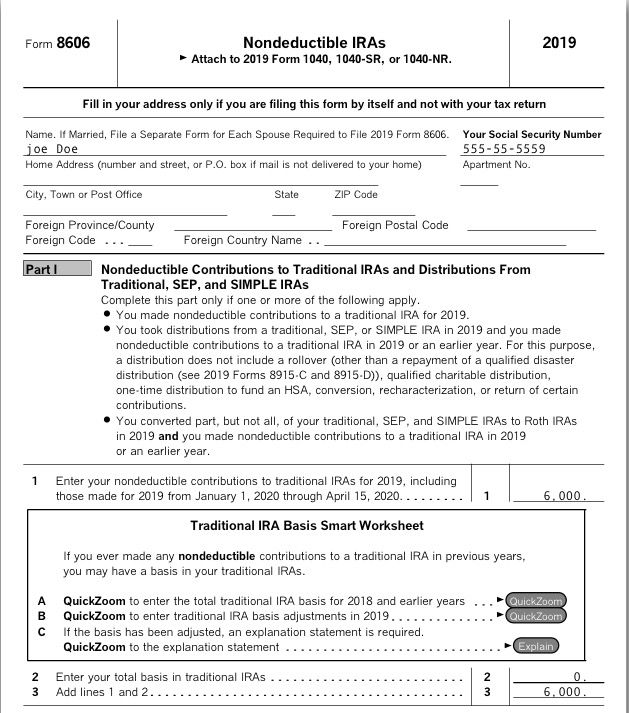

Did you enter the contribution as I posted above? The last screen in the IRA contribution interview will tell you if the contribution is allowed and ho much, if any, is deductible. It should say that your $6,000 contribution has a zero deduction if entered correctly and there should be a 8606 form as part of the tax return with the 2019 $6,000 contribution on line 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

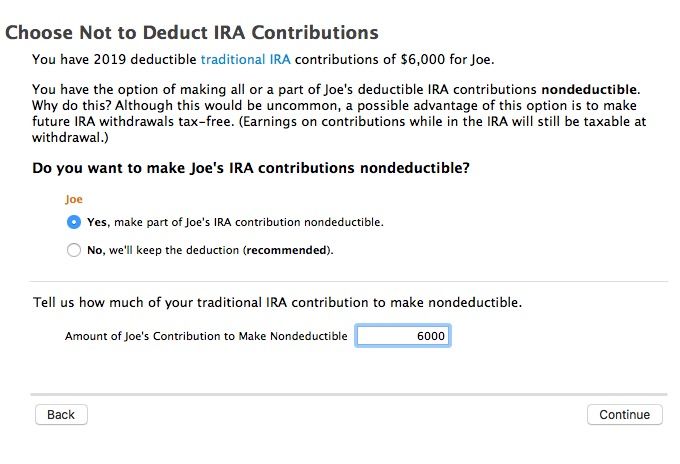

This is what you should see - the "choose not to deduct" screen will not appear if your MAGI prohibits a deduction , then non-deductible is automatic.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

This worked.

I was not looking into the deductions tab. Thanks a ton!