- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I converted my rental house to personal use in 2018, do I need to indicate that I disposed of the property from business use?

Since I converted rental property to personal use, I will not claim any expense for deduction. Instead of deleting the property from the asset worksheet, I was advised to indicate the property was disposed of, which I am confused on this part.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

When you go through the rental property interview, you do need to check that the property was disposed of, then that it was converted to personal use. When you come to the Asset summary screen, edit each asset to say it was converted to personal use and the date.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

I have the same question. What do I say in the Sales poriton. I didn't sell it? Very confusing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Begin working through the rental property in the Rental & Royalty Income (SCH E) section of the program and elect to EDIT the property.

Now elect to edit/update the property profile.

Work through the property profile screens and one of them will have a selection on it for "I converted this property from a rental to personal use in 2018." Select that option and continue working through the property profile section.

On the screen, 'Was this property rented for all of 2018?" you will select NO. The number of days rented will be the number of days from Jan 1st 2018 up to the date of conversion. This date is "generally" the day after the last renter actually moved out.

The number of days of personal use will be "ZERO". It's asking for the number of days of personal use *WHILE* *THE* *PROPERTY* *WAS* *CLASIFIED* *AS* *A* *RENTAL*. So the days you may have lived in it ***AFTER*** you converted the property do personsl use ***DO*** ***NOT*** ***COUNT*** for anything.

Finish working through the property profile section.

Now elect to update Rental Income and report all rental income you received.

Next, elect to update Rental Expenses and pay attention to detail. You can only claim those expenses you incurred while the property was classified as a rental. If you paid the property insurance *BEFORE* you converted it to a rental, then you will have to manually do the math yourself to prorate the amount of the insurance you paid, that you can actually claim on the SCH E.

For example, if the insurance was due Apr 1st and you paid it on or before that date, and you converted the property to personal use on July 1st, then you can deduct six months of insurance, and that's it. If you paid $1200 on Apr 1st for a year's insurance, that's $100/month. So for six months you would enter $600 in the expense section where it asks you for insurance.

Then on the next screen whre it asks for Real Estate Taxes, you will enter the "ENTIRE AMOUNT" of real estate taxes you paid for the "ENTIRE YEAR". The program will automatically do the pro-ration for you and will split the property taxes paid between the SCH E for the period of time it was classified as a rental, and SCH A for the period of time it was classified for personal use.

For the mortgage interest paid, you will enter the *ENTIRE AMOUNT* of mortgage interest you paid for the *ENTIRE YEAR*. The program will automatically do the pro-ration for you and will split the mortgage interest paid between the SCH E for the period of time it was classified as a rental, and SCH A for the period of time it was classified for personal use.

THen finish working through the Rental Expenses section.

Next, elect to update the Assets/Depreciation section and selec the option to go straight to your asset summary.

At an absolute minimum you will have the property itself listed there. You "may" have other assets too. But it's a fact that at an absolute minimum you will have "at least" one entry there and it will be the property itself. Elect to EDIT that property and start working it through. The first screen is titled "review information". Do not change anything what-so-ever on this screen and continue.

The next screen asks, "Did you stop using this asset in 2018?". Select the YES button.

For the "date of sale or disposition" the date you enter here must be at least one day after the last renter moved out. Enter that date and continue.

On the "Special Handling Required?" screen, click YES. If you click no, then you will "have" to enter a sales price. You did not sell this property, so click the YES button.

The screen now shows the depreciation for 2018, up to the date you reclassified the property from rental property to personal use. Just click continue and you're returned to the "Your property assets" screen.

Now if you have other assets listed, you *MUST* do this for every single one of those assets. Make sure your disposition/conversion date is the same for all assets.

Once you have worked through all assets to show them as removed for personal use, you can click the DONE button at the bottom of the "Your property assets" screen.

Now if you claimed "ANY" vehicle use for this rental for "any" period of time you owned it, then you must also work through the vehicle expenses section to show your disposition of this vehicular asset from the business; even if the vehicular use claimed was less than 100% business use.

When done with all this you can click the "DONE WITH RENTAL PROPERTY" button and that basically does it. From here you can continue on with the remainder of your tax return.

Once you have completed your tax return in it's entirety, it is *IMPORTANT* that you print a hard copy of the "ENTIRE" return on paper. You need to print absolutely everything. Not just the "forms required for filing" and not just fhe "forms to keep for your records". You need to print absolutely everything, which will include all forms and calculation worksheets.

You will need this information (particularly the data on the two IRS Form 4562's that will be printed for this property) in your future when any one of three things happens in your life.

A) you convert the property back to a rental

B) you sell or otherwise dispose of the property so that you no longer own it.

C) You die.

So keep that entire printout of your 2018 tax return in a safe place, and keep it *forever*, or at least until one of the aforementioned three things listed above have occurred.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

My husband and I have an LLC. We have a self rental (shop) on schedule E. We stopped using it Jan 1 2020. We want to convert the shop back to personal use and stop depreciating the asset. We are claiming no income or expenses for 2020. We are using Deluxe TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

To indicate that you converted your rental property to personal use please follow these steps:

TurboTax CD/Download

- Click on Federal Taxes > Wages & Income [In TurboTax Home & Business: click on the Business tab > Continue > I'll choose what to work on.]

- In the Rental Properties and Royalties section click on the Start/Update box.

- On the Income from Rentals or Royalty Property You Own screen, click Yes.

- If you have already started adding information about your rental, you will come to the Rental and Royalty Summary screen. Click on the Edit box next to the property.

- If you haven't yet entered rental/royalty information, continue through the screens, entering the requested information.

- On the Review Your [property name] Rental Summary screen, click on the Start/Update box in the Property Profile section.

- You will eventually come to a screen, Do Any of These Situations Apply to This Property? Mark the box next to I converted this property from a rental to personal use in 2020. [Screenshot #1, below.]

- Continue through the screens entering the requested information.

TurboTax Online

- On the Wages & Income screen, scroll down to Rentals, Royalties, and Farm.

- Click the Start/Revisit box next to Rental Properties and Royalties (Sch E).

- On the screen, Your 2020 rentals and royalties summary click Edit next to the property.

- On the Here's [XX]'s rental property info screen, click on the Edit box in the Property Profile section.

- On the Review your rental property info screen, click the Edit box below Situations in the General Info section. [Screenshot #2]

- Click the box Converted home to rental or rental to home. [Screenshot #3]

- Continue through the screens entering the requested information.

Screenshot #1

Screenshot #2

Screenshot #3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

This is great! But, what happens to the accumulated depreciation and other expenses that were not consumed entirely? Upon conversion there was still some expenses that accumulated against the property that couldn't be deducted on my personal return on schedule E. As a result there was a carry forward. Are those losses gone forever or can they be applied to future year's tax return on Form 8995 even though the property is out of service.?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

When you convert rental property into a personal home. And the rental home had suspended PALs. You can continue to deduct the suspended PALs from other passive income. If you have no other passive income, the suspended losses remain suspended. when yo sell any unused PAL's will be allowed. you will be subject to depreciation recapture.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Converted rental property in an LLC to personal use in 2022. Can't seem to find the CONVERTED TO PERSONAL USE questions.

Can't use SOLD, as no funds were exchanged.

Any help would be appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

This is question for TT BIZ for 2022. Once the property is disposed of, the LLC will be closed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

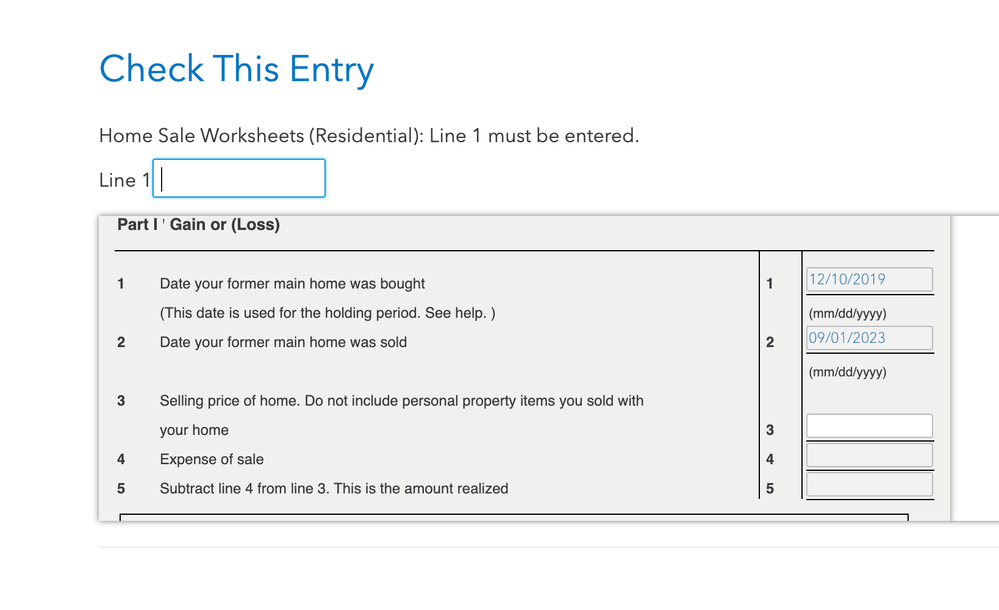

Hi. I followed this identically for my rental that I converted to a primary residence, and answered YES to special handling, but TurboTax web version is still asking me to input the sale price of the home. I've gone back and tried to modify it the same way each time, and cannot get that part to change for the Assets > Rental Property. At the "review" portion, it's asking for a value and I can't seem to change that despite following your instructions verbatim.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Also, on the last step for this, it states:

Depreciation Deduction Amount

Your depreciation deduction for Residential for 2023 is $XXX.

We'll transfer this amount to the correct for for you.

----------------------------------------------------------------------------------------

Is that expected here after answering 'Yes'?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Yes, if the property was used as a rental at all during 2023, that last screen would show the 2023 depreciation and transfer that to Schedule E.

HOWEVER the previous screen is not what would be used for a rental after reporting that it was converted

It looks like the rental is being disposed under

Personal Income

Less Common Income

Sale of Home

THIS IS NOT WHERE IT SHOULD BE REPORTED.

After you select "Yes" for special handling, the program should show you the screen you posted above for the 2023 depreciation and that should be the end of it, (unless you took Section 179 on any rental assets).

Please check

Personal Income

Less Common Income

Sale of Home

and make sure nothing is listed there

When a rental is SOLD, there is usually depreciation that needs to be "recaptured" or paid back.

When a rental is converted to personal use, that "depreciation recapture" is deferred until the property is eventually sold.

**Mark the post that answers your question by clicking on "Mark as Best Answer"